Cryptocurrencies are going by means of an excellent interval proper now, and a few individuals are prone to stroll away with a pleasant return on their funding as 2024 attracts to an in depth. However that is additionally excellent news for the IRS when it comes time on your subsequent tax invoice.

In terms of maintaining your tax invoice as little as potential, nonetheless, crypto losses can be your pal. You need to use them to offset income you made elsewhere in your crypto portfolio. With good occasions doubtlessly forward for crypto cash like Solaxy ($SOL), your tax place is one thing you need to be sooner relatively than later.

Crypto Earnings Are Taxable Earnings

Meme cash are within the ascendant proper now, with a lot of them – Crypto All-Stars ($STARS), Wall Road Pepe ($WEPE), and CatSlap ($SLAP), to call just a few – promising excessive staking yields and better costs. As traders reap the benefits of the bullish markets, it may be laborious to overlook {that a} proportion of any income legally have to go to the federal government.

The IRS is making huge modifications to the foundations beginning on January 1st, so except you do a little bit of advance planning, you possibly can end up handing over extra of your crypto wins to Uncle Sam than you’d hoped for. Considering forward to your subsequent one or two tax payments, subsequently, is smart, together with offset them together with your losses.

In fact, we’re not legal professionals or accountants, so we will’t give tax recommendation. We may give you some broad strokes hints, however it is best to at all times double-check the whole lot we are saying together with your accountant. Everybody’s tax liabilities are totally different, so what applies to some individuals gained’t essentially apply to others.

So When Does Crypto Turn out to be Taxable?

It helps to begin by defining what the IRS considers to be taxable in the case of crypto. In response to this Forbes article, you’ll have to pay tax in your crypto beneficial properties if you’re:

- Promoting any of your crypto balances for fiat foreign money

- Buying and selling one cryptocurrency for an additional one

- Spending your crypto stability on items or providers (many wallets, like Coinbase, now supply debit playing cards)

- Incomes crypto by means of staking, mining, or rewards, which is one thing traders really want to be careful for, when staking new meme cash

- Receiving airdrops or laborious forks

When you’ve carried out any of these items throughout 2024, you’ll want to ask your accountant for a Type 8949, Schedule D, or Schedule 1.

So, How Can Your Crypto Tax Invoice Profit From Losses?

It’s best to ideally be placing apart 25%-30% of your crypto wins for the tax man. However you possibly can doubtlessly make your invoice decrease by including your crypto losses to the tax return. That is utterly authorized. Nonetheless, you’ll want to do that by December thirty first to reap the benefits of this on your 2024 tax invoice.

Utilizing losses to offset a tax invoice is named tax loss harvesting. That is if you take a look at your belongings and resolve which of them are underperforming and at present inflicting losses for you. You may then promote them at a loss and report that loss to the IRS, who will then hopefully settle for them and take them off your invoice. In some circumstances, these losses could even apply to tax payments in future years.

This all serves as an example that making losses can have a silver lining.

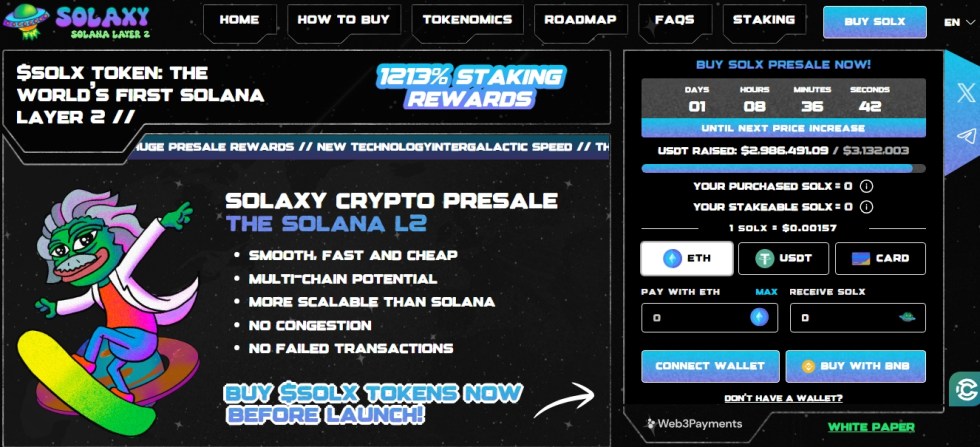

Indicators Look Good For Solaxy

At the start of the article, we talked about Solaxy ($SOL) which is one coin doing extraordinarily effectively for the time being. It’s the primary Solana Layer 2 protocol designed to sort out congestion and scalability points, which is what’s getting it loads of consideration proper now.

Whereas others like Wall Road Pepe and CatSlap are barely declining for the time being, Solaxy goes in the wrong way. It’s seeing beneficial properties of virtually 200% with a present token worth of $0.00001839, and a staking APY of 1,280%. So this is able to undoubtedly be one to contemplate together with in your portfolio.

Don’t Take Our Phrase as Gospel – Seek the advice of an Accountant!

What we’ve outlined listed below are merely generalizations. It’s best to at all times seek the advice of an accountant or a tax lawyer to ensure the foundations apply to your present scenario. Like investing in new crypto potentialities, at all times do your individual analysis!