Japan’s Yomiuri Shimbun reported Saturday that the Monetary Providers Company (FSA) is holding closed talks with “specialists” about cracking down on Bitcoin and crypto in Japan. Some residents are bullish on the information, as they hope for tax reduction by way of potential authorized amendments. Their hopes and skyrocketing centralized adoption in Japan hinge, partially, on the thrill that adopted Trump’s re-election in america.

Japan’s Yomiuri Shimbun reported early Saturday (JST) that the nation’s monetary regulator could also be transferring to crack down on crypto. In view of reining in unregistered peer-to-peer use (satirically, the entire level of Bitcoin within the first place), the Monetary Providers Company (FSA) is reportedly in closed-door talks with “specialists” about altering the authorized system in the case of digital belongings.

‘Unregistered’ crypto use focused as funding skyrockets in Japan

In gentle of the discussions, amendments might be made to the Cost Providers Act and the Monetary Devices and Change Act. The report notes that as centralized funding in crypto is “quickly growing” there’s a fly within the state’s soup: unregistered intermediaries and people buying and selling crypto with out Huge Bro’s permission.

To assist seize Satoshi’s pesky peer-to-peer creation bringing financial freedom to the lots, the Japanese political machine is reportedly contemplating stiffer penalties for “unregistered” use, and requiring “crypto asset issuers to reveal particulars of their enterprise operations and shares.”

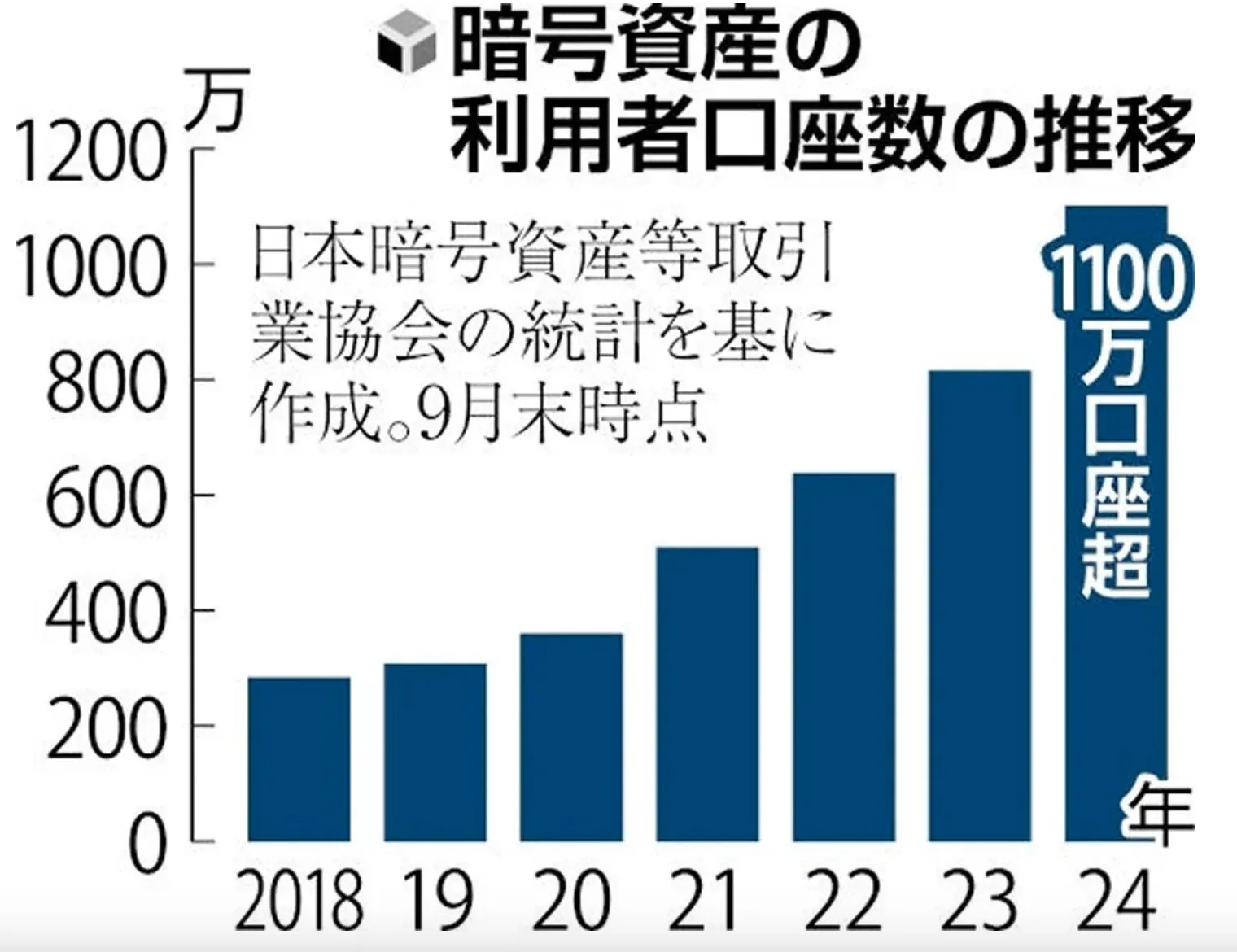

Crypto accounts opened in Japan have grown 3.5X over the past 5 years. Supply: Yomiuri Shimbun.

Public sentiment break up with potential Bitcoin tax overhaul and spreading Trump mania

On the flip facet, some normie traders appear fairly blissful. One concern the Japanese public has their eyes on is reducing the nation’s astronomically excessive taxation of cryptocurrencies. As Cryptopolitan has beforehand reported, there was political discourse a few separate 20% tax price for digital belongings. At the moment, Bitcoin traders in Japan will be taxed as excessive as 55% on their positive aspects.

The Yomiuri report notes that the tax overhaul could also be a results of the key FSA talks, presumably as a consequence of stricter legal guidelines permitting crypto to be seen as a extra reliable asset class.

Nonetheless, the report could also be complicated for some. Simply this week, headlines within the nation have been selling the concept rules may very well develop into much less cumbersome for so-called intermediaries and different smaller companies concerned with crypto.

The rub? They’ll need to be supervised by a registered change to get pleasure from the advantages of proposed lightened restrictions for NFTs and in-game/particular currencies.

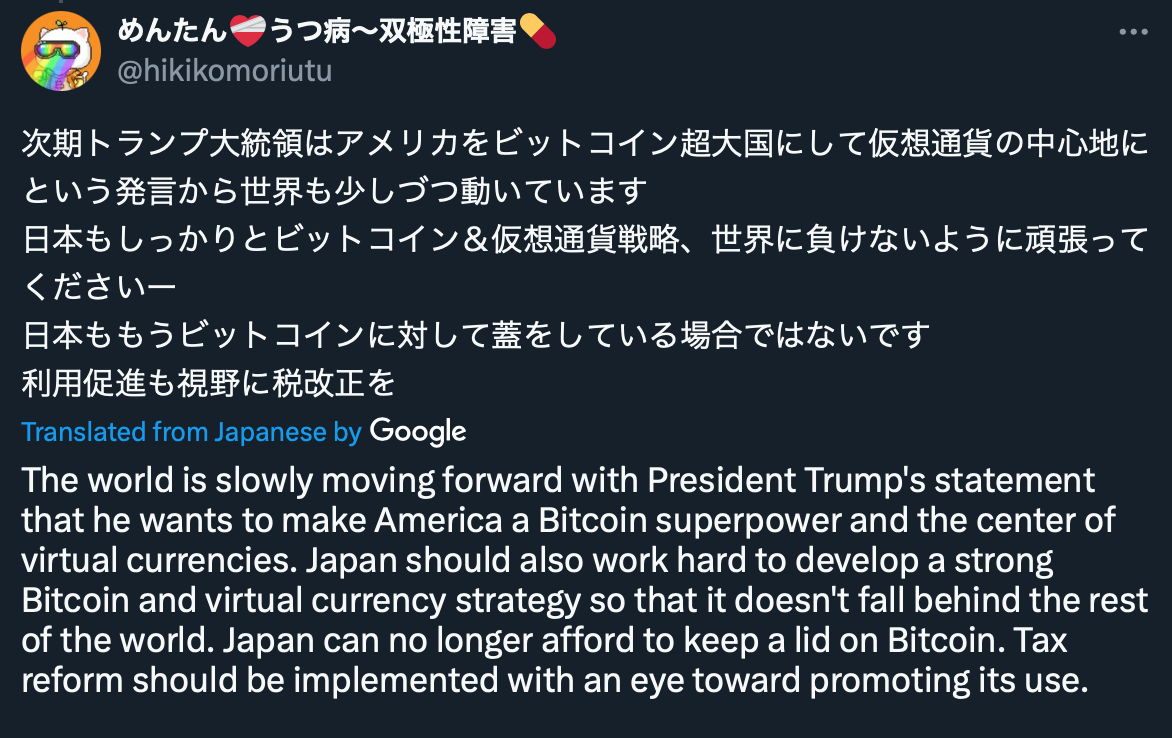

Additional coloring the overhaul concern is the Trump hype seeping into the psyche of traders in Japan, who worry the nation might lag behind “crypto-friendly” regimes like they think about the U.S. to be. “Japan can not afford to maintain a lid on Bitcoin,” one social media consumer famous on X, referencing Donald Trump. “Tax reform needs to be applied with a watch towards selling its use.”

The Yomiuri Shimbun report talked about the truth that the U.S. President-elect promised to make America a “Bitcoin superpower,” and famous the launch of Bitcoin exchange-traded funds (ETFs). However advocates of permissionless peer-to-peer (P2P) use of crypto as described within the Bitcoin whitepaper and people who assume the Japanese state has higher issues to do than huff the flatulence of Musk and Mango Messiah, stay unimpressed.

“A nasty premonition,” one other commenter tweeted.

The FSA plans to achieve a choice concerning the matter inside fiscal 2024 yr, as per the report, and work with the Monetary System Council in 2025 if stronger rules are deemed crucial.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap