Ethereum’s latest rejection on the key resistance area of the 100-day MA stage suggests a false breakout and a possible short-term correction.

Nonetheless, a break above this threshold might set off a bullish surge towards $3K. The value is anticipated to consolidate, with $2.4K as a crucial assist stage.

Technical Evaluation

By Shayan

The Every day Chart

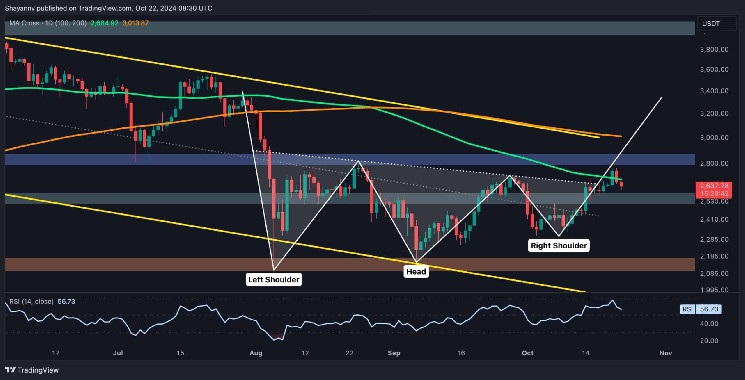

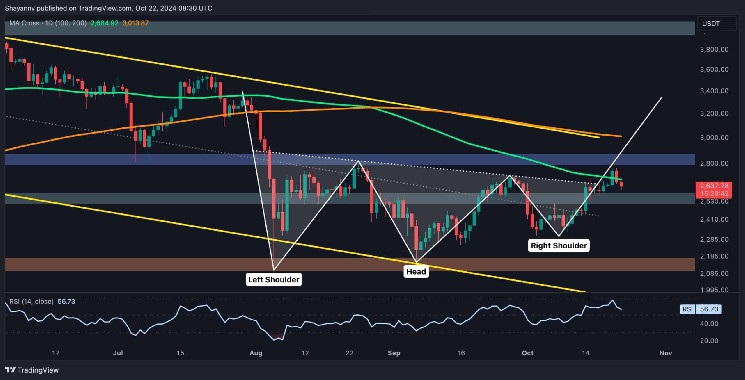

Ethereum has not too long ago seen a notable improve in demand and bullish momentum, inflicting the asset to check and barely breach the decisive resistance area shaped by the 100-day transferring common at $2.7K and the inverted head and shoulders neckline at $2.6K. Regardless of this transient breach, ETH rapidly confronted rejection on account of important provide at this stage, inflicting the worth to plummet under the 100-day MA.

This false breakout hints at a bull lure, signalling a possible interval of descending consolidation correction within the quick time period. Ethereum is buying and selling between the 100-day MA and the $2.5K assist area, with a breakout above this resistance prone to sign a sustained bullish development.

The 4-Hour Chart

On the 4-hour chart, Ethereum surged towards the crucial resistance zone bounded by the 0.5 ($2.6K) and 0.618 ($2.7K) Fibonacci retracement ranges, representing a big barrier for consumers. A breakout above this vary might result in huge quick liquidations and an additional worth rally. Nonetheless, the latest worth motion signifies intense promoting strain close to this space, leading to a rejection and a halt in bullish momentum.

If this promoting strain persists, Ethereum will possible enter a interval of mid-term consolidation correction, concentrating on the decrease boundary of the flag sample across the $2.4K threshold. Conversely, if shopping for strain resurges and the worth breaks by means of the $2.7K resistance, the following goal will possible be the $3K substantial resistance, which additionally coincides with the 200-day transferring common.

Onchain Evaluation

By Shayan

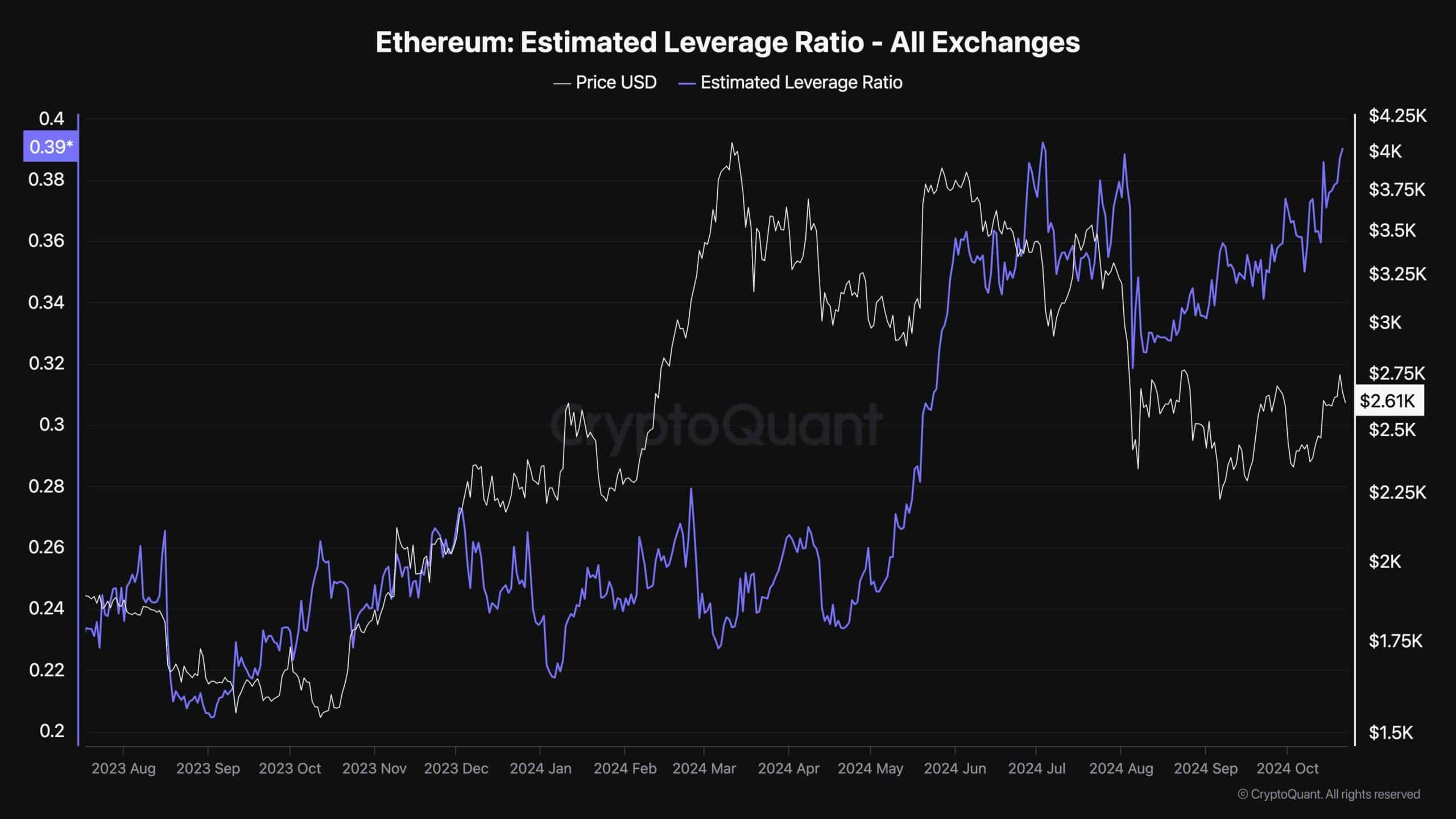

The Estimated Leverage Ratio is a vital metric for gauging the danger members within the futures market are keen to take through the use of leverage. A rising ELR sometimes indicators a rise in leveraged positions, which might amplify market strikes in both route.

The metric has elevated over the previous couple of months, coinciding with an total worth downtrend. This means that extra merchants are opening high-leverage quick positions, betting on additional worth declines for Ethereum. The market seems bearish on ETH’s upcoming prospects, with many anticipating additional draw back.

With leverage at regarding ranges, the futures market is now thought-about overheated. This leaves Ethereum weak to a possible short-squeeze occasion.

In such a situation, if ETH rises unexpectedly, merchants with quick positions might be compelled to cowl their positions by shopping for again ETH, creating an impulsive worth spike. The 100-day transferring common at $2.7K is a key resistance stage. A breakout above this stage would possible result in huge quick liquidations, growing ETH’s worth.