With the final crypto market nonetheless dealing with heightened volatility, Ethereum has as soon as once more didn’t reclaim the pivotal $3,000 value degree. Bearish strain continues to linger in its value motion, resulting in speculations about its potential within the quick time period. Though ETH has didn’t expertise a serious surge, analysts consider the altcoin might see a turnaround in the direction of the upside shortly.

Ethereum Gearing Up For A Bullish Run?

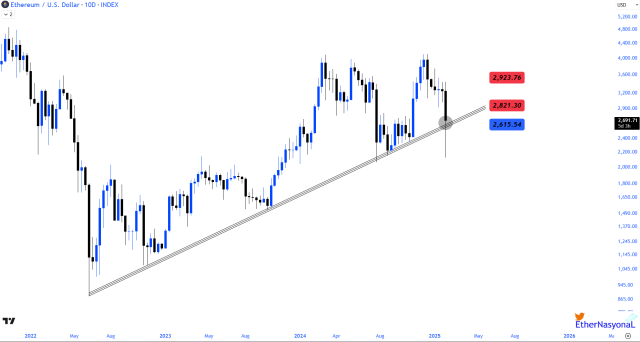

Ethereum could have seen a notable decline in the previous few days, however Ether Naysonal, a market skilled and dealer is unshaken in regards to the heightened volatility. In accordance to the technical skilled, “ETH remains to be in its main uptrend,” indicating resilience amid broader market volatility.

Regardless of occasional pullbacks, the skilled cites that ETH continues to carry key help ranges, reinforcing optimistic sentiment amongst buyers. With the altcoin sustaining its uptrend, it might pave the best way for a potential breakout towards greater ranges within the upcoming weeks.

Ether Naysonal highlighted alongside sustaining its main uptrend, ETH has additionally persistently held the $2,615 help degree, which is sweet for its value motion. Nonetheless, for Ethereum to make a fast restoration, it should a minimum of shut above the $2,820 mark for sooner or later.

A detailed above the $2,820 degree would doubtless reignite bullish momentum for the altcoin once more. In the meantime. the much-anticipated pump might be triggered if the candle closes above $2,923.

Ethereum has skilled exceptional adoption and curiosity regardless of occasional value corrections. This rising institutional curiosity coupled with rising on-activity would possibly function key elements bolstering the anticipated upside transfer.

Ether Naysonal has questioned the actions of people presently offloading their ETH holdings regardless of institutional buyers accumulating ETH at an enormous scale. Main firms are at present seen buying ETH in present market situations.

Monetary behemoth and asset supervisor agency Blackrock has bought over 100,535 ETH, valued at $284 million. Moreover, asset administration firm Constancy has additionally acquired about 9,552 ETH, price round $26.39 million.

Whereas the most important world funding establishments are nonetheless buying, the analyst asserts it’s utterly illogical for particular person buyers to promote after being uncovered to deceptive waves inside a brief interval.

A Surge To New All-Time Excessive Imminent

A number of bullish buildings have emerged on ETH’s chart, suggesting a attainable rebound within the quick time period. With upside momentum constructing for ETH, the asset could also be set for a rally towards a brand new all-time excessive.

After inspecting Ethereum’s value motion, market skilled Jonathan Carter highlighted that the asset remains to be buying and selling inside a Symmetrical Triangle sample within the weekly time-frame. Carter famous that liquidity was collected under help by current downward wicks earlier than returning to the sample.

As soon as ETH breaks out of the ascending triangle, Carter anticipates a push in the direction of greater targets akin to $3,100, $4,000, $4,850, $6,000, and $7,500 in the long run.

Featured picture from Unsplash, chart from Tradingview.com