President-elect Donald Trump has signaled that his administration will take a friendlier strategy to bitcoin and cryptocurrency, which can affect the way in which they’re taxed within the US and overseas.

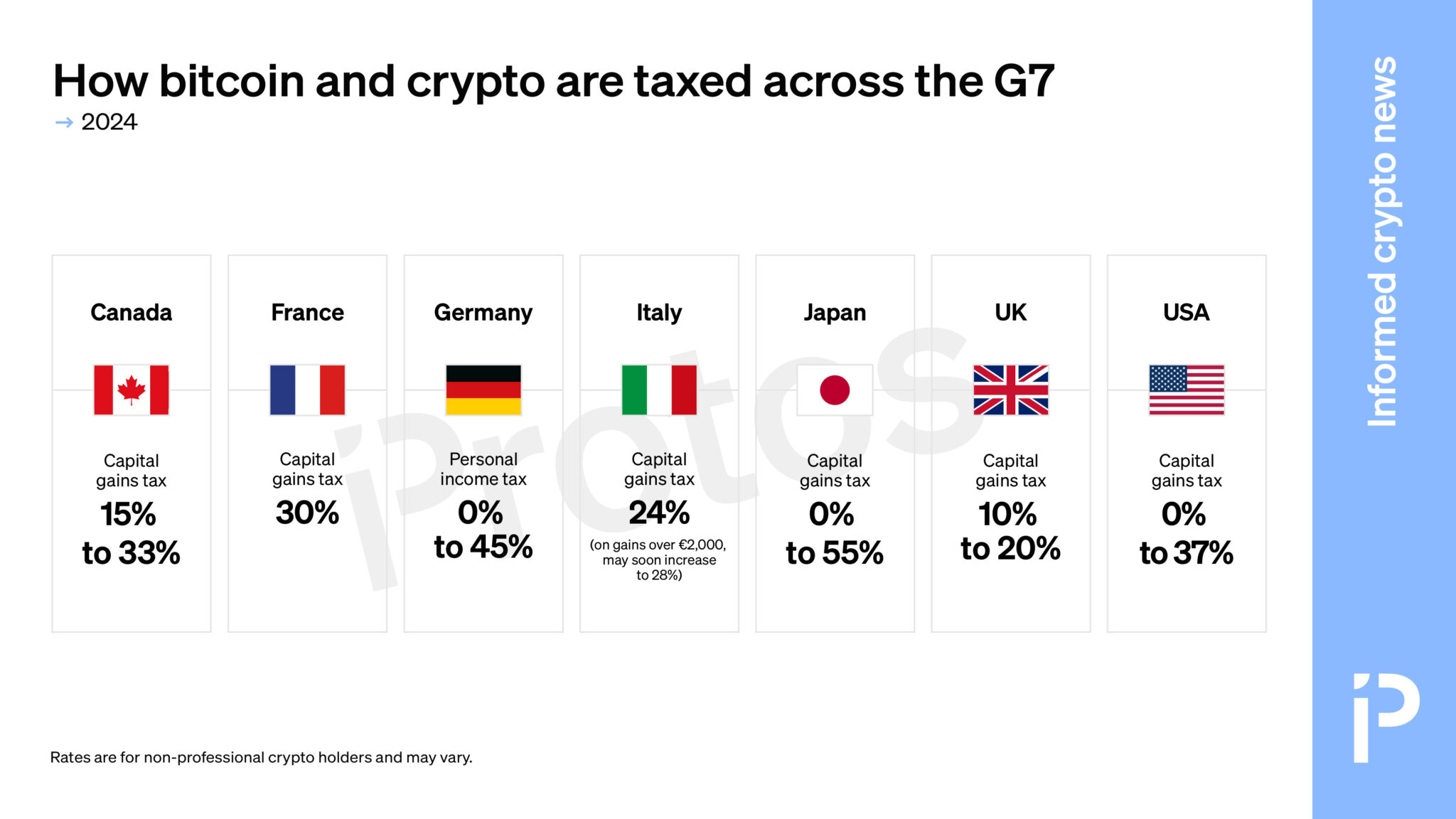

Within the US, bitcoin and crypto are at the moment considered as property. Quick-term positive aspects (lower than one yr) are taxed between 10% and 37%, relying on revenue. Equally, long-term bitcoin and crypto positive aspects are taxed between 0% and 20%.

US crypto holders might use their capital losses to offset their positive aspects. For most people, the tax deadline is similar as for different belongings: April 15.

As much as the north, Canada taxes simply 50% of an informal investor’s capital positive aspects. Tax charges comply with Federal Revenue Tax and Provincial Revenue Tax, which means bitcoin and crypto are taxed between 15% to 33% relying on revenue. Beneficial properties could also be offset by 50% of capital losses.

Click on to enlarge.

Learn extra: CHART: How bitcoin and crypto are taxed within the EU

Throughout the pond within the UK, capital positive aspects tax ranges from 10% to twenty%. The UK additionally taxes mining, staking, and lending rewards between 20% and 45% (revenue tax).

France, in the meantime, merely has a 30% flat fee on bitcoin and crypto capital positive aspects for the informal investor. Beneficial properties under €305 are tax free. That is just like Italy, the place the flat fee is 24% on bitcoin and crypto positive aspects over €2,000. Not too long ago, a fee hike to 42% has been floated however extensively contested, and can doubtless change to twenty-eight%.

In Germany, the speed is between 0% and 45% relying on revenue. Lastly, in Japan, positive aspects exceeding 200,000 Japanese Yen ($1,300) are taxed between 15% to 55% relying on revenue.

Please notice these tax charges are for informal buyers, will not be exhaustive, and are topic to vary.