Over the previous few days, Ethereum (ETH) whales have been relentlessly promoting their cash, dampening the market’s momentum. Whale influx into cryptocurrency exchanges has surged, indicating a robust need for revenue because the coin’s value has skyrocketed by double digits over the previous seven days.

The spike in promoting strain will seemingly restrict Ethereum’s near-term upside potential. Right here is how.

Ethereum Whales Take Benefit of Value Hike

Ethereum’s value has climbed by 14 % over the previous week to commerce at $2,644 at press time. Nevertheless, this rally might face resistance because of latest sell-offs by some giant holders, or “whales.”

On Monday, an early Ethereum Preliminary Coin Providing (ICO) participant, who obtained 150,000 ETH on the Genesis block — now valued at over $389 million — deposited 3,510 ETH ($9.12 million) into Kraken after greater than two years of inactivity.

Over the weekend, one other important whale, recognized for holding giant quantities of ETH, additionally bought off cash. On-chain analyst Spotonchain revealed in a publish on X that the whale deposited 15,000 ETH ($38.4 million) into exchanges. This whale has a historical past of promoting ETH simply earlier than market drops. In July, it bought 10,000 ETH ($34.2 million) forward of a 7.6% value decline, and in August, it unloaded 15,000 ETH ($39.7 million) shortly earlier than a 2.5% dip.

Learn extra: Put money into Ethereum ETFs?

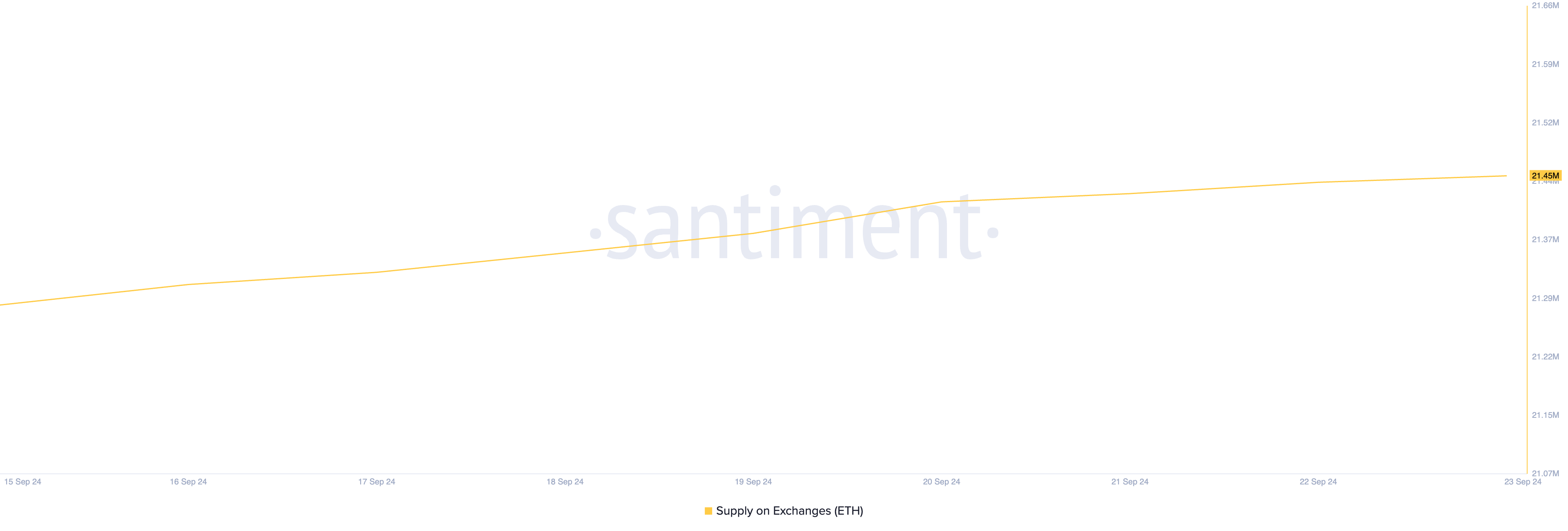

Ethereum Provide on Exchanges. Supply: Santiment

Because of the actions of those whales, the provision of ETH on crypto exchanges has risen. At the moment, 21.45 million ETH, value above $56 billion, are held throughout crypto exchanges. Since September 20, a cumulative of 30,000 ETH, valued at $79.20 million at present market costs, has been despatched to exchanges.

When an asset’s provide on exchanges climbs, particularly with important deposits from the whales, it signifies profit-taking exercise. This may increasingly put downward strain on the asset’s value, as extra sellers available in the market can result in oversupply, particularly if new demand doesn’t enter the market.

ETH Value Prediction: Value Could Rise To $2,868 Or Fall To $2,111

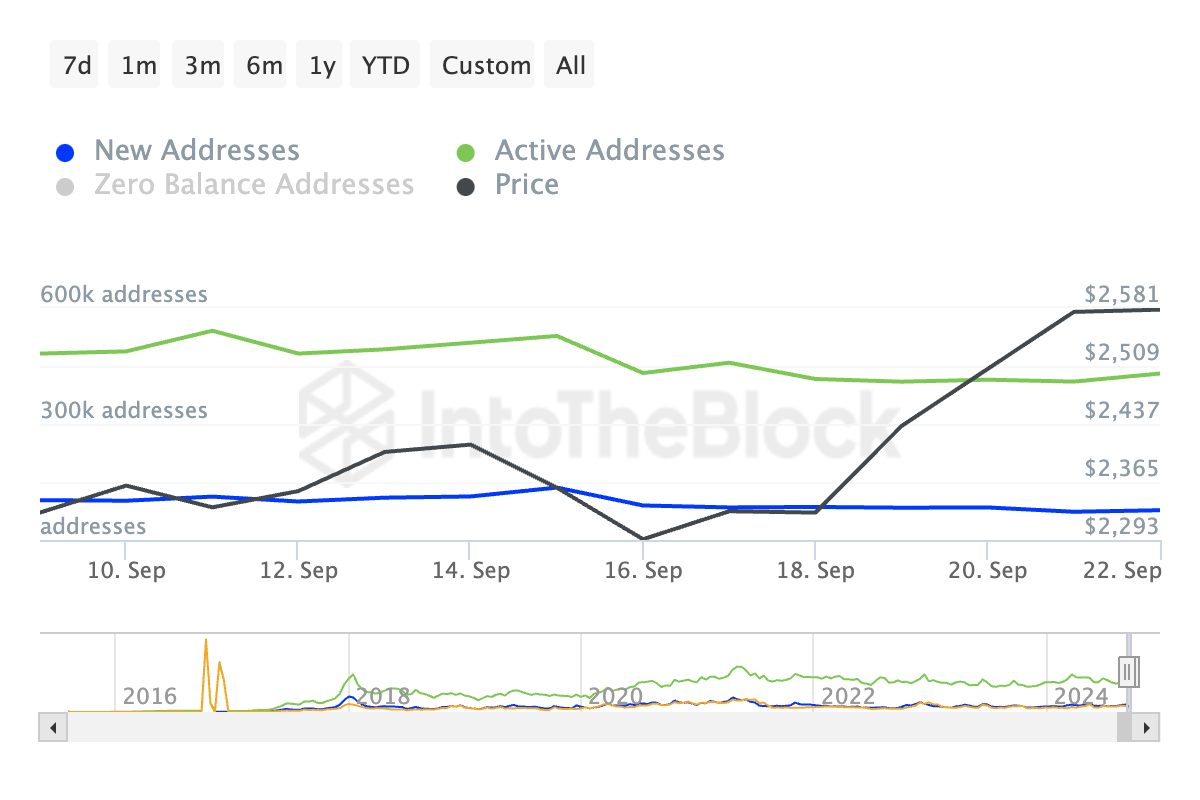

The decline within the variety of new addresses created to commerce ETH over the previous week helps this outlook. IntoTheBlock’s information has revealed a 43% decline in new addresses which have traded the altcoin over the previous seven days. Throughout the identical interval, the energetic handle depend on the community has additionally plummeted by 18%.

Ethereum Each day Energetic Addresses. Supply: IntoTheBlock

When an asset’s energetic handle depend drops, it could put downward strain on its value. Decreased community exercise can result in much less demand for the asset and elevated promoting from holders trying to exit their positions in worry of losses.

Ethereum’s latest 14% surge pushed its value above the $2,579 resistance degree. Nevertheless, continued profit-taking by ETH whales might make it troublesome for the coin to reclaim the $2,868 mark.

If the broader market additionally begins offloading cash, Ethereum’s value might retest the $2,579 degree. Ought to this assist fail, the worth might drop by 18%, doubtlessly hitting the August 5 low of $2,111.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

Ethereum Value Evaluation. Supply: TradingView

Conversely, if whales cease promoting and new demand enters the market, Ethereum might rise by one other 8%, with a robust likelihood of breaking previous the important thing $2,868 resistance.