Ethereum (ETH) worth has lately skilled a 13% decline, with costs dipping in the direction of the tip of September. Regardless of this drop, Ethereum is presently holding robust above its bear market assist flooring, suggesting that the cryptocurrency could also be poised for a restoration.

Traders are actually in search of bullish indicators that might push ETH past the six-week barrier, bringing new alternatives for worth progress.

Ethereum Traders Are Resilient

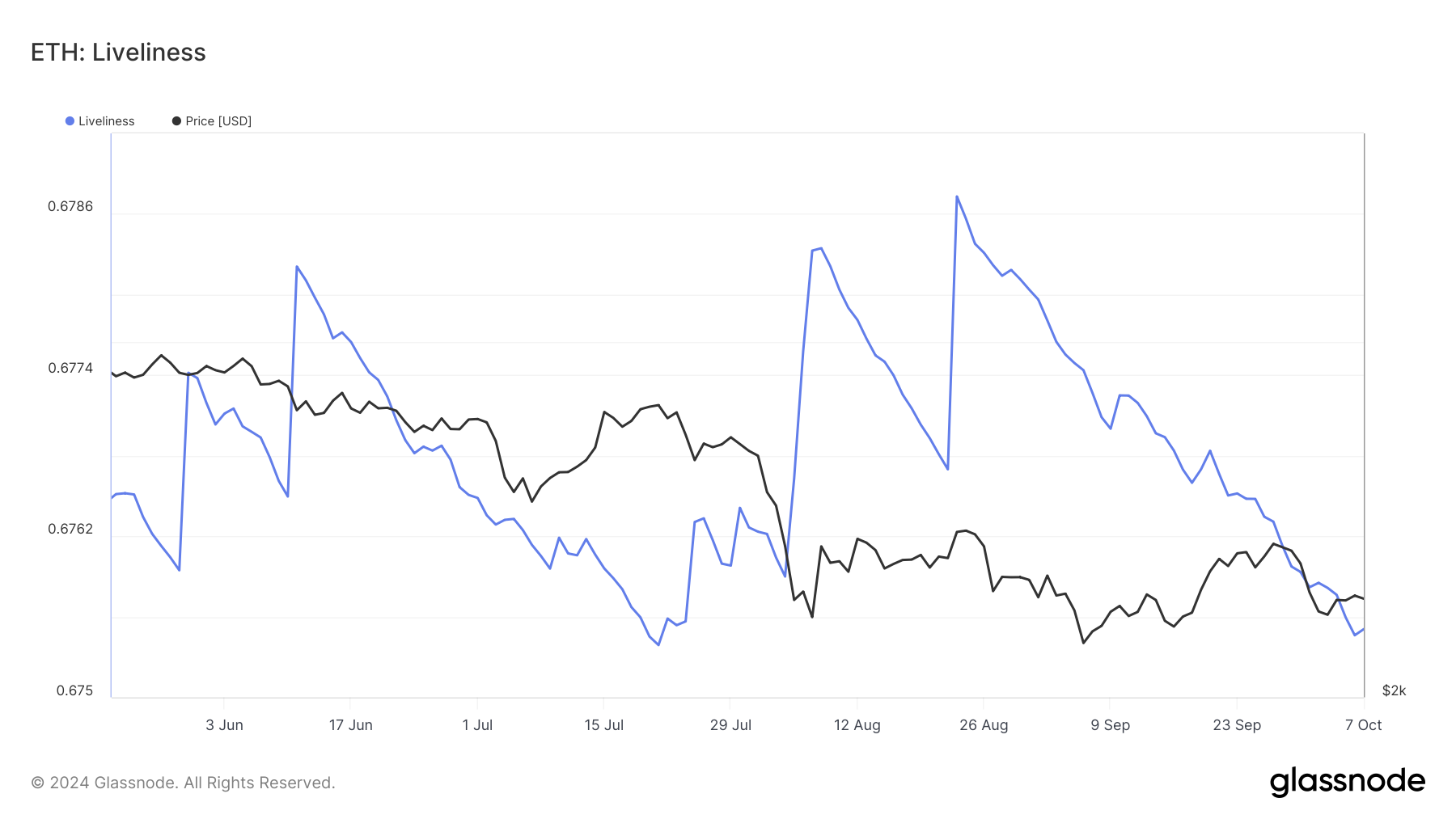

Ethereum’s long-term holders (LTHs) are exhibiting renewed power, as indicated by the Liveliness metric. This indicator tracks LTHs’ habits, declining after they accumulate and rising after they liquidate their holdings. At present, the LTHs are in accumulation mode, a constructive signal for Ethereum’s worth trajectory.

As extra holders select to HODL, the potential for a bullish breakout will increase, signaling long-term confidence within the cryptocurrency. This stability may very well be the muse Ethereum wants to interrupt via its present resistance ranges.

Learn extra: Learn how to Put money into Ethereum ETFs?

Ethereum Liveliness. Supply: Glassnode

From a technical perspective, Ethereum can also be exhibiting indicators of macro-bullish momentum. The Relative Energy Index (RSI) has been trending positively because the starting of August, hovering close to the impartial line at 50.0. As soon as this line is flipped into assist, Ethereum’s bullish momentum will possible achieve additional power, pushing costs increased.

The macro momentum, supported by technical indicators just like the RSI, means that Ethereum is constructing a stable basis for additional good points. If the broader cryptocurrency market stays steady, Ethereum may capitalize on this momentum and goal increased worth ranges within the coming weeks.

Ethereum RSI. Supply: TradingView

ETH Worth Prediction: Previous Obstacles, New Highs

Ethereum is presently buying and selling at $2,431, holding above the essential 23.6% Fibonacci Retracement stage at $2,401, also referred to as the bear market assist flooring. So long as ETH stays above this stage, it’s more likely to proceed consolidating whereas awaiting a bullish set off that might drive its worth increased.

Ought to the anticipated bullish indicators arrive, Ethereum may surge in the direction of $2,591. This stage coincides with the 38.2% Fibonacci line, and flipping it into assist may permit ETH to rise in the direction of $2,745. Notably, this worth level has remained unbreached for the previous six weeks, making it a key goal for Ethereum’s subsequent breakout.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

Nonetheless, if Ethereum fails to assemble sufficient momentum to surpass $2,591, the worth might consolidate inside this vary, remaining above $2,401. This lack of motion would invalidate the bullish outlook, resulting in a protracted interval of sideways buying and selling.