FTX collectors proceed to hope they are going to be made complete following the trade’s collapse in November 2022. As the choice relating to the platform’s restructuring looms, it stays to be seen what type the funds will take.

Extra developments are anticipated in This autumn, beginning October, with creditor funds more likely to trigger market volatility.

FTX Collectors Compensation Replace

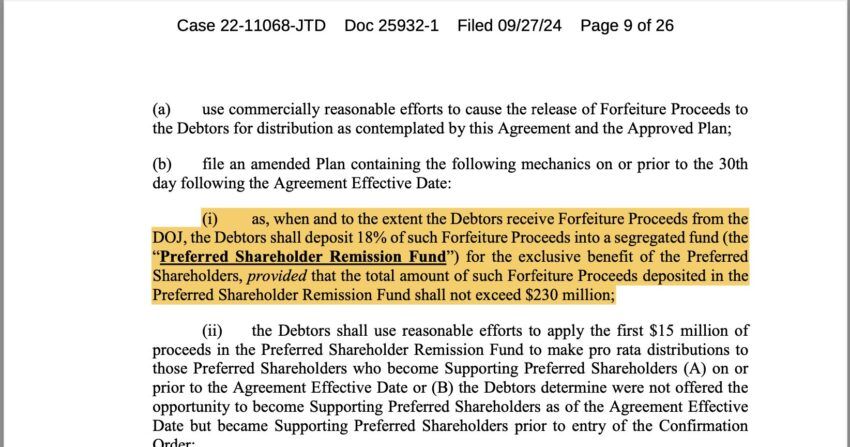

In line with FTX creditor activist Sunil Kavuri, the trade’s clients may get between 10% and 25% of their crypto again. The replace comes because the now-defunct trade strikes 18% of the forfeiture funds ($230 million) to fairness holders (shareholders), which some discover regarding.

“[This is] Only a fast estimate of how a lot petition date goes to pay us versus present worth,” the activist defined.

FTX Creditor Replace, Supply: Courtroom Paperwork

Learn extra: FTX Collapse Defined: How Sam Bankman-Fried’s Empire Fell

The replace comes amid frothing buzz that FTX will start distributing $16 billion to its collectors beginning October. Notably, this stays unconfirmed, as the choice relating to the restructuring plan for the trade’s clients is pending court docket affirmation. The court docket listening to associated to this scheduled is due on October 7.

“The choice relating to the restructuring plan for FTX clients won’t be made till October 7. As a result of the court docket listening to associated to it’s scheduled for that date. Personally, I couldn’t discover any details about what type of reimbursement will probably be, crypto or money, and this is essential within the context of withdrawals from the cryptocurrency market,” CryptoTrail wrote.

It comes barely two months after the court docket agreed to a $12.7 billion reimbursement. However, the court docket banned FTX and its sister enterprise, Alameda Analysis, from buying and selling digital belongings and didn’t impose any civil financial penalty.

There’s nonetheless controversy across the reorganization plan after a US trustee objected, citing the necessity for extra equitable distribution amongst collectors. Earlier than the US Trustee’s objection, FTX collectors, together with Sunil Kavuri, had additionally filed an objection to the reorganization plan. The bone of competition is that the plan incorporates broad exculpation provisions and an absence of in-kind distribution choices for purchasers.

“It’s painfully obvious that the Debtors’ proposed Plan will inflict extra hardships on clients by means of compelled taxation that might be averted by making an ‘in sort’ distribution,” the collectors argued.

Equally, the US Securities and Change Fee (SEC) questioned the plan. It demanded the removing of the discharge provision and different modifications. The securities regulator dedicated to difficult the plan’s affirmation if the trade doesn’t make these modifications.

Learn extra: Crypto Regulation: What Are the Advantages and Drawbacks?

In the meantime, crypto markets are bracing for impression on two completely different fronts. On one hand, FTX nonetheless holds over $1 billion in Solana tokens amid ongoing liquidation efforts post-bankruptcy. As BeInCrypto reported, this important variety of tokens may stress Solana’s market valuation.

Then again, buyer repayments may inject a brand new wave of capital, more likely to stream into Bitcoin and altcoins.