Bitcoin velocity measures the speed at which cash are circulating throughout the market. It’s calculated by dividing the trailing 1-year estimated transaction quantity—or the cumulative sum of transferred tokens—by the present provide of Bitcoin. Velocity is a crucial metric as a result of it signifies the extent of financial exercise within the community. A better velocity signifies that cash are transferring extra continuously, suggesting increased transactional exercise. In distinction, decrease velocity implies that cash are idle, presumably reflecting a long-term holding mentality.

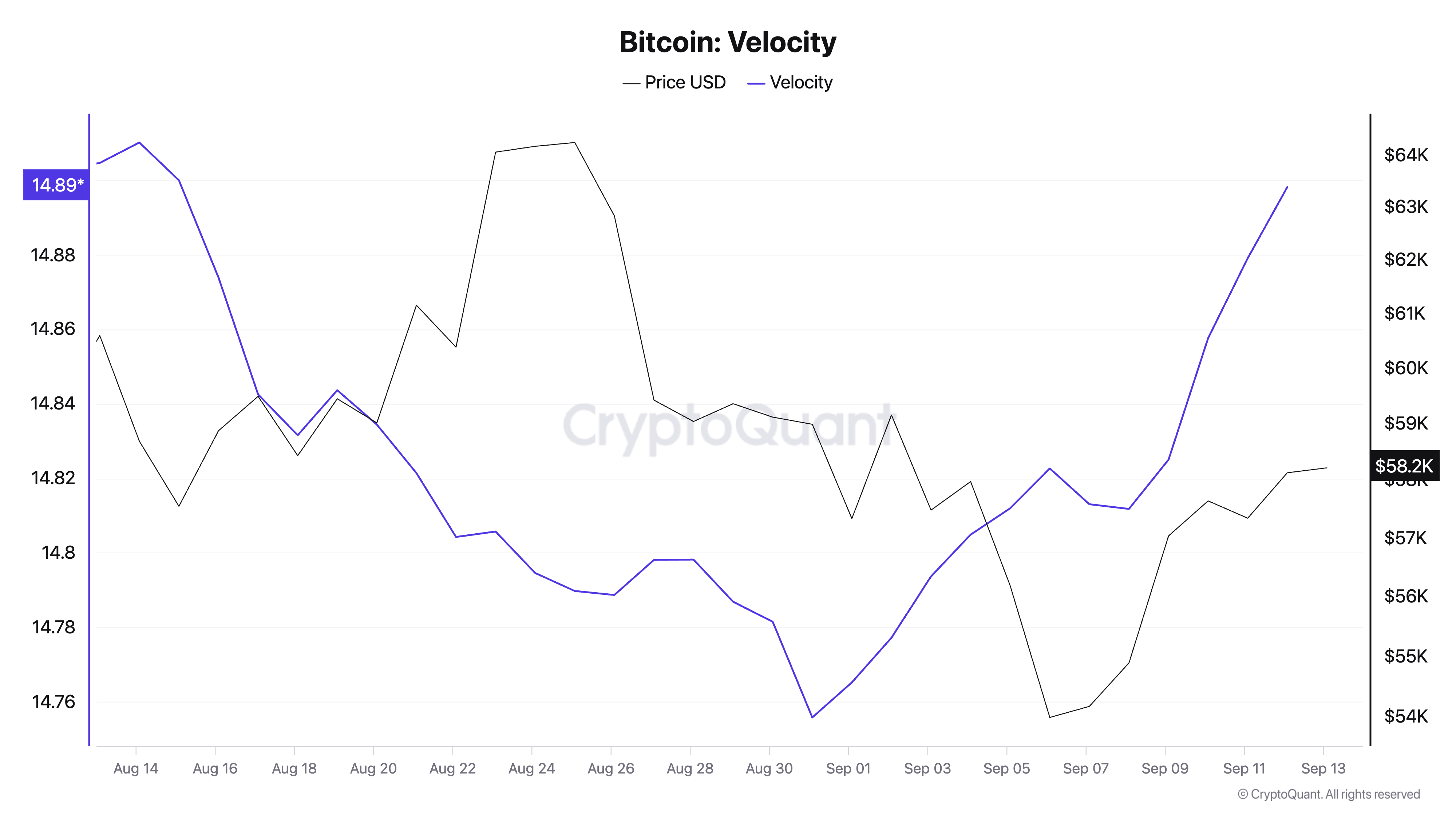

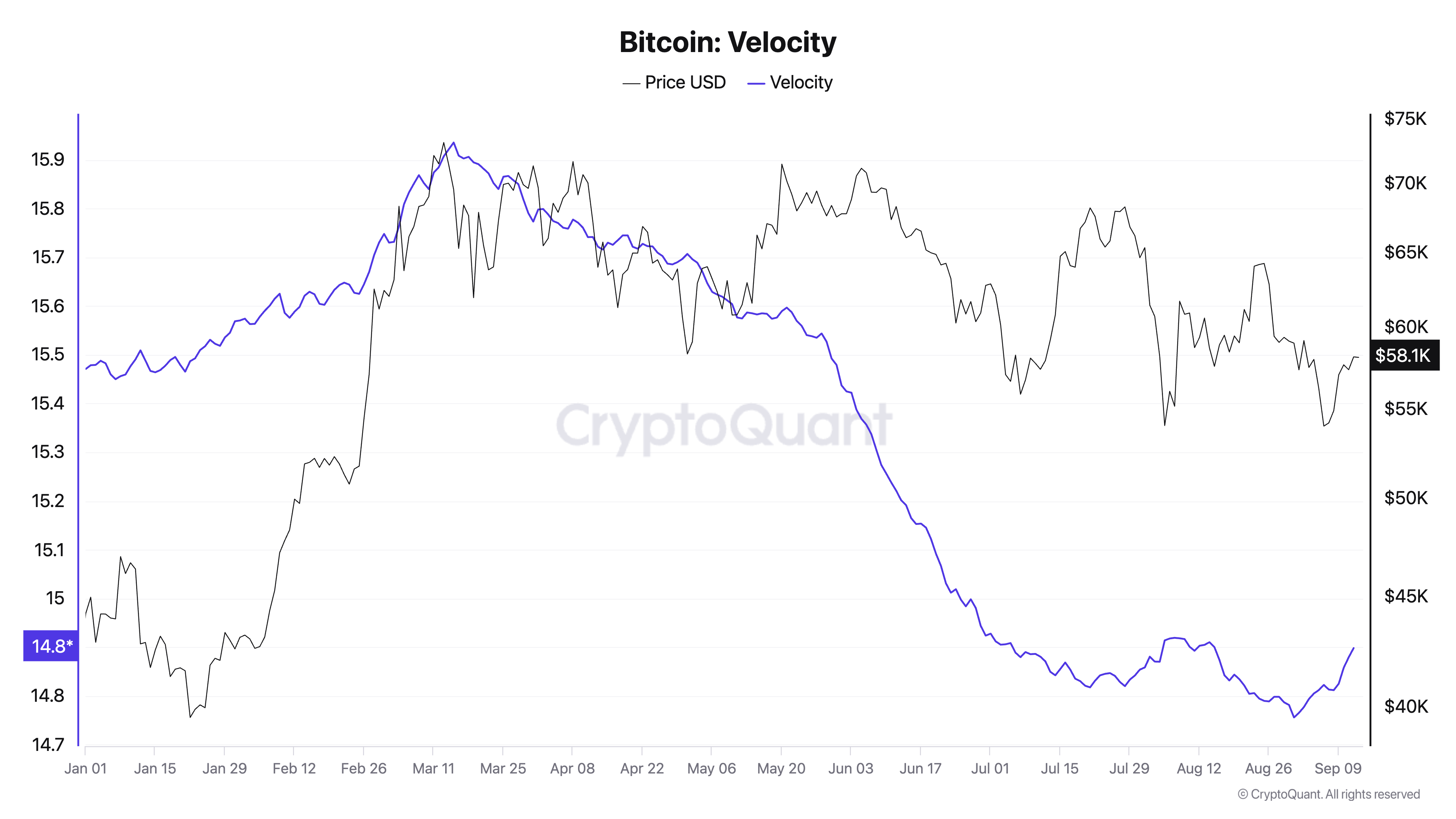

cryptoteprise’s evaluation discovered that Bitcoin’s velocity noticed a notable uptick in September. This short-term improve follows a chronic interval of decline that started in mid-March. To grasp the importance of this uptick, we should look at each the latest spike and the long-term downward pattern in velocity.

Bitcoin velocity started to extend after months of regular decline on the finish of August 2024. This short-term improve suggests a renewed wave of market exercise. Whereas the uptick will not be substantial in absolute phrases, it marks the primary notable rise in Bitcoin velocity in months. This means that after a interval of consolidation, the market could possibly be getting ready for extra energetic participation.

Spurred by exterior developments and expectations of additional value actions, merchants have begun to maneuver their holdings once more. This could possibly be attributable to varied elements, but it surely often boils right down to volatility—when costs transfer considerably, buying and selling exercise spikes because the market races to seize revenue or lower losses from the value swings, growing transaction quantity and velocity.

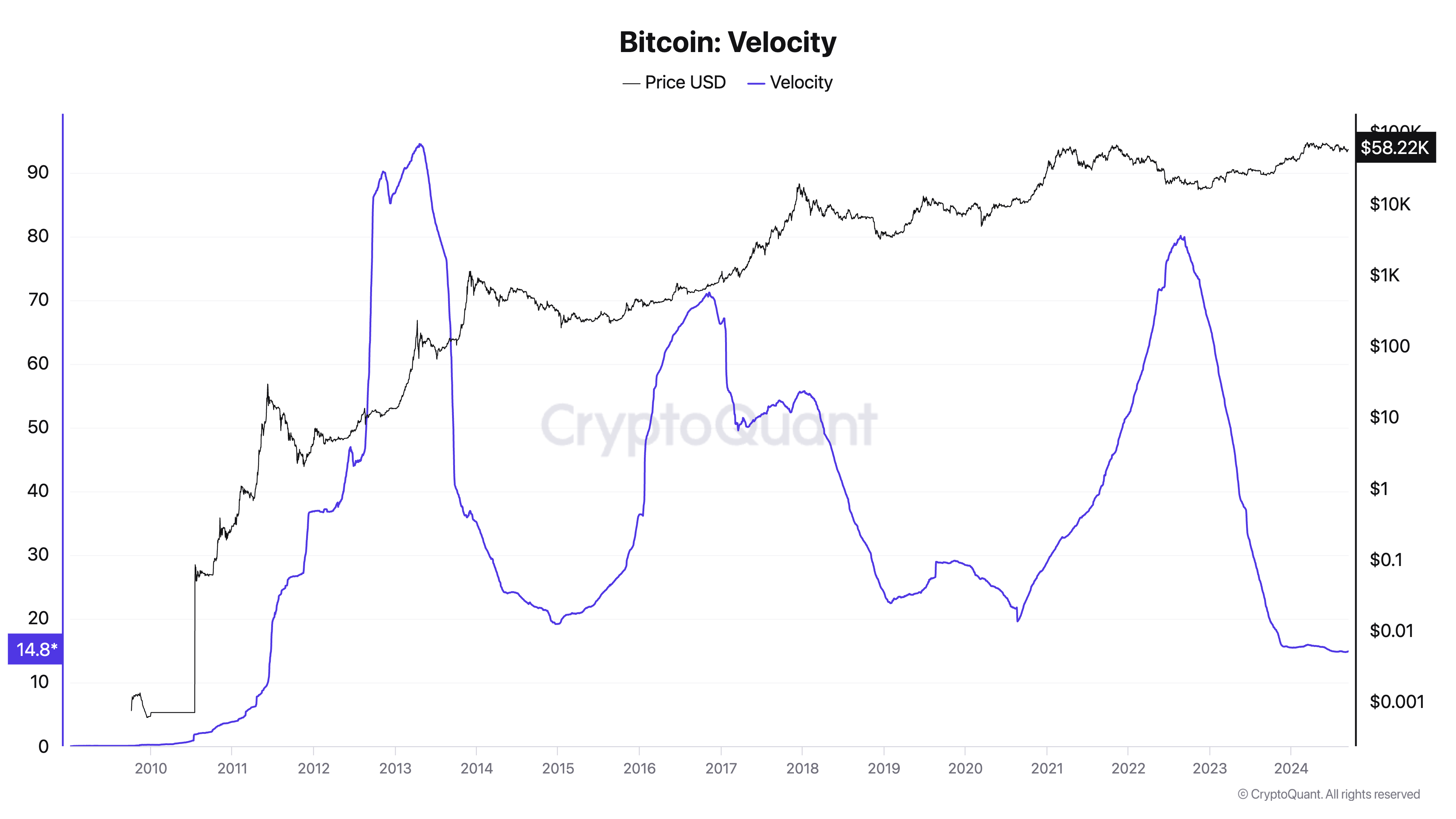

Nonetheless, this short-term spike stands in stark distinction to the broader pattern. Traditionally, Bitcoin’s velocity has been on a gradual decline. After reaching its peak in the course of the 2013 bull market, velocity has declined considerably. Whereas there have been notable spikes in 2017 and 2021, corresponding with Bitcoin’s historic bull runs, velocity shortly dropped off afterward, returning to decrease ranges. This extended decline displays a major shift in how Bitcoin is used throughout the market.

Over time, Bitcoin has more and more been perceived as a retailer of worth relatively than a medium of change. Lengthy-term holders are likely to accumulate Bitcoin with the expectation of future appreciation, lowering the necessity for frequent transactions. As institutional adoption has grown, so has the long-term accumulation pattern.

Giant institutional gamers have a tendency to maneuver Bitcoin in bigger however much less frequent transactions. This habits contributes to the decrease general velocity, as establishments are typically much less keen on frequent buying and selling than retail contributors. This has turn out to be particularly evident in 2024 with the spike in institutional demand from spot Bitcoin ETFs.

Whereas the spike in velocity we’ve seen because the starting of September is critical within the quick time period when contemplating the market, it’s nonetheless minuscule in comparison with the overall downward pattern in 2024.

The present uptick in velocity means that the market could also be getting into a extra energetic section after an extended interval of consolidation. It could possibly be an early indicator of renewed curiosity and speculative exercise, presumably signaling a bullish outlook.

The broader market continues to be dominated by long-term holders, with HODLing and institutional involvement contributing to the general decline in velocity. Until this latest uptick is accompanied by sustained value appreciation and broader market exercise, it’s unlikely to result in a long-term reversal of the declining velocity pattern.

The submit First vital rise in Bitcoin velocity since March reveals spike in buying and selling appeared first on cryptoteprise.