It is a section from the Empire e-newsletter. To learn full editions, subscribe.

Let’s be trustworthy: Ethereum’s not having a very good time. A part of it, as I wrote yesterday, is because of the general lack of momentum for altcoins. There’s additionally only a lack of constructive sentiment — which is in contrast to what we’re seeing for bitcoin (even when it hovers under $100,000).

In my dialog with Amberdata’s Greg Magadini, one half that was overlooked of yesterday’s version have been his ideas on ETH.

“The drag on ETH, in my thoughts, is as a result of the worth proposition of EIP-1559 making a provide burn was made invalidated, or was invalidated as soon as everybody began constructing their L2s and app chains and having all of the transactions course of off Ethereum and settle again to Ethereum. So then you definately flip from a deflationary asset to an inflationary asset. That’s a elementary purpose for ETH taking place,” he defined.

In different phrases, ETH’s incapacity to regain momentum shouldn’t be immediately tied to the remainder of the market proper now — particularly not the memecoin craze.

Okay so this wasn’t my most constructive intro, however I truly needed to take extra of a constructive have a look at Ethereum proper now due to a Galaxy report from Vice President of Analysis Christine Kim.

The report is concentrated on what’s being constructed on Ethereum and is a pleasant refresher — or inside look — to see how initiatives are utilizing it.

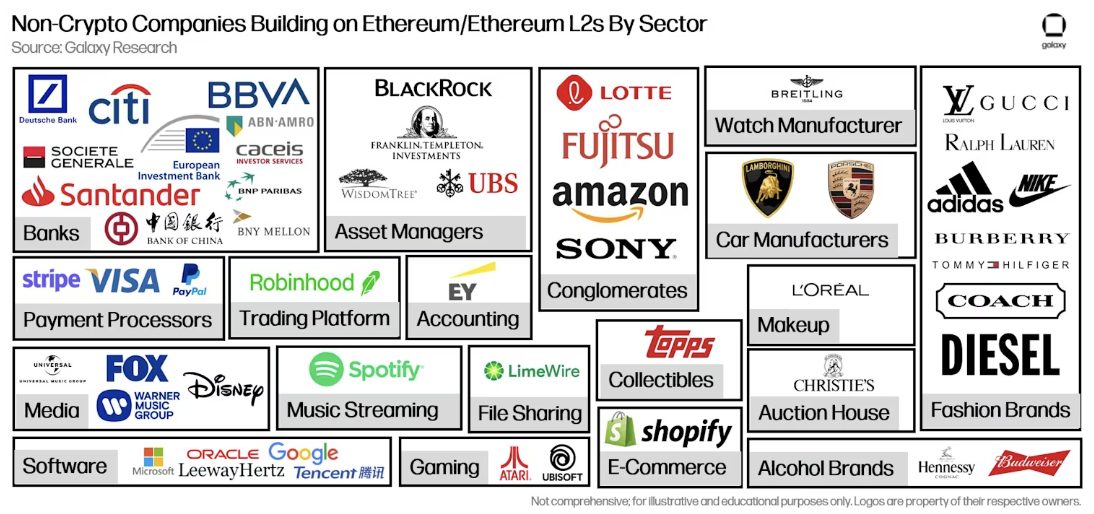

Kim famous that over 50 non-crypto firms have constructed both on Ethereum or an Ethereum L2. That’s no small quantity, particularly if you dig in and discover that about 20 of them are monetary establishments with 10 of these being banks.

Supply: Galaxy

The largest use case, which ought to come as no shock to loyal Empire readers, is real-world property. That’s the place you’ve gotten the monetary establishments constructing and experimenting with tokenized property — similar to cash market funds (assume BlackRock or Franklin Templeton) or authorities bonds.

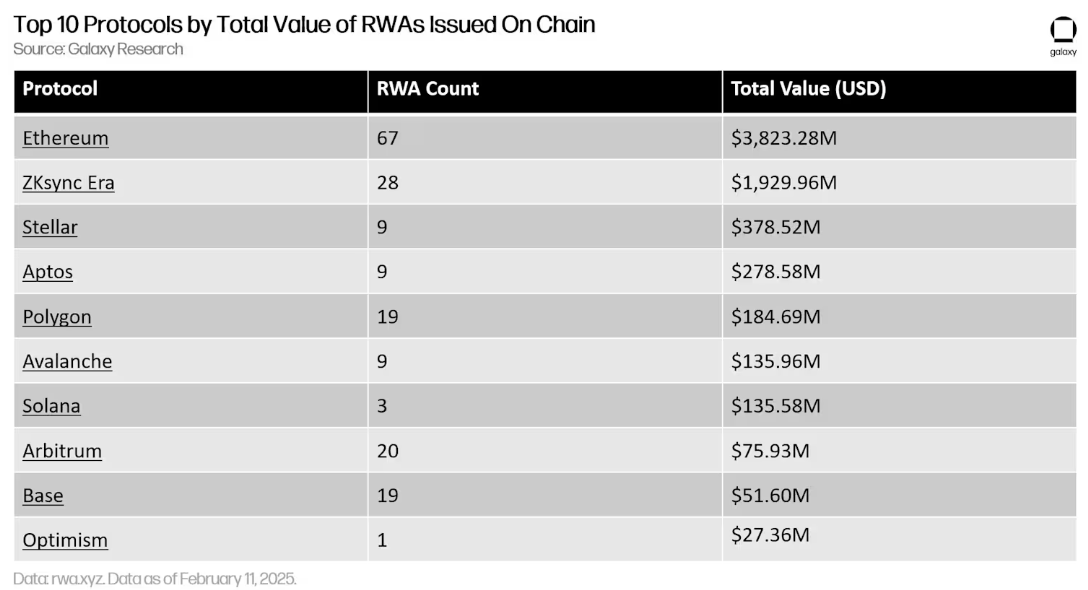

As seen under, Ethereum greater than doubles the variety of RWAs issued by Ethereum L2 rollup ZKSync.

Now I do know that RWAs aren’t the sexiest use case for crypto — and I get it — however I feel we are able to all agree that they present among the promise of crypto for non-crypto natives (as long as we hold them away from the memecoins).

However, okay, let’s transfer on to a different use case Galaxy discovered: gaming on Ethereum L2s.

NFTs haven’t made a comeback, which implies that among the firms that attempted to get some crypto publicity by way of them stopped issuing them years in the past. Truthful sufficient. However Galaxy discovered that these days, there is a use case for NFTs for some non-crypto native firms and that’s gaming.

“What’s most notable concerning the ongoing funding and improvement of NFTs by non-crypto-native firms like Atari, Lamborghini, and Lotte’s Caliverse is that they’re being developed within the context of a bigger on-chain gaming utility,” Kim wrote.

“This highlights how the scalability positive aspects from L2s are serving to to assist crypto-native use circumstances that require frequent on-chain interactions like gaming amongst main retail manufacturers and companies,” she continued.

There are nonetheless numerous questions and issues about Ethereum and the place it goes from right here, and that’s one thing I’m certain we’ll be overlaying once more quickly. However Galaxy’s report exhibits that we’re nonetheless seeing numerous constructing taking place, and it’s attracted people exterior of crypto. And that, I feel, is a small constructive.