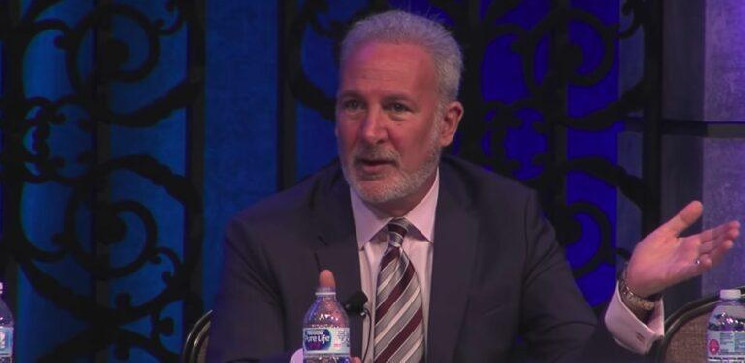

In a current interview with Kitco Information, Peter Schiff, the chairman of SchiffGold and founding father of Euro Pacific Asset Administration, made daring predictions about the way forward for the U.S. economic system. Schiff argued that the Federal Reserve’s upcoming actions will result in extreme penalties for the U.S. greenback and world monetary markets. He advised that the Federal Reserve’s choice to chop rates of interest could be a catastrophic error. In keeping with Schiff, this transfer will enable inflation to run unchecked and expose the Fed’s incapability to manage the state of affairs.

Schiff contends that when the Fed cuts charges, inflation will spiral uncontrolled, damaging its credibility even additional. He believes that this can outcome within the final collapse of the U.S. greenback. Schiff went on to assert that the times of the greenback being the world’s reserve foreign money are coming to an finish. He emphasised that the de-dollarization course of is already underway however will speed up quickly within the close to future. In his view, this shift will trigger important monetary disruptions, notably for the U.S. economic system.

Furthermore, Schiff predicted that gold would emerge as the last word secure haven throughout this financial turmoil. He confidently acknowledged that gold costs may soar to $10,000 an oz within the coming years. Schiff defined that as central banks transfer away from the U.S. greenback, gold will reclaim its position as the first world reserve asset. In Schiff’s opinion, gold has at all times been the last word retailer of worth, and its resurgence will replicate the rising instability of fiat currencies.

Turning to the labor market, Schiff highlighted that current knowledge revisions paint a a lot bleaker image of the U.S. economic system than beforehand reported. Schiff referenced the Bureau of Labor Statistics’ downward revisions to payroll knowledge, arguing that the variety of jobs created over the previous yr has been exaggerated. Schiff believes that many new jobs are part-time positions taken by employees struggling to deal with rising inflation. He additional claimed that the labor market is artificially propped up by low-quality jobs, that are a direct results of inflation eroding actual wages.

Moreover, Schiff criticized the U.S. authorities’s dealing with of financial knowledge, accusing it of masking the true state of the economic system. He acknowledged that labor market and inflation knowledge are sometimes revised downward after preliminary releases, indicating that the numbers are unreliable. In keeping with Schiff, this development of revising knowledge exhibits that the economic system shouldn’t be as sturdy as the federal government claims. He argued that these revisions reveal a a lot weaker labor market and better inflation charges than what’s publicly introduced.

Schiff additionally expressed concern in regards to the U.S.’s rising commerce and finances deficits. He defined that the U.S. is operating report commerce deficits, which he believes signifies a weak economic system. Schiff famous {that a} sturdy economic system produces extra items domestically, decreasing the necessity for imports. Nonetheless, he identified that the U.S. economic system more and more depends on imports, additional widening the commerce deficit. In Schiff’s view, this development will proceed, exacerbating the nation’s monetary issues.

When requested in regards to the Federal Reserve’s future actions, Schiff warned that the Fed’s reliance on flawed knowledge may result in extra poor choices. He acknowledged that the Fed typically makes use of inaccurate knowledge to justify its insurance policies, leading to ineffective financial choices. Schiff argued that the Fed’s reliance on government-reported inflation knowledge, which he considers unreliable, has blinded policymakers to the true extent of the financial disaster.

As well as, Schiff addressed the chance that the U.S. authorities could also be actively suppressing gold costs to masks the weak spot of the greenback. Whereas Schiff acknowledged the idea that governments is perhaps manipulating the worth of gold, he famous that the gold value has risen considerably over the past 20 years regardless of any potential suppression efforts. Schiff asserted that gold’s long-term upward development is a sign that the worldwide economic system is shedding religion in fiat currencies.

Lastly, Schiff concluded that we’re heading in the direction of an financial surroundings the place quantitative easing (QE) will return and rates of interest shall be lower additional. He predicted that this might gasoline inflation, driving up long-term rates of interest and making it troublesome for the Fed to handle the economic system. In keeping with Schiff, the Fed shall be compelled to intervene within the markets by buying extra bonds, a transfer he believes will additional destabilize the greenback.