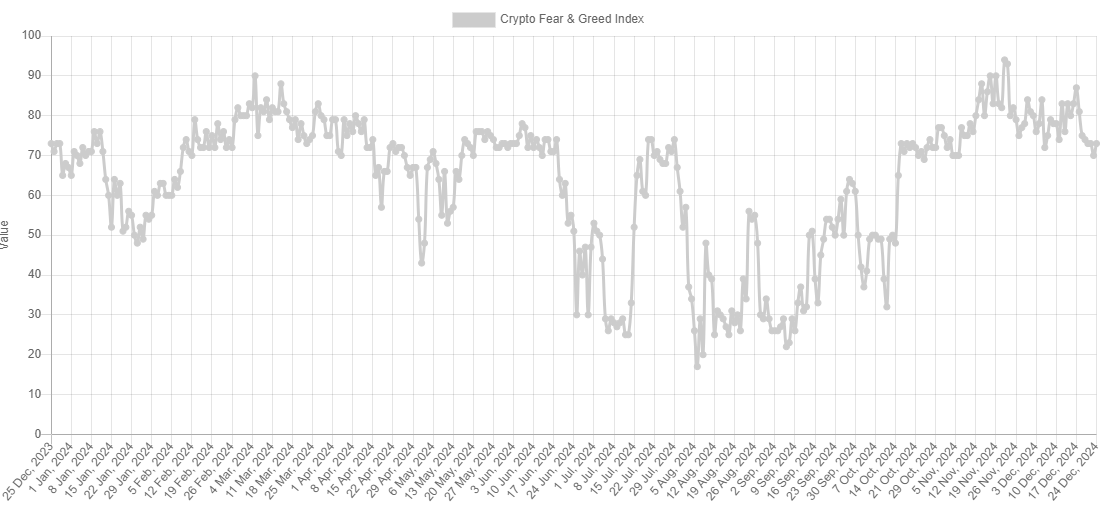

Knowledge exhibits the Bitcoin market sentiment continues to be fairly near the acute greed zone, a possible signal {that a} additional value cooldown could also be wanted earlier than a backside.

Bitcoin Concern & Greed Index Nonetheless Has A Excessive Greed Worth

The “Concern & Greed Index” refers to an indicator created by Different that tells us concerning the common sentiment amongst traders within the Bitcoin and wider cryptocurrency markets.

The index makes use of a numeric scale that runs from zero to hundred for representing this mentality. Its worth being higher than 53 means the traders as an entire are displaying greed, whereas it being beneath 47 implies the presence of concern out there. Values mendacity between these cutoffs correspond to a internet impartial sentiment.

Now, right here is how the present sentiment within the sector seems to be based on the Bitcoin Concern & Greed Index:

As is seen above, the indicator has a worth of 73 in the intervening time, which suggests the common dealer is holding a sentiment of greed. This greed sentiment can be a very sturdy one, so sturdy in truth that it’s sitting very near a particular area known as the acute greed.

The acute greed happens when the index reaches a worth of 75 or greater. The same zone additionally exists for the concern facet, often known as the acute concern, and is located at 25 or beneath.

Traditionally, the acute sentiments have confirmed to be essential for Bitcoin and different cryptocurrencies, as tops and bottoms have tended to happen whereas the market has been inside these zones.

The connection between value and sentiment has typically been an inverse one, which means excessive greed results in tops and excessive concern to bottoms. The BTC high earlier within the month occurred when the index was at a worth of 87.

With the value decline that has occurred since then, market sentiment has cooled off a bit. The query is: has it cooled sufficient? Whereas different phases of the market normally require dips into concern or excessive concern for bottoms to happen, bull markets typically don’t see pullbacks that deep.

Typically occasions, a enterprise into the traditional greed zone or the impartial territory is sufficient for the value to regain steam. That stated, the current sentiment has nonetheless been fairly near excessive greed, so it might want a bit extra earlier than an actual turnaround is reached.

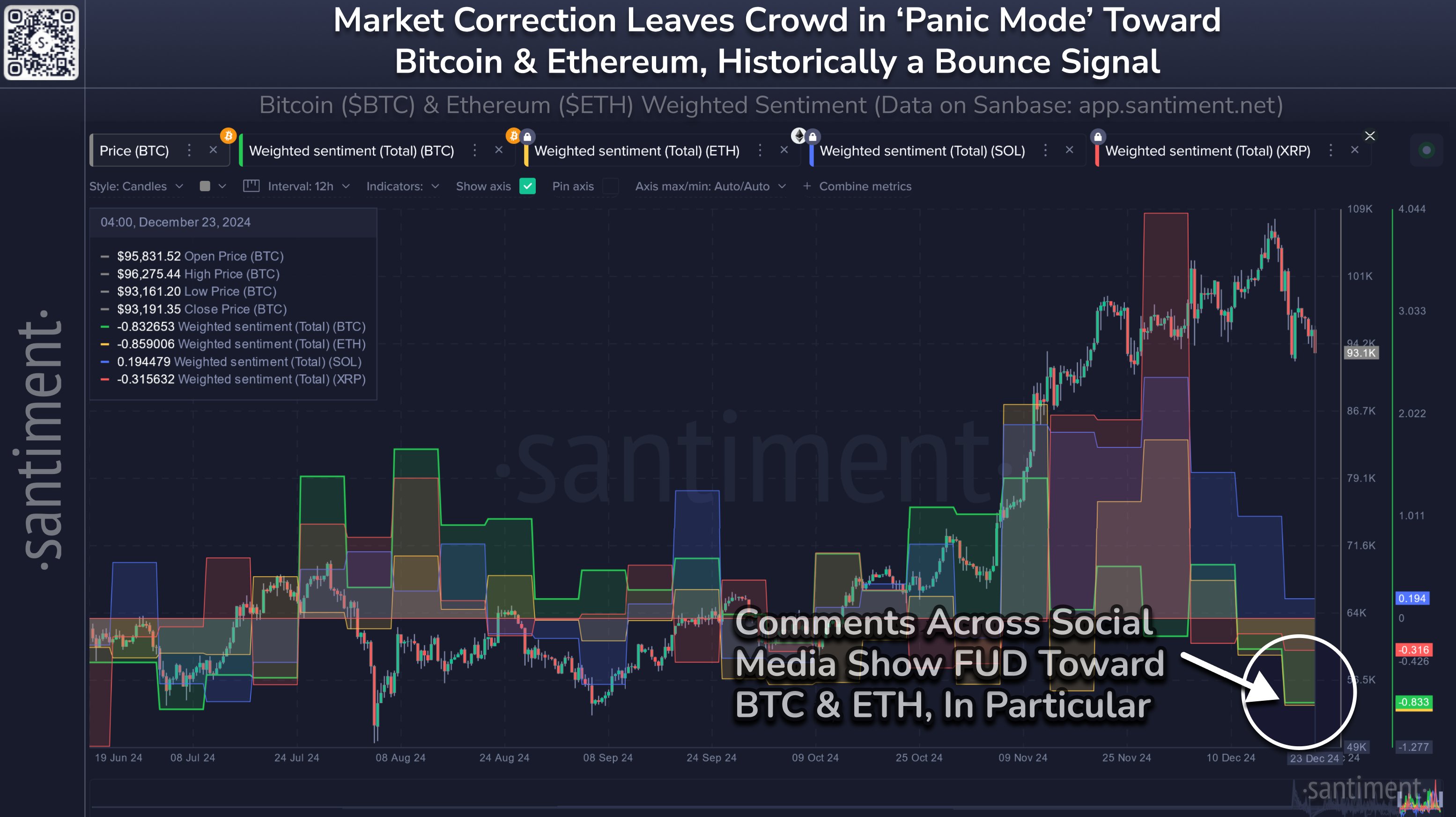

The Concern & Greed Index calculates its worth utilizing a number of elements, one among which is social media sentiment. Whereas the general sentiment has nonetheless been optimistic, it appears social media customers have began to point out concern, because the analytics agency Santiment has identified in an X publish.

BTC Worth

Bitcoin has proven a pointy 6% rebound over the past 24 hours, a possible indication that the dip into the greed sentiment might have been sufficient for the rally to restart in any case.

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com