Ethereum’s worth has struggled to interrupt above the $4,000 psychological barrier because it reclaimed its year-to-date excessive of $4,093 on December 6.

Nonetheless, market members proceed to build up the main altcoin regardless of broader market consolidation. This will increase the chance of a break above the $4,000 worth degree within the close to time period. This evaluation particulars why.

Ethereum Purchase Orders Surge

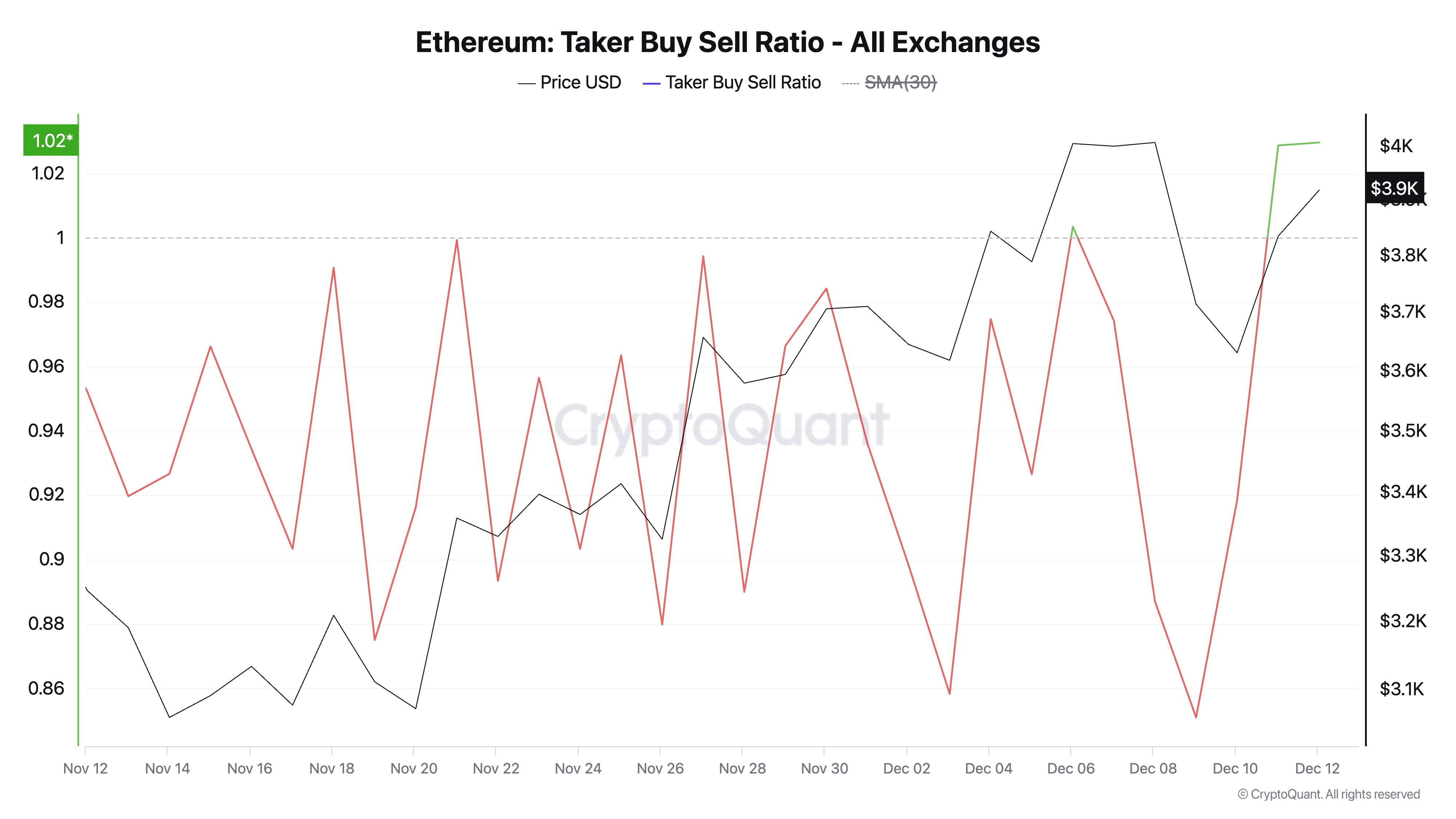

Ethereum’s Taker Purchase-Promote Ratio has surged to a month-to-month excessive of 1.033, indicating a spike in purchase orders within the coin’s derivatives market.

This metric affords perception into an asset’s market sentiment and potential worth course by evaluating the quantity of purchase orders crammed by market takers to the quantity of promote orders crammed.

A ratio higher than 1 suggests bullish sentiment, as consumers are prepared to pay the asking worth, reflecting elevated demand for the asset. It means stronger shopping for stress, which might sign an upward worth pattern within the underlying asset.

Ethereum Taker Purchase Promote Ratio. Supply: CryptoQuant

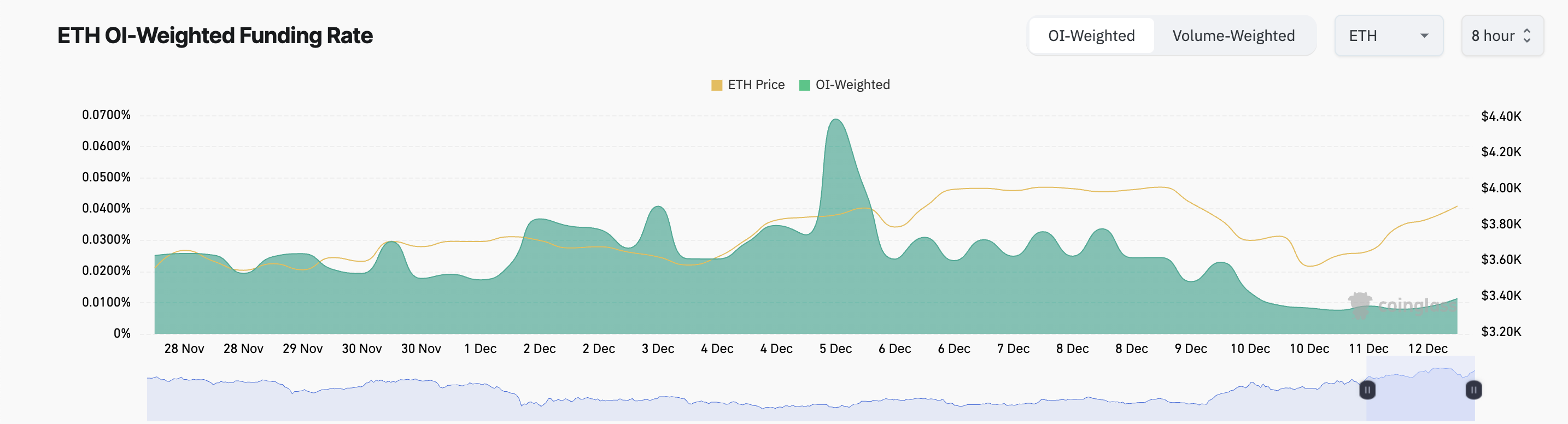

Notably, the coin’s optimistic funding fee helps this bullish outlook. At press time, ETH’s aggregated funding fee throughout cryptocurrency exchanges stands at 0.011%.

The funding fee is a periodic cost between merchants in perpetual futures contracts designed to align the contract worth with the underlying asset’s spot worth. A optimistic funding fee signifies that lengthy merchants are paying brief merchants, indicating larger demand for lengthy positions. This usually indicators bullish sentiment out there, as merchants are prepared to pay a premium to carry lengthy positions.

Ethereum Funding Charge. Supply: Coinglass

ETH Worth Prediction: The Bulls Strengthen Their Management

On the day by day chart, ETH’s rising On-Steadiness Quantity confirms the coin’s regular accumulation. As of this writing, the momentum indicator stands at 26.06 million.

This indicator makes use of quantity stream to foretell modifications in an asset’s worth. When an asset’s OBV climbs, it suggests robust shopping for stress, indicating that quantity is predominantly pushed by consumers, usually a bullish sign for potential worth will increase.

Ethereum Worth Evaluation. Supply: TradingView

If ETH consumers stay in management, they might push its worth above $4,000 towards $4,093, its year-to-date excessive. Nonetheless, if the present pattern reverses, ETH’s worth might plummet to $3,673, invalidating the bullish thesis.