After years of ready, the Securities and Trade Fee (SEC) made a cryptocurrency market splash in January 2024, first with a pretend announcement ensuing from a hack after which with the real approval of a string of spot Bitcoin (BTC) exchange-traded funds (ETFs).

Traders in search of to achieve publicity to BTC with out participating immediately with the world of digital belongings had been instantly flooded with choices, with every main issuer making an attempt to entice merchants with aggressive payment buildings.

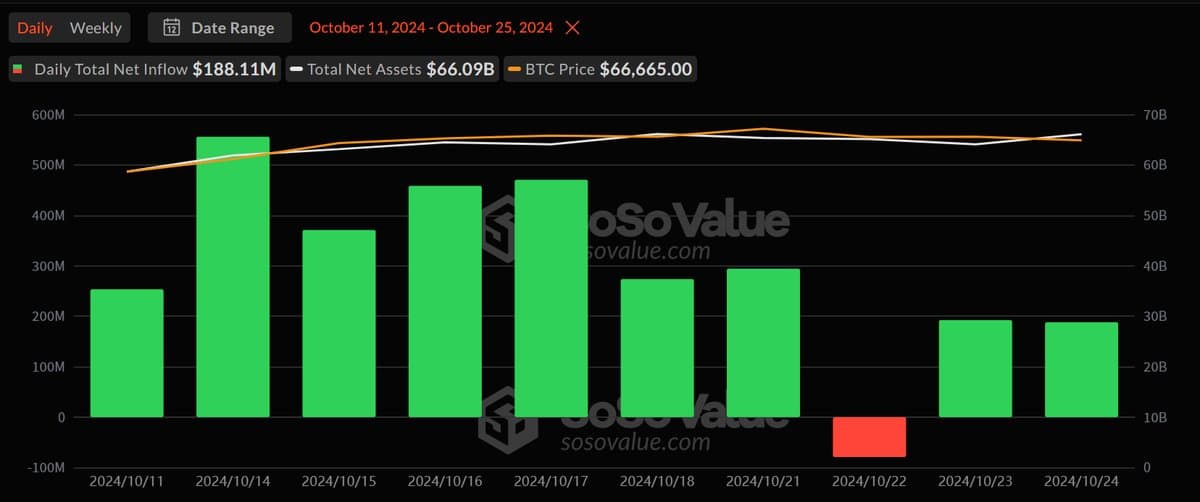

The method has up to now confirmed profitable, with $188 million flooding into BTC ETFs on Thursday, October 24 alone.

Although any of the accessible funds will be argued for, most buyers would most likely discover BlackRock’s (NYSE: BLK) iShares Bitcoin Belief ETF (NASDAQ: IBIT) finest serves their wants.

Why IBIT may be your best option for BTC ETF fanatics

Whereas a lot could possibly be stated in regards to the causes for choosing IBIT, the strongest argument boils right down to BlackRock’s sheer dimension and the size of its monitor document.

Certainly, a number of the massive causes for choosing an exchange-traded fund over immediately proudly owning cryptocurrencies are associated to the protection of participating with huge and well-established monetary establishments overseen by the SEC.

On this regard, BlackRock’s historical past – it’s 36 years outdated in 2024 – and $11.5 trillion in belongings below administration (AUM) by the tip of 2023 make it a primary selection.

Moreover, IBIT is competitively priced in comparison with its friends. In actual fact, at 0.25% each year, it’s pretty middle-of-the-road and dearer than, for instance, Franklin Templeton, Bitwise, and Ark’s choices and similar to WisdomTree and Constancy’s funds.

With greater than $26 billion in AUM, IBIT additionally advantages from its personal dimension, not simply BlackRock’s, and has turn out to be the most important such product, all of the whereas boasting substantial institutional backing.

Lastly, the iShares BTC fund additionally advantages from ease of entry – a pivotal promoting level for BTC ETFs – is additional bolstered with a partnership with Coinbase (NASDAQ: COIN).

IBIT provides comparable efficiency to BTC

By press time on October 25, the ETF had additionally managed a comparatively comparative efficiency with its underlying asset, as it’s 55.67% within the inexperienced within the all-time chart and boasts a share value of $38.87.

Concurrently, Bitcoin is up 58.95% since January 12 – IBIT’s begin date – and is, at press time, priced at $68,035.13.

Kaafi alag alag Selection ki hai China

Kaafi alag alag Selection ki hai China mein#shorts #china #tea #like #meals #humorous

mein#shorts #china #tea #like #meals #humorous Podcast #140: Criptomonedas y el Efecto Trump en el Mercado

Podcast #140: Criptomonedas y el Efecto Trump en el Mercado