Ethereum has been notably bearish, marked by a pointy decline following a pullback to the decrease boundary of a damaged wedge, coupled with the formation of a loss of life cross.

Regardless of this, the value is nearing an important assist stage that would result in a short-term sideways consolidation.

By Shayan

The Every day Chart

Ethereum has been in a robust downtrend, instilling worry and uncertainty amongst market individuals. Low inflows into spot ETH ETFs have additional underscored this sentiment, signaling lowered investor curiosity and the looks of the loss of life cross, the place the 100-day shifting common crosses under the 200-day shifting common.

Following a rejection on the decrease boundary of the multi-month wedge and the 0.5-0.618 Fibonacci ranges, Ethereum has continued its decline, confirming the power of sellers available in the market.

Nonetheless, the value is approaching a essential assist zone, outlined by the static $2.1K stage and the 0.786 Fibonacci retracement stage at $2,067. This space is predicted to have a considerable demand, which might result in a short-term pause within the downtrend, with potential sideways consolidation earlier than Ethereum’s subsequent transfer is set.

The 4-Hour Chart

On the 4-hour chart, ETH was firmly rejected from the resistance zone between the 0.5 ($2.6K) and 0.618 ($2.7K) Fibonacci ranges, leading to continued bearish momentum towards the $2.1K assist. This stage has held beforehand, notably in early August, suggesting it would appeal to consumers trying to accumulate at these value factors.

If demand resurfaces on the $2.1K mark, Ethereum could expertise a brief consolidation section, pausing the downward stress. Nonetheless, if this important assist is breached, it might set off a long-liquidation occasion, doubtlessly driving the value down towards the $1.8K area.

The approaching days will probably be essential in figuring out whether or not Ethereum can maintain this assist or if a deeper correction is on the horizon.

By Shayan

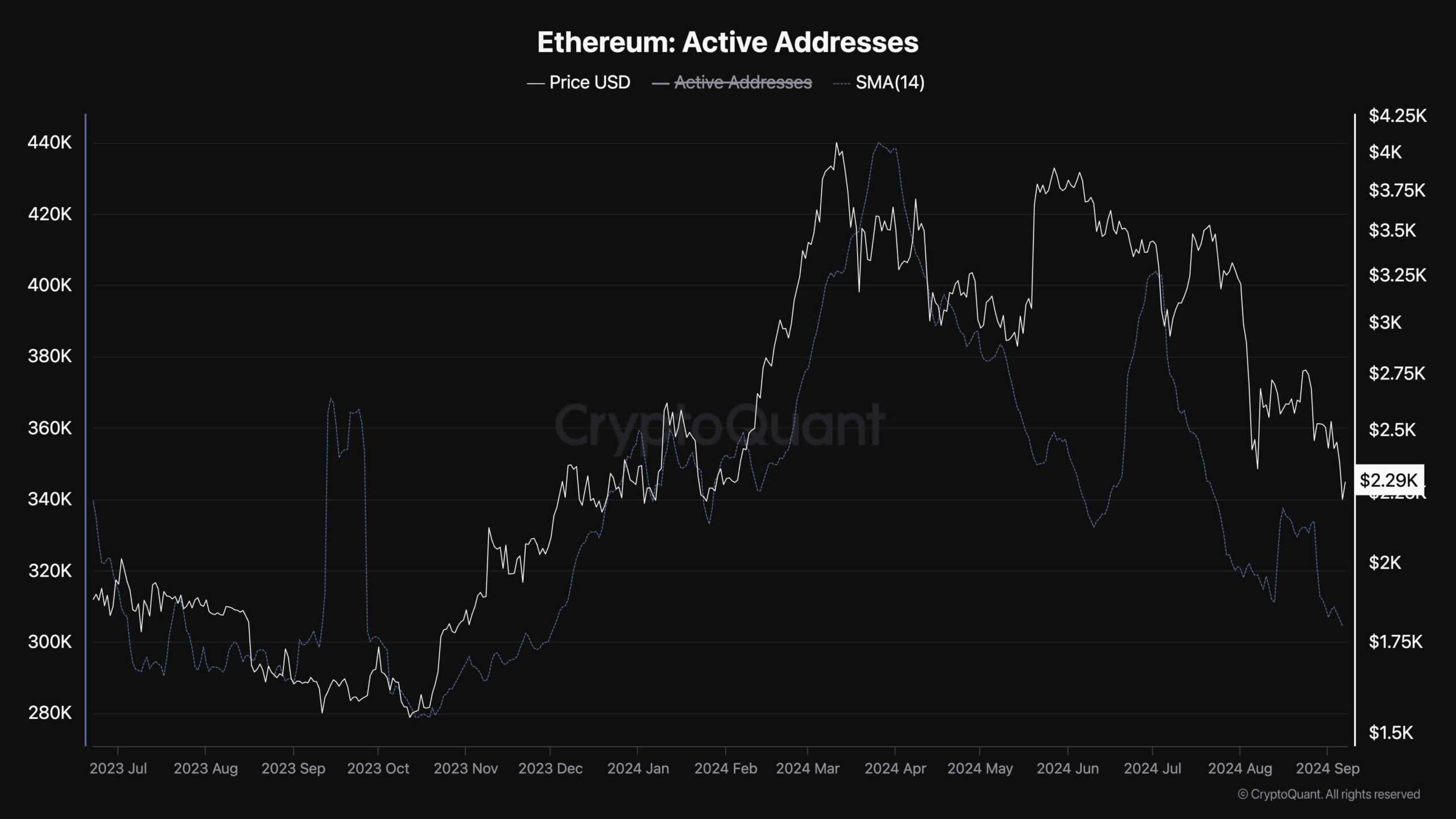

Ethereum’s worth is essentially tied to its decentralized community and the energetic engagement of its customers. One key metric to gauge this engagement is the variety of distinctive energetic addresses on the community, which may function a precious proxy for Ethereum’s general market demand and valuation.

The chart showcases the 14-day shifting common of Ethereum Lively Addresses, which represents the full variety of distinct energetic addresses, together with each senders and receivers of ETH transactions. Since late March 2024, this metric has quickly declined, highlighting a drop in consumer exercise and transaction volumes.

This downward development displays a bearish market sentiment, with lowered demand and decrease investor participation. For Ethereum to get better and doubtlessly embark on a long-term sustainable rally, this development should reverse. A resurgence within the variety of energetic addresses would point out rising curiosity and accumulation of Ethereum, signaling extra strong demand and the potential for a bullish market reversal.