Ethereum’s value has fluctuated underneath $2,800 for the previous few weeks, and it’s caught in a consolidation section. Regardless of a number of makes an attempt, ETH has been unable to interrupt by means of key resistance ranges, leaving buyers unsure.

Blended indicators from varied technical indicators are including to the paradox, making it tough to foretell whether or not Ethereum can climb again to $3,000 quickly.

Ethereum Is Shedding Cash

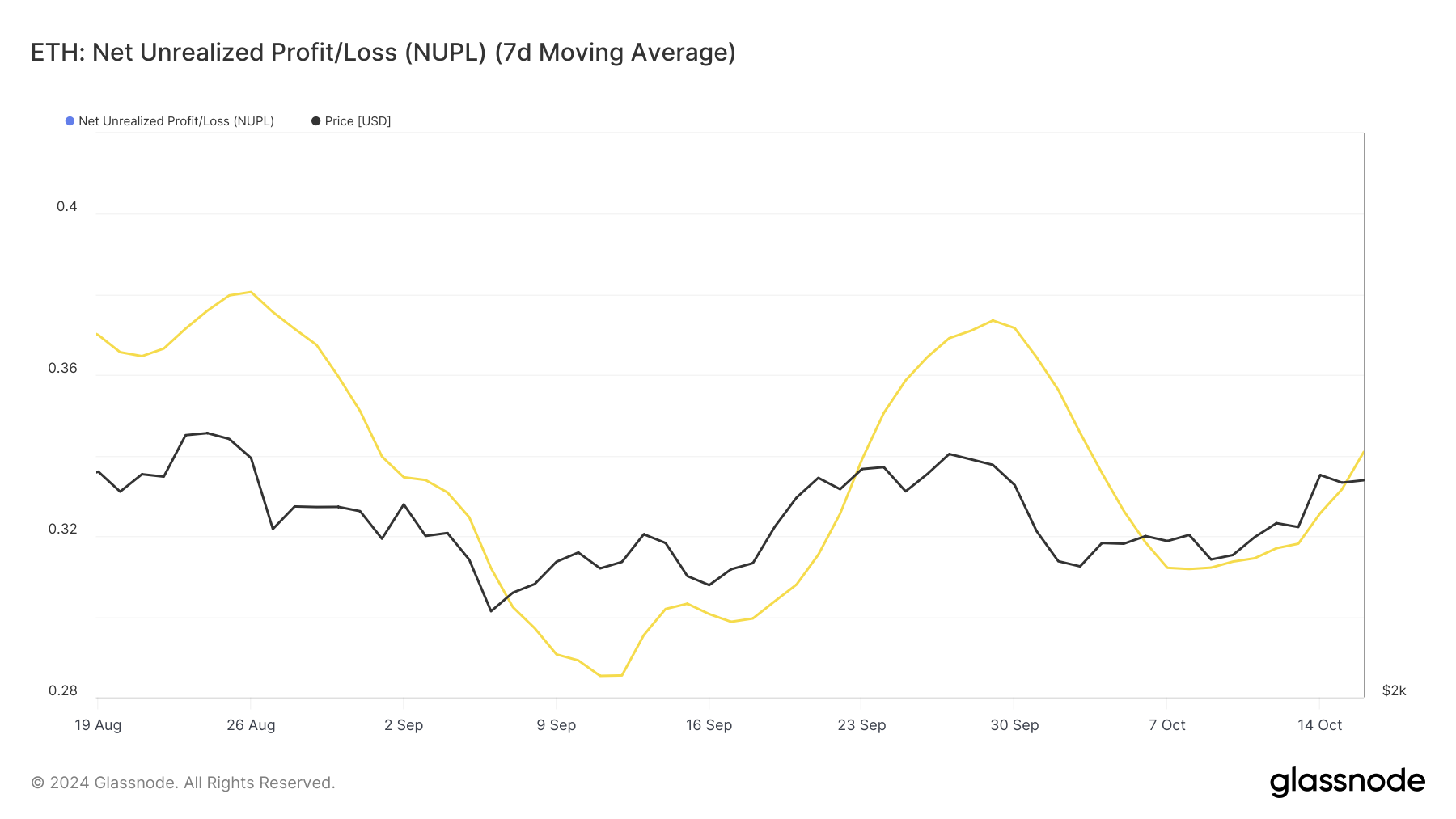

Ethereum’s Community Unrealized Revenue/Loss (NUPL) presently sits within the optimism zone, signaling enhancing market sentiment. This indicator tracks all holders’ whole revenue or loss relative to after they acquired their property. The present ranges mirror rising confidence amongst buyers.

This optimistic sentiment is conserving buyers engaged, with many holding their property quite than promoting them. So long as the NUPL stays on this favorable vary, the probabilities of a dramatic sell-off are slim, which may assist Ethereum’s value within the close to time period.

Learn extra: How one can Spend money on Ethereum ETFs?

Ethereum NUPL. Supply: Glassnode

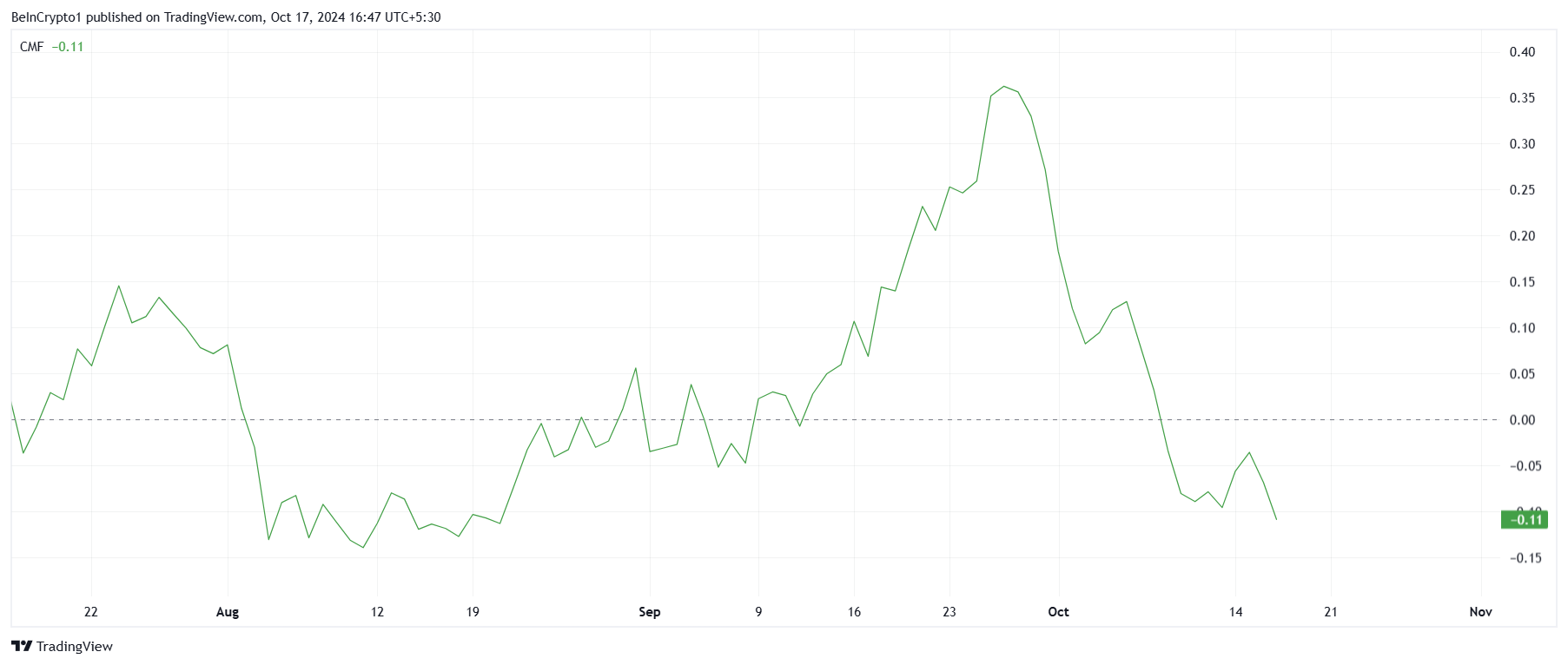

On the macro aspect, Ethereum’s momentum seems blended, as proven by the Chaikin Cash Stream (CMF) indicator. The CMF, which tracks the stream of capital into and out of an asset, briefly rose final week however has since dipped once more.

This decline is a bearish sign, because it means that extra capital is flowing out of Ethereum than coming in. It is a sign that the promoting strain is probably rising.

The outflow of capital is a crucial issue to observe, as sustained declines within the CMF typically precede value drops. Ethereum may face extra challenges in breaking by means of its present resistance ranges regardless of the in any other case constructive market sentiment if this development continues.

Ethereum CMF. Supply: TradingView

ETH Worth Prediction: Staying in Lane

Ethereum is presently buying and selling at $2,610, struggling to beat resistance at $2,700. Since early August, ETH has been repeatedly blocked by this degree, with temporary breaches above it failing to carry. So long as Ethereum stays underneath this resistance, vital upward momentum could also be tough to realize.

Blended indicators from key indicators counsel that the continued consolidation between $2,700 and $2,344 will proceed. The market might stay on this tight vary till there’s a decisive shift in sentiment or capital inflows.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

For Ethereum to achieve $3,000, it should first flip the $2,700 resistance into assist. As soon as this degree is breached, the subsequent key barrier will probably be $2,930. If Ethereum can rise above this, it’s going to hit a two-and-a-half-month excessive, probably invalidating the present bearish outlook.