In distinction, the spinoff from Grayscale’s Ethereum Belief has seen its internet inflows persistently develop during the last three days.

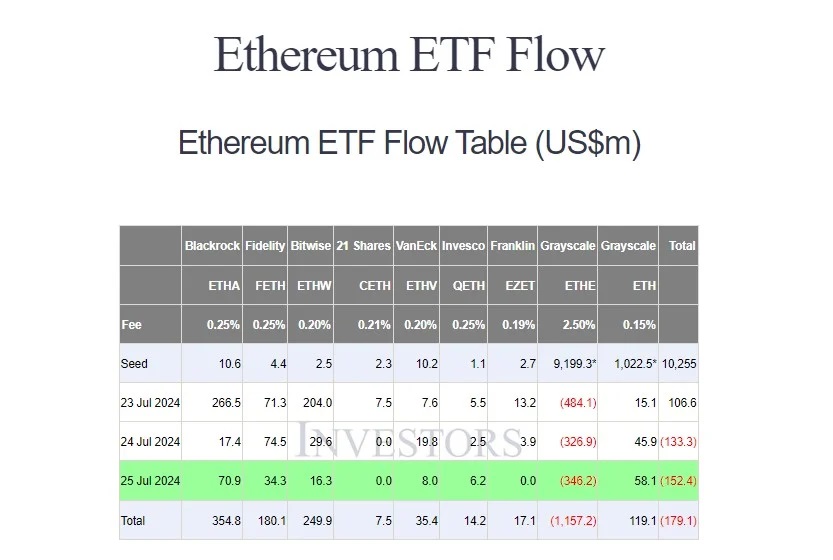

Grayscale’s Ethereum ETF (ETHE) ended Thursday with roughly $346 million in internet outflows, extending its losses to $1.1 billion inside three buying and selling days since its conversion, knowledge from Farside Traders reveals. After the third buying and selling day, ETHE’s property underneath administration plummeted from over $9 billion to $7.4 billion, a exceptional decline because the launch of US spot Ethereum ETFs.

In distinction, BlackRock’s iShares Ethereum Belief (ETHA) led inflows on Thursday, attracting roughly $71 million. Grayscale’s Ethereum Mini Belief (ETH), a derivative of Grayscale’s Ethereum Belief, adopted with over $58 million in internet inflows.

Different funds, together with Constancy’s Ethereum Fund (FETH), Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), and Invesco/Galaxy’s Ethereum ETF (QETH), additionally reported inflows. The remaining ETFs noticed zero flows.

Regardless of inflows to eight Ethereum ETFs, the mixed internet outflow for all 9 funds on Wednesday reached $152 million, the biggest since their buying and selling debut on July 23. This outflow was largely pushed by Grayscale’s ETHE.

ETHE’s 2.5% price makes it a significantly costly choice for buyers who want to get publicity to Ethereum. Traders have been promoting their ETHE shares and transferring to lower-fee newcomers.

The scenario just isn’t totally sudden given the expertise of Grayscale’s Bitcoin ETF (GBTC). The fund’s outflows topped $5 billion after the primary buying and selling month, in response to knowledge from Bloomberg.

Nonetheless, this time, Grayscale’s Ethereum Mini Belief might assist it eliminate the deja vu. ETH’s 0.15% price makes it one of many lowest-cost spot Ethereum funds within the US market, and the fund’s inflows have persistently grown because it was transformed into an ETF.