The funding fee for perpetual futures serves as a proxy for market sentiment and reveals the stability between lengthy and quick positions. Important deviations from the typical funding fee throughout exchanges can sign potential imbalances in positioning. A spike within the funding fee on a specific alternate reveals a lot of lengthy positions, which might result in a possible squeeze or lengthy liquidations if the market turns.

One other remark that may be produced from the adjustments in funding charges is arbitrage alternatives. A major divergence between exchanges or contract varieties allows merchants to capitalize on short-term market inefficiencies. That is why even the slightest adjustments in funding charges could be essential, as they’ll act as early warning indicators of potential market shifts or adjustments in sentiment.

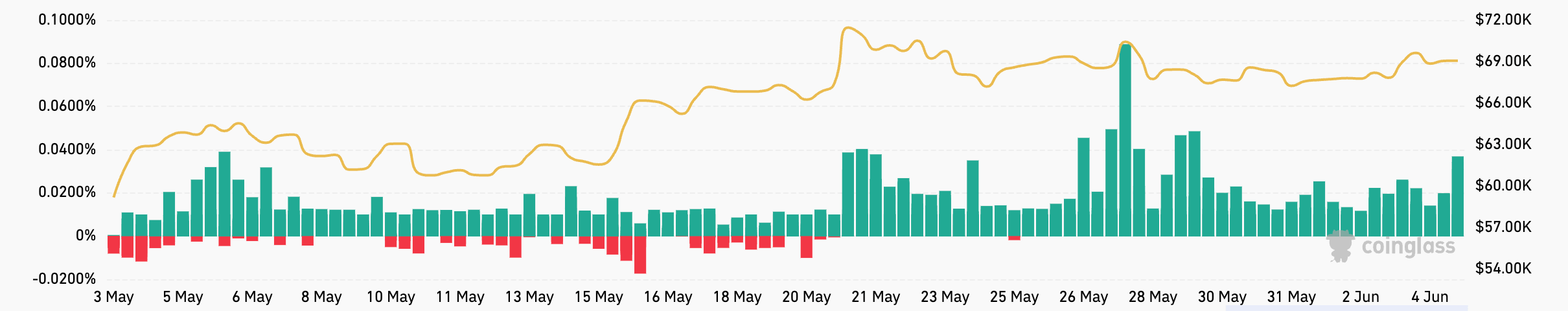

The funding fee for USDT and USD-margined perpetual futures has been comparatively steady all through Could. That is indicative of a comparatively steady market that’s leaning bullish. This stability was briefly damaged on Could 27, when the funding fee for USDT and USD-margined perpetual futures on dYdX spiked to 0.0889%. This was a pointy deviation from the typical fee of round 0.0120% throughout different exchanges, indicating a big imbalance between lengthy and quick positions. Extra merchants taking up lengthy positions might have resulted from Bitcoin’s temporary worth spike to over $70,000. Nonetheless, as different exchanges noticed much less volatility of their funding fee, there might have been a specific inefficiency that dYdX merchants had been dashing to take advantage of.

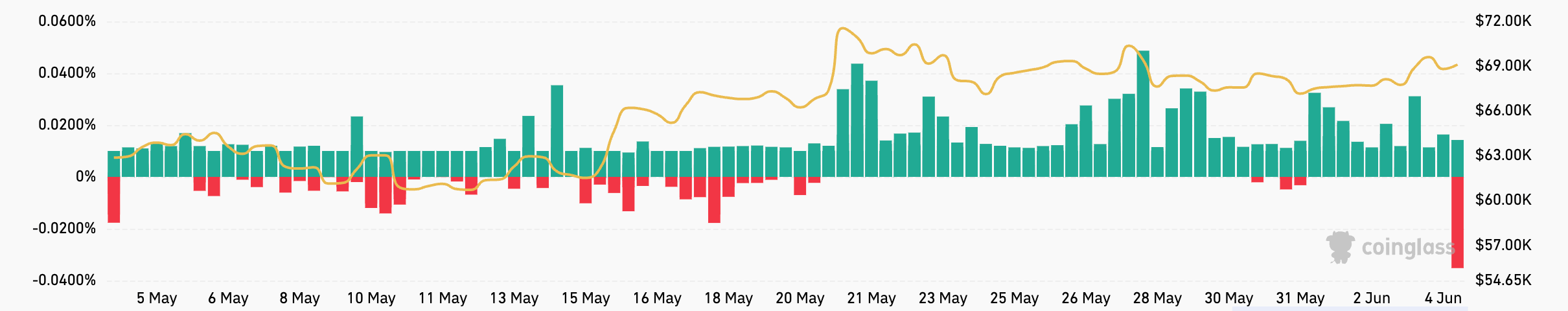

The funding fee for token-margined perpetual futures has skilled comparable stability up to now 30 days, hovering between 0.0100% and 0.0140% all through Could. Within the early hours of June 4, Bitmex noticed a big drop in funding fee for token-margined perpetual futures from a steady 0.0100% to -0.0352%. Such a pointy drop in 24 hours confirmed a strong bearish sentiment amongst merchants. Nonetheless, with different exchanges seeing their charges steady at 0.0100%, the bearish sentiment appears to be concentrated amongst Bitmex customers alone. Bitmex’s morning funding fee was near the decrease restrict of -0.0375% set by many exchanges, which confirmed excessive positioning in these contracts in comparison with USDT or USD-margined contracts.

All through the day, the funding fee managed to consolidate at round -0.0150%, additional displaying the volatility’s short-lived nature.

A few of this volatility could possibly be attributed to the speculative nature of token-margined contracts. Exchanges providing token-margined perpetual futures typically present increased leverage than USDT or USD-margined contracts. Whereas increased leverage can amplify potential positive aspects, it additionally magnifies losses, making token-margined contracts riskier and extra appropriate for speculative buying and selling methods.

Token-margined perpetual futures have a tendency to draw the next proportion of retail merchants and speculators who’re extra risk-tolerant and will search increased returns. Institutional buyers {and professional} merchants, who usually prioritize danger administration and capital preservation, usually tend to gravitate in the direction of USDT or USD-margined contracts, that are perceived as extra steady.

One other essential issue that would have led to such a pointy drop within the funding fee on Bitmex is market depth. Token-margined perpetual futures often have decrease liquidity than their USDT or USD-margined counterparts. Decrease liquidity results in wider bid-ask spreads, making these markets extra inclined to hypothesis and volatility.

The steady charges throughout most exchanges over the previous 30 days, mixed with Bitcoin’s comparatively range-bound worth motion, point out a interval of market uncertainty and indecision. Subsequently, the remoted drops and spikes in funding charges on particular exchanges up to now weeks point out inner tendencies and adjustments greater than market-wide ones.

The put up Funding fee volatility reveals localized buying and selling imbalances regardless of market stability appeared first on cryptoteprise.