Immediately, benefit from the On the Margin e-newsletter on Blockworks.co. Tomorrow, get the information delivered on to your inbox. Subscribe to the On the Margin e-newsletter.

Welcome to the On the Margin Publication, dropped at you by Ben Stack, Casey Wagner and Felix Jauvin. Right here’s what we unpack right this moment:

- The Fed simply shared its charge resolution, and extra importantly, its end-of-year projections. Let’s dive into what this implies and the way markets are reacting.

- Deliberate spot ETH ETFs noticed some motion, however then issues appeared to stall. In case you misplaced observe, right here’s the place we stand.

- Bitcoin miner Core Scientific re-listed earlier this yr after rising from chapter. It’s up 170% yr so far.

It’s Fed Day!

The Federal Open Market Committee wrapped this afternoon — revealing rates of interest would stay unchanged at 5.25% to five.5%. Projections from central bankers present the committee expects charges to fall to between 4.9% and 5.4% by the top of 2024.

The largely anticipated resolution comes hours after the newest CPI determine dropped forward of this morning’s market open. Inflation is up 3.3% yr over yr in Could, and costs on all items excluding meals and vitality rose 0.2% through the month.

The CPI print was, by most accounts, nice. Each headline figures got here in under expectations and had been sufficient to guarantee markets {that a} charge lower may come as quickly as September. The chance of a September charge lower elevated to 63% following the discharge of the FOMC assertion, based on CME Group information.

The S&P 500 and Nasdaq Composite indexes beloved the inflation-related numbers too, rallying as a lot as 1.3% and a couple of%, respectively, through the first few hours of buying and selling.

Crypto additionally rode the wave. Bitcoin and ether every gained about 4% after the CPI report. BTC briefly moved again into the $70,000 vary earlier than paring positive aspects to hover round $69,500 by early afternoon.

Following the Fed’s charge resolution, bitcoin traded flat, nonetheless sitting slightly below $70,000.

After the Fed relieved their rate of interest resolution and projections, equities held regular. The S&P pared positive aspects barely however was nonetheless buying and selling 1% larger over 24 hours. In the meantime, the Nasdaq maintained a 1.7% rally over the buying and selling session within the moments following the discharge.

Whereas markets could also be digesting the already-priced-in charge resolution properly, the important thing determine is committee members’ long-term outlook for rates of interest.

“Whereas there are excessive hopes that the Federal Reserve can discover a steadiness in lowering inflation with out stalling financial progress, market shocks may nonetheless happen within the coming months,” stated RAW Capital Companions managing director Ben Nichols.

Final week’s jobs information got here in a bit too sizzling for consolation, spiking Treasury yields and inflicting traders to rethink what number of charge cuts — if any in any respect — we’d see earlier than the top of the yr. Committee members right this moment confirming that they see rates of interest ending 2024 decrease ought to come as a aid.

Immediately’s resolution comes after the European Central Financial institution final week opted to chop charges, even amid persistent inflation. The Financial institution of England is subsequent up, with its charge resolution anticipated subsequent week.

Now’s the time for traders to department out, Nichols stated.

“For traders, the main focus should stay on guaranteeing that portfolios can endure any turbulence which will stem from central financial institution motion all over the world,” he famous. “So we count on to see many opting to proceed diversifying investments throughout uncorrelated asset lessons, areas and sectors, in addition to a mix of conventional and various investments.”

Keep in mind, you heard it from him, not me! No funding recommendation right here.

— Casey Wagner

48%

The share of surveyed Fortune 500 executives saying crypto can enhance entry to the monetary system and permit the underbanked to create wealth.

So principally half. Additionally roughly half of small enterprise house owners say they’re more likely to search crypto-familiar candidates when hiring finance, authorized or tech execs, the current Coinbase report discovered. Banks can discover extra methods to work with crypto corporations and encourage innovation, one Fortune 500 exec stated as a part of the survey.

It’s a development we’ve already began to see. Citi and JPMorgan collaborate with Avalanche, for instance — amongst different TradFi blockchain trials in current months. And there isn’t a lot signaling it can decelerate.

What’s up with the ether ETFs?

The SEC doesn’t seem like in a specific rush to get ether ETFs to market.

Although to be honest, it hasn’t even been two weeks because the potential fund issuers filed their newest amended registration statements, aka S-1s.

As a reminder, the securities regulator accredited so-called 19b-4 proposals. A separate division of the SEC now must log off on the S-1s, which may take a pair rounds of feedback and edits.

Bloomberg Intelligence analysts had famous that whereas a speedy course of to approve S-1s (two or so weeks) was doable, they and others weren’t ruling out a several-month ordeal.

In any case, the SEC’s Division of Company Finance is tasked with guaranteeing the correct disclosures are in place for the investing public.

Nonetheless, a supply acquainted with the filings advised Blockworks on Tuesday that issuers had been informally advised to count on feedback on amended S-1s by June 7.

That didn’t occur — signaling persistence may very well be the secret.

It hasn’t been all quiet right here. ProShares — a fund agency identified for its BITO bitcoin futures ETF that additionally gives an ether futures-focused fund suite — threw its hat within the spot ETH ETF ring on June 6.

The SEC acknowledged on Monday it was contemplating the 19b-4 proposal for that fund. ProShares revealed an S-1 for its deliberate Ethereum ETF on Tuesday.

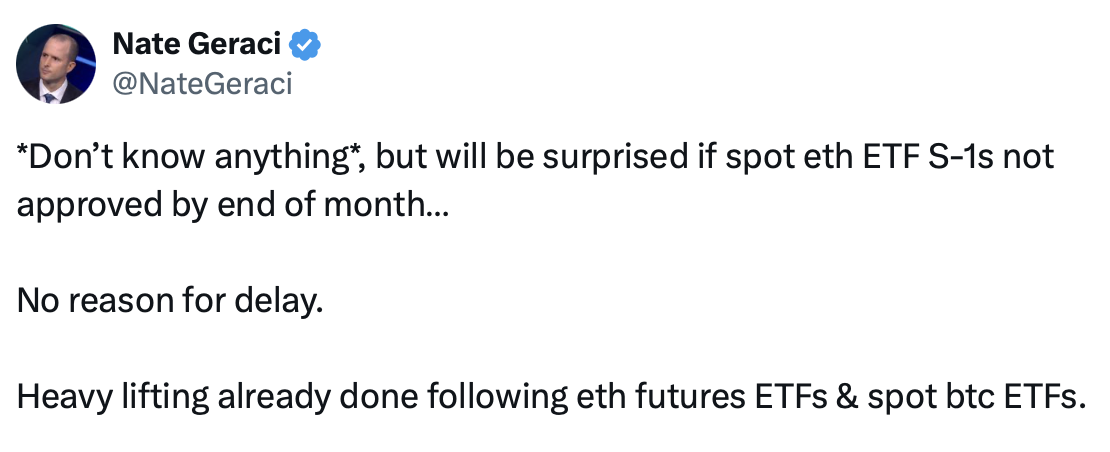

Theoretically, there needs to be much less to take a look at as a complete given the SEC’s approval of ether futures ETFs and spot bitcoin ETFs in October 2023 and January 2024, respectively. Nate Geraci, president of The ETF Retailer, thus believes a simple approval ought to come quickly.

Whereas eyes stay on this, the “when, not if” vibes for spot ether ETF launches appear to stymie any potential for main rigidity in crypto hearts.

— Ben Strack

Keep watch over this miner

Core Scientific stays a crypto inventory to observe.

Undoubtedly no worth predictions from this journalist, however I’ll be eyeing with curiosity what the bitcoin miner’s share worth does within the coming months.

The Texas-based miner’s story is fascinating. It grew quick, then needed to file for chapter in December 2022 after having bother overlaying debt obligations.

Core Scientific (CORZ) got here out of chapter in January — its inventory worth dropping 30% instantly upon its re-listing on the Nasdaq. Its shares spent the primary few months of the yr beneath $4.

It then made a 12-year take care of CoreWeave final week to supply 200 MW of infrastructure to host the cloud-provider’s high-performance computing (HPC) providers.

The deal confirmed Core Scientific’s dedication to HPC and the possibly greater alternative — serving a rising market whereas “diversifying our high line,” based on CFO Denise Sterling. The high-margin income from the CoreWeave deal is estimated to complete $290 million per yr.

CORZ inventory was sub-$5 on June 3. It was at $9.41 at 2 pm ET Wednesday.

The corporate has mined 35,000 or so bitcoin since 2021 — greater than some other North American public rival. “We believed that bitcoin mining was the beginning of a bigger enterprise, however essentially the top,” Sullivan stated throughout an investor name Wednesday.

Nonetheless, executives harassed the corporate shouldn’t be ditching the self-mining enterprise line. HPC is ready to make up about 500 MW of the corporate’s 1.2 gigawatts of capability.

Compass Level Analysis & Buying and selling analyst Joe Flynn elevated his CORZ worth goal from $8.50 to $12.50. The worth goal may go as excessive as $17.50, he added, upon extra HPC bulletins.

— Ben Strack

Bulletin Board

- The SEC and Terraform reached an settlement Wednesday. The previous stablecoin issuer pays practically $4.5 billion, based on the newest filings.

- Bitcoin miner Riot Platforms on Wednesday got here out in opposition to what it referred to as a “shareholder-unfriendly poison capsule” proposal from Bitfarms. Riot tried to accumulate the corporate in April, and Bitfarms has claimed the rival agency seeks to “undermine” its strategic evaluation course of.

- Joseph Wang is ready to interrupt down the newest FOMC assembly and different macro developments throughout this week’s On the Margin podcast. Catch it Thursday on YouTube, or wherever you get your podcasts.