It has been lower than two weeks since Donald J. Trump stepped again into the White Home, and he has already rattled the cages with quite a few controversial choices. The most recent got here on Saturday night as he levied hefty taxes on China but additionally its two neighbors – Canada and Mexico.

Given the truth that his actions got here in the course of the weekend when just one monetary market was open for buying and selling, it was anticipated that this explicit market would face the music.

Bitcoin Slumps Throughout the Weekend

Trump’s 25% tariffs on Canada didn’t go unnoticed, and the latter’s Prime Minister, Justin Trudeau, responded kindly by imposing the identical tax on American items. Following Trump’s justification, claiming that these taxes purpose to guard Americans, in addition to lowering the movement of medicine and undocumented immigrants into the US, Trudeau had this to say:

“We don’t wish to be right here; we didn’t ask for this.” Nevertheless, he added that his nation would “not again down” and that their retaliation was an indication that they’d be “standing up for Canadians.”

With Mexico getting ready its response and China stated to problem Trump’s tariffs on the World Commerce Group, the state of affairs appears removed from reaching a peak, and there’s no de-escalation in sight. Furthermore, the US president has a clause within the order he signed that enables him to impose even greater taxes ought to the aforementioned nations retaliate, as they appear to be doing.

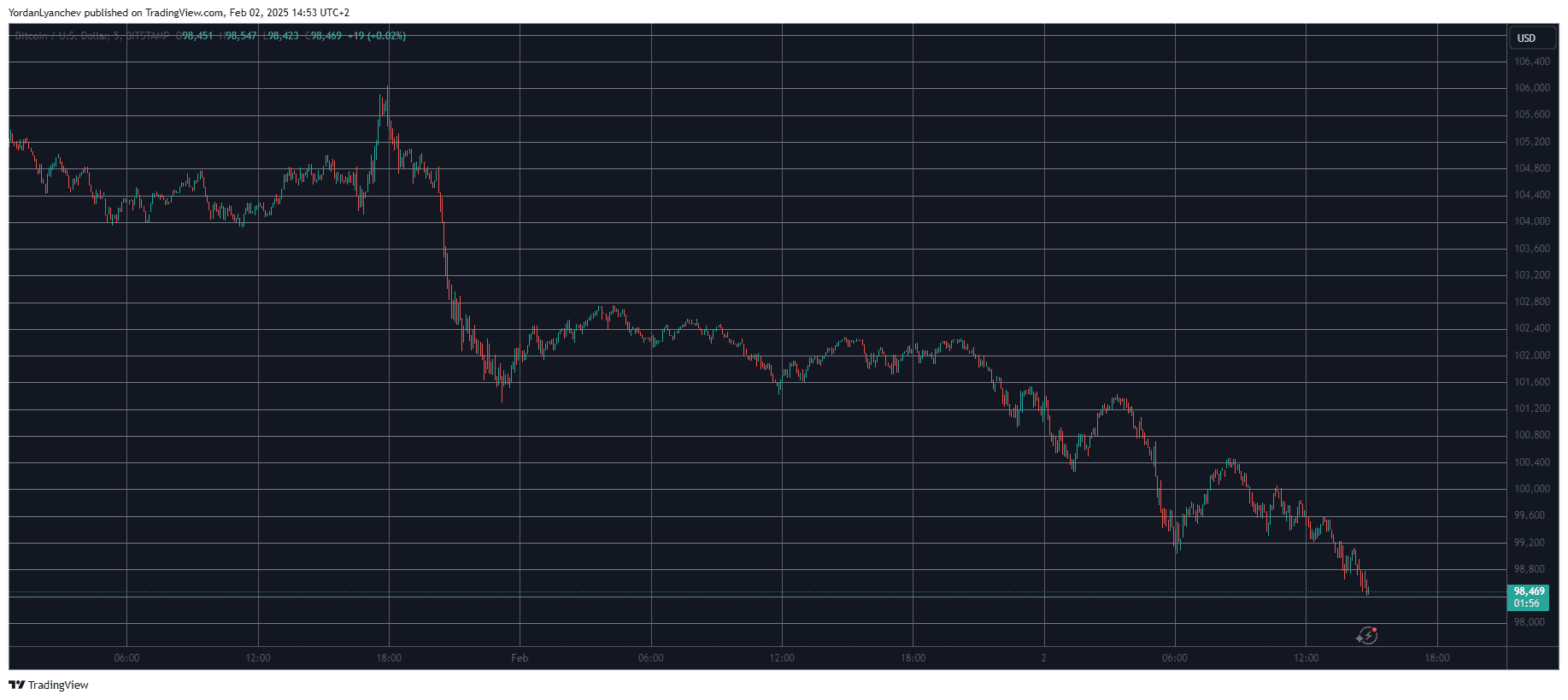

The political panorama worsened in the course of the weekend as Trump’s orders had been signed on Saturday, and the one opened monetary market acquired the most important blow. Being a 24/7 tradable asset, BTC’s worth slumped from over $106,000 on Friday to beneath $98,500 earlier right now.

Gold Hits ATH

On the floor, gold’s worth actions prior to now a number of days appear to distinction with these of BTC. In any case, the valuable metallic shot as much as a recent all-time excessive of just about $2,820/oz on Friday. Nevertheless, the bullion additionally retraced after its new peak and closed Friday (and January) at just below $2,800.

Furthermore, gold, identical to shares and all different non-crypto monetary markets, is closed for buying and selling in the course of the weekend, so the affect on it’s but to be seen. The futures markets provide little perception as of press time, so when the Asian buying and selling session opens on Monday morning, it would reveal the true image behind Trump’s actions.

On the identical time, the affect on crypto and BTC might additionally worsen if a much bigger sell-off transpires within the subsequent few days.