On-chain knowledge exhibits the Ethereum whales have been taking part in fixed distribution for the final six months, an indication that’s not perfect for ETH.

Ethereum Accumulation Development Rating Has Been Pink For Cohorts As A Complete

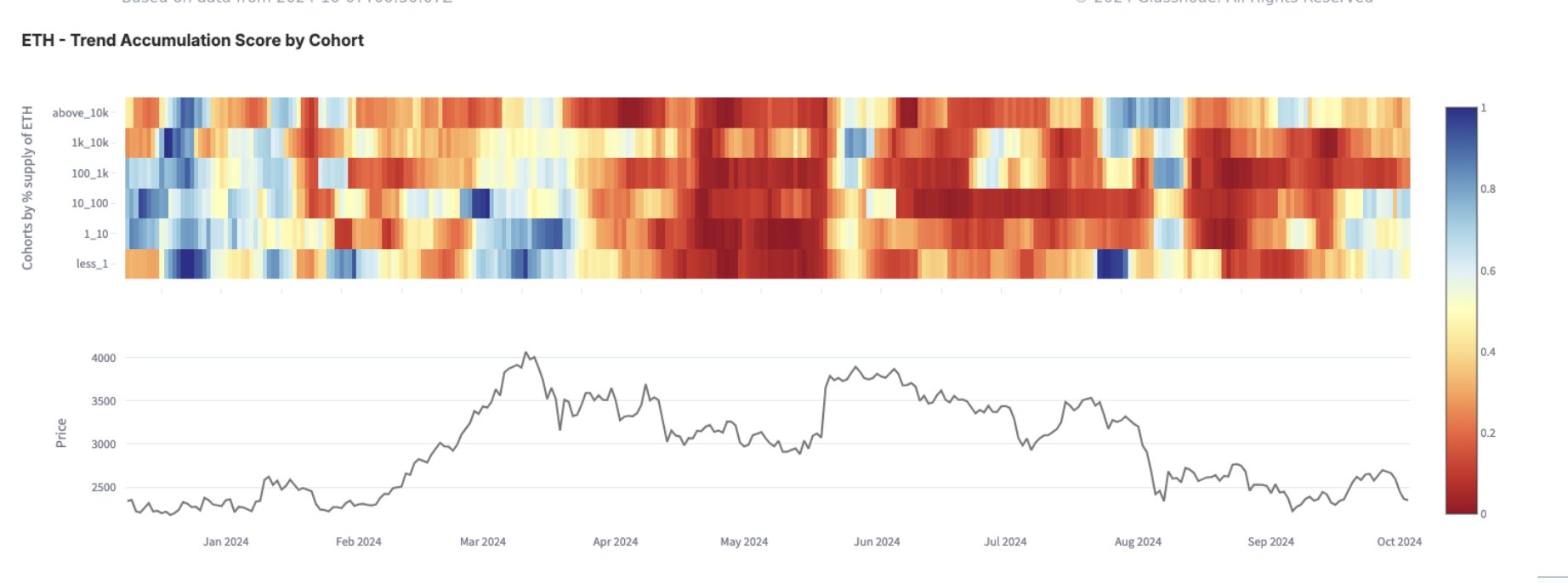

As analyst James Van Straten identified in a brand new put up on X, the Accumulation Development Rating has been displaying a grim image for Ethereum just lately. The “Accumulation Development Rating” right here refers to an indicator from Glassnode that tells us whether or not the buyers of a given asset are accumulating or not.

This metric takes under consideration for not simply the online stability adjustments taking place within the wallets of the buyers, but additionally the dimensions of the entities. Which means that bigger entities have the next weight within the indicator. When the worth of the rating is near 1, it means both the big buyers are taking part in sturdy accumulation or numerous small holders are shopping for. However, it being near 0 implies web distribution is occurring within the community or not less than, there’s a lack of accumulation happening.

Within the context of the present subject, the model of the Accumulation Development Rating that’s of curiosity is the one for the person cohorts. Addresses have been divided into these teams based mostly on the stability that they’re carrying.

Now, here’s a chart that exhibits the development within the Ethereum Accumulation Development Rating for the totally different cohorts over the previous yr:

The worth of the metric seems to have been pink for many of the cohorts just lately | Supply: @btcjvs on X

As displayed within the above graph, the Ethereum Development Accumulation Rating confirmed a shade of blue throughout the cohorts in the course of the early components of the yr, implying the buyers as a complete had been taking part in a point of accumulation.

Shortly after the Bitcoin all-time excessive (ATH) again in March, nevertheless, the buyers began aggressively promoting, with the indicator’s worth taking a deep pink shade (that’s, very near the zero mark). Because the preliminary sharp distribution, promoting has calmed down over the previous few months, however the metric has nonetheless been tending in direction of being pink. Of observe, the 100 to 1,000 BTC, the 1,000 to 10,000 BTC, and the ten,000+ BTC teams are nonetheless in a section of distribution.

These cohorts are popularly known as, in the identical order, sharks, whales, and mega whales. Buyers of this measurement can carry a point of affect out there, so their participation in constant promoting over the past six months or so is of course not an excellent signal for Ethereum.

It’s attainable that till the assorted cohorts return again to accumulation mode, ETH received’t be capable to make any vital restoration.

ETH Worth

On the time of writing, Ethereum is floating round $2,400, down greater than 7% over the past seven days.

Appears like the value of the coin has been transferring sideways over the previous few days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com