As Bitcoin (BTC) faces the problem of sustaining its value above the $65,000 help degree, on-chain knowledge signifies there could be a glimmer of hope for the crypto.

Notably, knowledge from crypto evaluation platform CryptoQuant, shared by analyst Ali Martinez on June 15, exhibits {that a} part of buyers are more and more accumulating Bitcoin following the current dip.

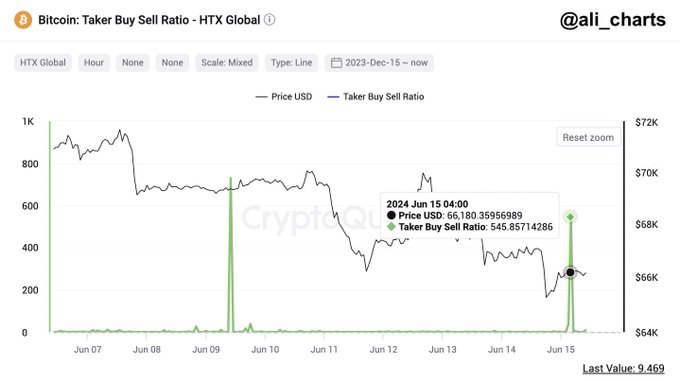

The information exhibits that the Taker Purchase Promote Ratio on the HTX cryptocurrency trade has surged to 545, signaling strong purchase stress. This spike within the metric is commonly seen as an indicator of bullish sentiment, suggesting a possible upward value motion for Bitcoin.

Martinez supplied a chart that tracks the Bitcoin value alongside the Taker Purchase Promote Ratio over the previous week. Bitcoin’s value has proven a normal downtrend from roughly $70,000 to only over $66,000, with minor fluctuations however an total downward course.

On June 9, the Taker Purchase Promote Ratio considerably spiked, indicating a sudden improve in shopping for stress. One other substantial spike occurred on June 15, with the ratio reaching 545.857, coinciding with a Bitcoin value of $66,180.

Will Bitcoin rally?

Traditionally, spikes within the Taker Purchase Promote Ratio usually precede value will increase, and the present surge means that buyers are accumulating Bitcoin, presumably anticipating a value restoration or breakout.

Certainly, a Bitcoin rally might alleviate fears of a potential crypto downturn, contemplating that the maiden digital asset has been underperforming in comparison with different asset courses. Particularly, an earlier Finbold report famous that shares and bonds are beating Bitcoin within the second quarter of 2024.

There stays normal uncertainty concerning Bitcoin’s subsequent trajectory, with the market presumably torn between whether or not bears or bulls will take cost. As reported by Finbold, analyst CryptoCon recommended that buyers ought to be careful for the 20-week exponential shifting common (EMA), at the moment at $61,603, as it would act as a key anchor for the subsequent bullish motion.

Bitcoin value evaluation

Bitcoin was buying and selling at $66,200 by press time, correcting by virtually 1% within the final 24 hours. On the weekly chart, Bitcoin was down practically 5%.

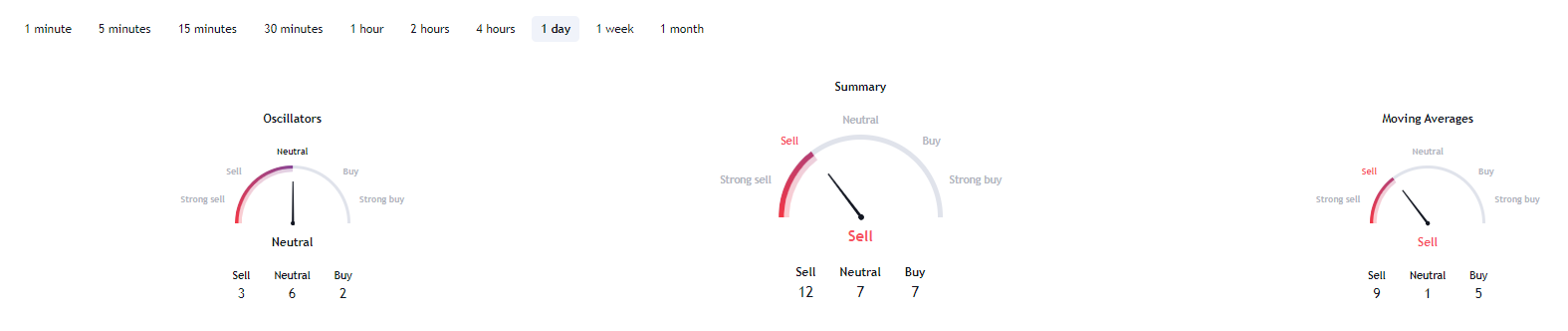

Though the shopping for stress means that Bitcoin would possibly face an imminent breakout, technical evaluation signifies that bearish sentiments dominate the crypto. A abstract of the one-day gauges retrieved from TradingView aligns with the ‘promote’ sentiment at 12. Shifting averages at 9 replicate an analogous sentiment. Then again, oscillators suggest neutrality, gauging at 6.

For the time being, for Bitcoin to have any likelihood of breaking out, it must breach the rapid resistance at $67,000. Nonetheless, dropping the $65,000 help might spell extra bother for Bitcoin.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.