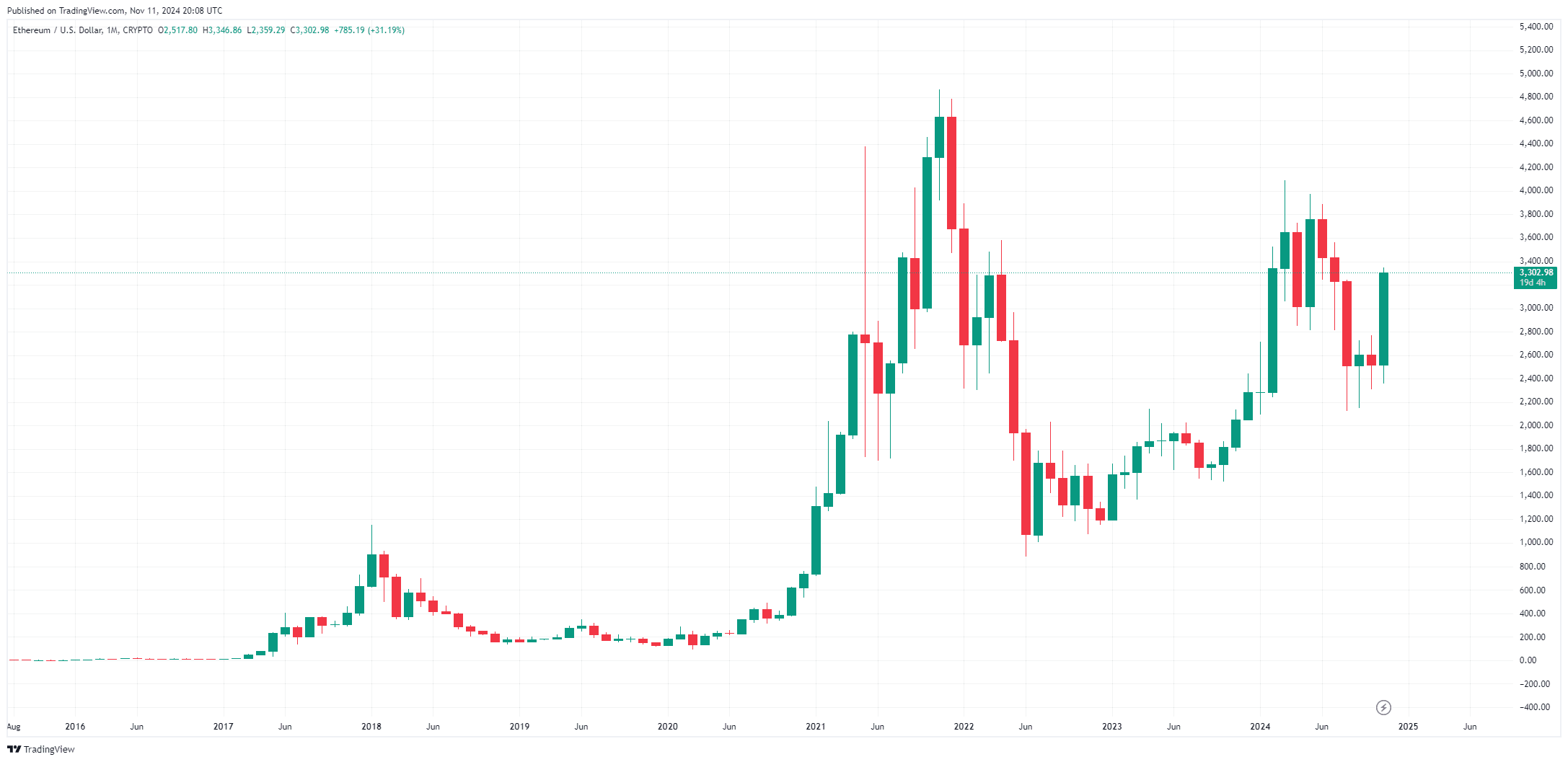

Ethereum (ETH) has captured vital consideration with an unprecedented rise in funding inflows and a bullish surge in its weekly quantity. Amid a outstanding 1,652% spike in ETF inflows and transaction volumes hitting file highs, Ethereum is positioned for potential new yearly highs and an prolonged bullish pattern. Traders and merchants are intently watching Ethereum’s efficiency because it consolidates, with the rising relevance of ETH in decentralized finance (DeFi) strengthening its function as a number one crypto asset. Simply like Bitcoin and Solana have been surging to new highs and nearing new ranks, Ethereum is preparing for its main breakout ever!

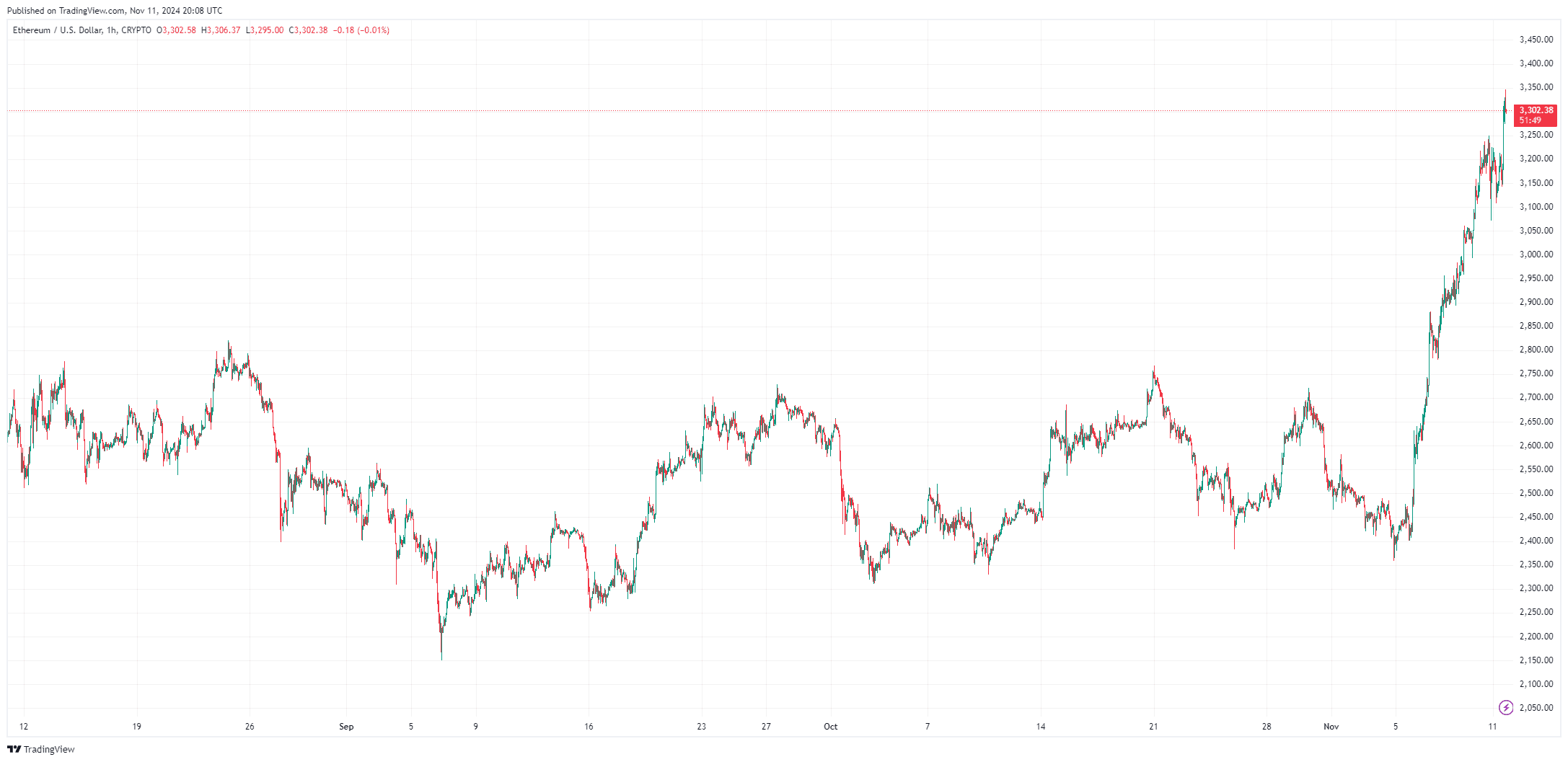

By TradingView – ETHUSD_2024-11-11 (3M)

Ethereum ETF Inflows: A New Report

Latest knowledge from CoinShares highlights a powerful $1.98 billion influx into cryptocurrency-based funding merchandise, with Ethereum main the cost. Ethereum-linked exchange-traded funds (ETFs) obtained a notable $157 million, marking a 1,652% weekly improve. This inflow has propelled Ethereum ETFs to a cumulative $915 million influx this 12 months, underlining rising investor curiosity in conventional monetary merchandise linked to Ethereum. With Ethereum ETFs reaching a staggering $12.09 billion in property below administration, the altcoin is drawing elevated adoption from these looking for alternate options to Bitcoin.

As analysts notice, the surge in Ethereum’s inflows could also be influenced by the present U.S. political panorama, the place potential pro-crypto administrative shifts may benefit main cryptocurrencies. Ethereum’s established place as the first different to Bitcoin makes it a main candidate for this wave of curiosity, notably given its functions in DeFi and blockchain improvements.

Ethereum Weekly Quantity Hits New Highs

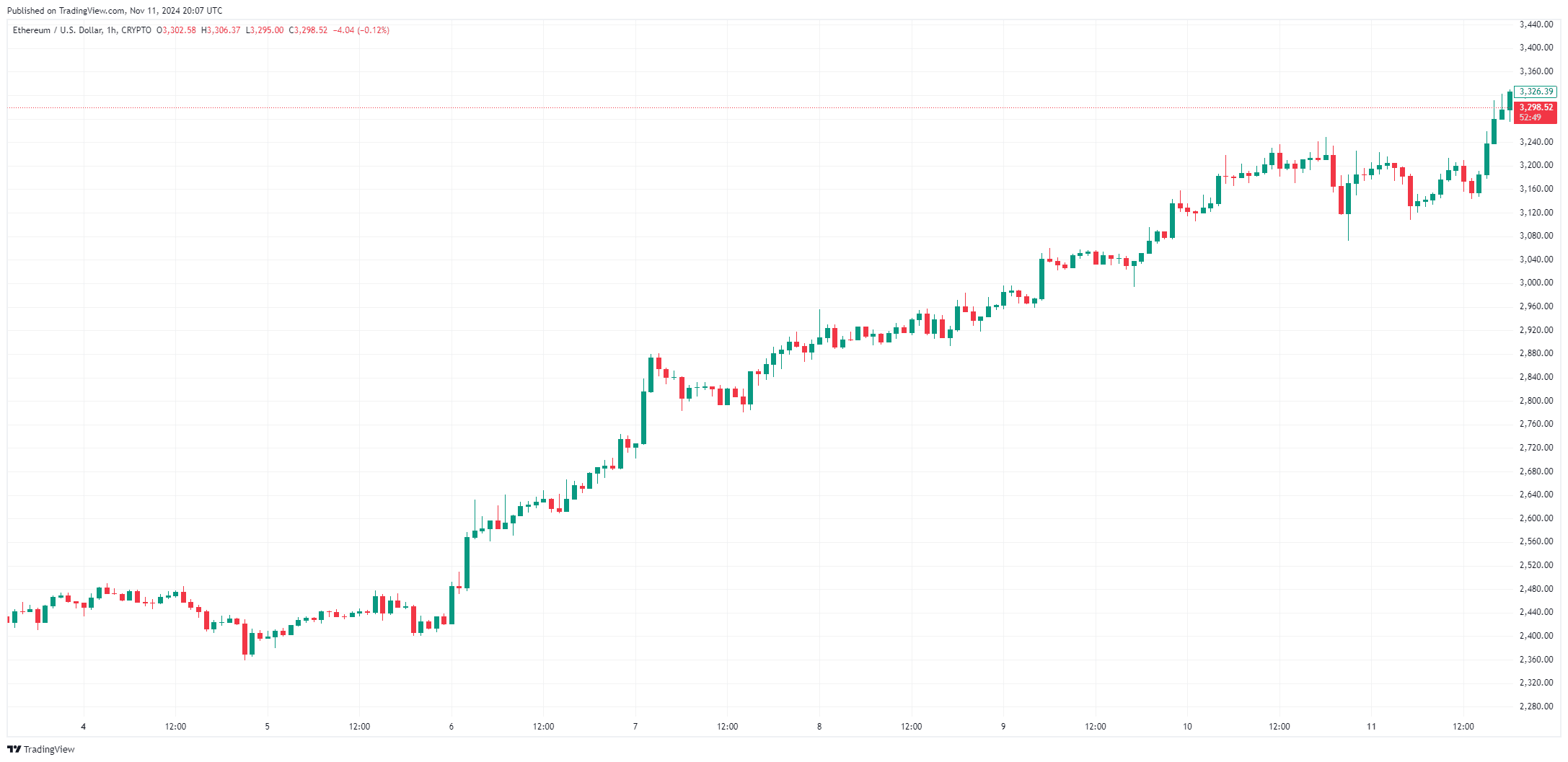

Ethereum has seen a considerable rise in buying and selling exercise, with weekly transaction quantity surpassing $60 billion for the primary time since July. In line with IntoTheBlock, this increase in on-chain exercise aligns with Ethereum’s 35% worth improve, a promising signal of the community’s increasing curiosity and engagement. Ethereum is at present buying and selling at $3,322, with a market capitalization of $400.29 billion and a 24-hour buying and selling quantity of $53.24 billion. A rally of this magnitude displays a bullish breakout for ETH because it assessments crucial resistance ranges, with investor optimism suggesting potential beneficial properties within the close to future.

For ETH to maintain this upward pattern, sustaining power above present ranges is important. Many merchants and analysts anticipate that Ethereum may obtain its yearly excessive if the momentum persists, with the broader market rally additional supporting this outlook. This elevated transaction quantity, mixed with ETH’s worth rise, indicators robust market confidence, which may solidify Ethereum’s bullish trajectory.

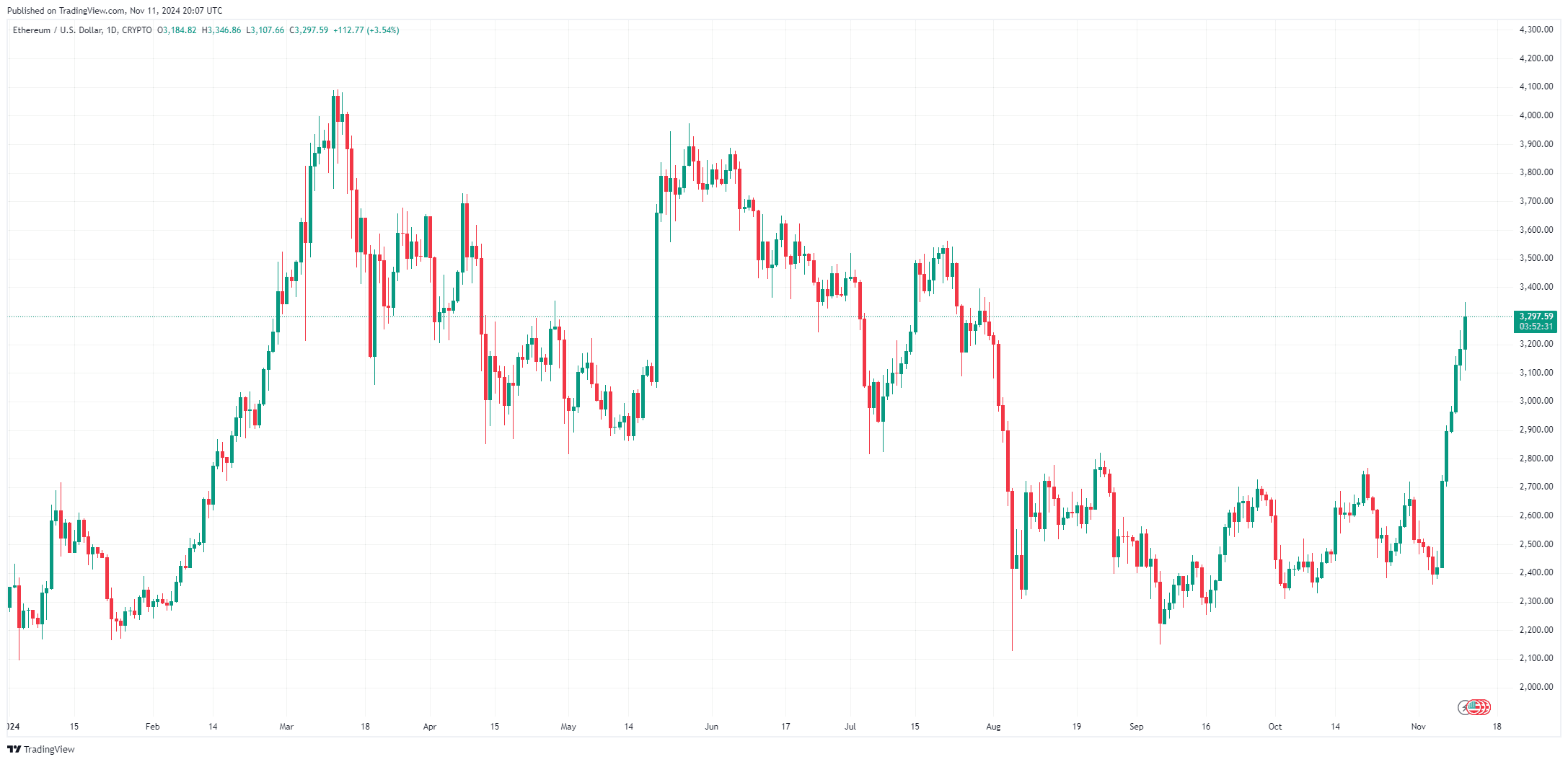

By TradingView – ETHUSD_2024-11-11 (YTD)

Ethereum Bullish Development Amid Consolidation Part

Following almost eight months of constant downtrend, Ethereum has launched into a bullish reversal, supported by vital accumulation from “sensible cash” traders. The latest Ethereum worth motion reveals a pivot from subdued exercise to fast development, pushed by renewed curiosity throughout buying and selling platforms. IntoTheBlock knowledge reveals Ethereum’s mainnet facilitated almost $60 billion in transactions over the previous week, indicating that each retail and institutional traders are actively buying and selling and accumulating ETH.

Ethereum consolidates above $3,300, as at present buying and selling round $3,322 after reaching a neighborhood excessive of $3,250. This consolidation section may present ETH worth the soundness wanted to arrange for its subsequent breakout, with help on the essential $2,950 degree aligning with the 200-day transferring common (MA). Holding above this degree would reaffirm bullish sentiment and should lead Ethereum towards a brand new goal of $3,500. This degree of help is important for sustaining Ethereum’s momentum, with market analysts watching intently for a possible transfer towards the $4,000 yearly excessive.

By TradingView – ETHUSD_2024-11-11 (5D)

Ethereum Value Is Getting Prepared For Its Main Breakout EVER

The present consolidation interval presents a strategic alternative for Ethereum to assemble momentum whereas absorbing any instant promoting stress. With its rising relevance in DeFi and broader blockchain adoption, Ethereum shouldn’t be solely a speculative asset however more and more considered as a retailer of worth. If Ethereum sustains help above key technical ranges, it could quickly expertise one other rally, positioning it for attainable new all-time highs alongside broader market optimism.

Ethereum’s power above the 200-day MA is pivotal for confirming a long-term bullish pattern. Whereas Ethereum faces volatility as buying and selling exercise heats up, the consensus amongst analysts is that it has the potential to interrupt by way of its $4,000 goal, marking an important milestone in its ongoing ascent.

By TradingView – ETHUSD_2024-11-11 (All)