The staking ecosystem is rising quickly, with rising institutional curiosity and potential regulatory oversight. Everstake, a blockchain validator, secures over 80 cryptocurrencies and helps among the business’s main networks. In an unique interview, Sergey Vasylchuk, Everstake CEO mentioned the platform’s origins, the challenges of staking, regulatory developments, and the function of governance in blockchain ecosystems.

Balancing Progress, Safety, and Danger Administration

Everstake’s journey started as an experimental mission whereas Vasylchuk was constructing a cryptocurrency alternate. As a software program developer with a background in funds and banking, he was centered on making blockchain know-how sooner and extra sensible for monetary establishments. Nevertheless, the constraints of early proof-of-work networks, together with sluggish transaction speeds, led him to discover proof-of-stake (PoS) options.

“Once I first noticed EOS, it was mind-blowing—transactions in below two seconds. That’s after I realized we have been getting nearer to the velocity monetary techniques require,” Vasylchuk defined. His workforce turned deeply concerned in optimizing blockchain efficiency, and growing methods to enhance community effectivity. The success of those improvements led Everstake to emerge as a validator for a number of blockchains, evolving right into a full-scale infrastructure supplier for over 80 blockchain initiatives as we speak.

Everstake’s function goes past staking; it acts as a vital infrastructure layer for blockchains, bridges, and decentralized functions. “We’re not simply validators. We assist blockchain ecosystems, guarantee safety, and assist new networks scale,” Vasylchuk emphasised.

With staking changing into a mainstream characteristic in crypto, validators face rising operational and safety challenges. Managing 1000’s of keys and servers requires rigorous threat administration processes to stop expensive errors. Vasylchuk famous that Everstake maintains an uptime of practically 99.9%, a testomony to its dedication to reliability.

“The largest problem isn’t operating current blockchains, it’s onboarding new testnets. New networks include design flaws and bugs, and selecting the best rising blockchain to assist requires cautious technical analysis,” he stated.

To strengthen institutional confidence, Everstake just lately secured SOC 2 Kind 1 certification, a well known safety customary. Whereas retail stakers belief the corporate based mostly on its long-standing popularity, institutional buyers require extra verification. “For a lot of establishments, it’s not about whether or not they belief us, it’s a requirement. With out the certification, they merely can’t work with us,” Vasylchuk defined.

Ethereum Staking Progress and Market Outlook

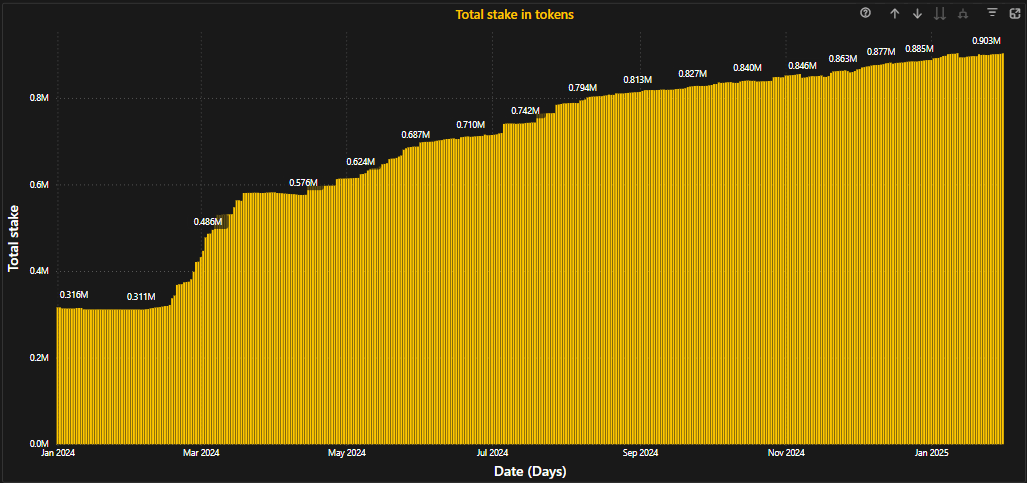

Ethereum has seen a gradual 4% improve in staked ETH over the previous yr, signaling long-term confidence in PoS networks. Vasylchuk believes this progress will proceed, drawing comparisons to Solana, the place over 65% of tokens are staked.

“Ethereum staking continues to be comparatively low at 27%, that means there’s important room for progress. Taking a look at networks like Solana, we count on Ethereum’s staking proportion to extend considerably,” he famous.

Past Ethereum and Solana, Vasylchuk sees potential in newer staking ecosystems however believes long-term success depends upon sturdy governance fashions. “Staking isn’t nearly incomes rewards, it’s about governance. Whenever you stake, you’re delegating your voting energy. Sadly, many customers prioritize APR over selecting accountable validators,” he cautioned.

The Function of Validators in Blockchain Governance

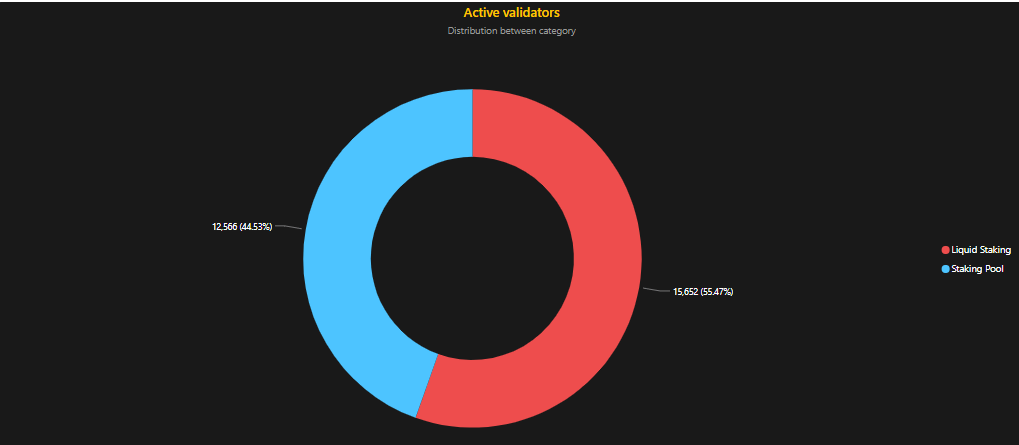

As a serious validator throughout a number of networks, Everstake performs a key function in governance selections. Nevertheless, Vasylchuk dismissed issues that enormous validators pose a centralization threat. “Regardless of being one of many largest, our stake in Solana is only one.4%, in Sui, it’s 1.3%. That’s removed from centralization,” he clarified.

As a substitute, he pointed to centralized exchanges as a larger menace to blockchain governance. “Exchanges management staked funds however don’t permit customers to take part in governance. This weakens decentralization and provides them disproportionate affect over networks,” he warned.

Regulatory Uncertainty and Institutional Adoption

With governments more and more centered on cryptocurrency regulation, staking is coming below larger scrutiny. Vasylchuk believes regulators nonetheless lack a deep understanding of staking, typically misinterpreting it as a purely monetary instrument slightly than a governance mechanism.

“Once we clarify staking as a voting course of, regulators get confused. They wish to regulate it, however they don’t know the way,” he stated. Nevertheless, he stays optimistic that clearer rules below the brand new U.S. administration may create pathways for establishments to totally embrace staking.

“If establishments achieve regulatory readability, we may see staking ETFs or publicly traded staking corporations emerge, unlocking huge new funding streams,” Vasylchuk predicted.

2025 and Past: A Bullish Outlook

Regardless of regulatory uncertainties, Vasylchuk believes 2025 will likely be a powerful yr for staking, pushed by a bullish market, institutional entry, and larger regulatory readability. Nevertheless, the total potential of staking will solely be realized as soon as conventional monetary establishments can entry it via regulated funding automobiles.

“A staking ETF can be a game-changer. It’s not a matter of if, it’s when. With correct threat administration and regulation, staking may turn into a multi-trillion-dollar market,” he concluded.

As Everstake continues to increase its function in blockchain governance and safety, Vasylchuk stays dedicated to bridging the hole between crypto and conventional finance. His twin mission of optimizing blockchain infrastructure whereas educating regulators positions Everstake as a pivotal participant in the way forward for decentralized finance.