A protracted-dormant Ethereum ICO participant just lately moved 3,510 ETH price about $912 million and transferred the belongings to the Kraken alternate after two years of inactivity. The participant, who acquired 150,000 ETH throughout Ethereum’s Genesis occasion for $46,500, now has $389.7 million.

The newest deposit marks the primary important motion from this tackle in over 771 days, because the pockets beforehand obtained three separate transfers of 5,000 ETH every. After this transaction, the pockets has round 11,490 ETH price of $30.6 million, in addition to 16 different tokens.

The #Ethereum Basis bought 100 $ETH($264K) once more in lower than 3 days!#Ethereum Basis has bought a complete of three,566 $ETH($9.94M) this 12 months.https://t.co/xHfVttUPKg pic.twitter.com/TvRrGR0p4F

— Lookonchain (@lookonchain) September 23, 2024

The current actions of this participant is a reason behind concern as giant deposits on the alternate are seen as an indicator of the participant’s intention to promote because of the liquidity provided within the alternate.

Ethereum Basis’s Continued ETH Gross sales Elevate Issues

In addition to the whale exercise, the Ethereum Basis has been rampantly liquidating ETH. As per Arkham, the above talked about Ethereum Basis tackle (0xd7…c1f4) transferred a further 200 ETH for $528,000 DAI by Cow Protocol between 16;02 and 16;16 UTC+8 on September 23.

The cash was then transferred to a different Ethereum Basis ETH tackle. This sale alone brings the whole ETH bought by the Basis in September to 1,150 ETH, equal to about $2.8 million.

In accordance with Arkham’s monitoring, the suspected Ethereum Basis tackle (0xd7…c1f4) bought 200 ETH for $528,000 DAI through Cow Protocol between 16:02 and 16:16 UTC+8 in the present day, after which transferred the funds to a different Ethereum Basis tackle.https://t.co/5eBuzInR0r

— Wu Blockchain (@WuBlockchain) September 23, 2024

On twenty first of September the Basis bought 300 ETH for about $763,000 with a median ETH value of $2,543. These gross sales entailed exchanging ETH for DAI, which is without doubt one of the a number of such operations carried out by the Basis this month.

Such frequent gross sales that happen each 4 to seven days have raised curiosity from buyers who’re cautious of the results of standard ETH liquidations available in the market.

Rising Ethereum Transaction Charges and Burn Charges

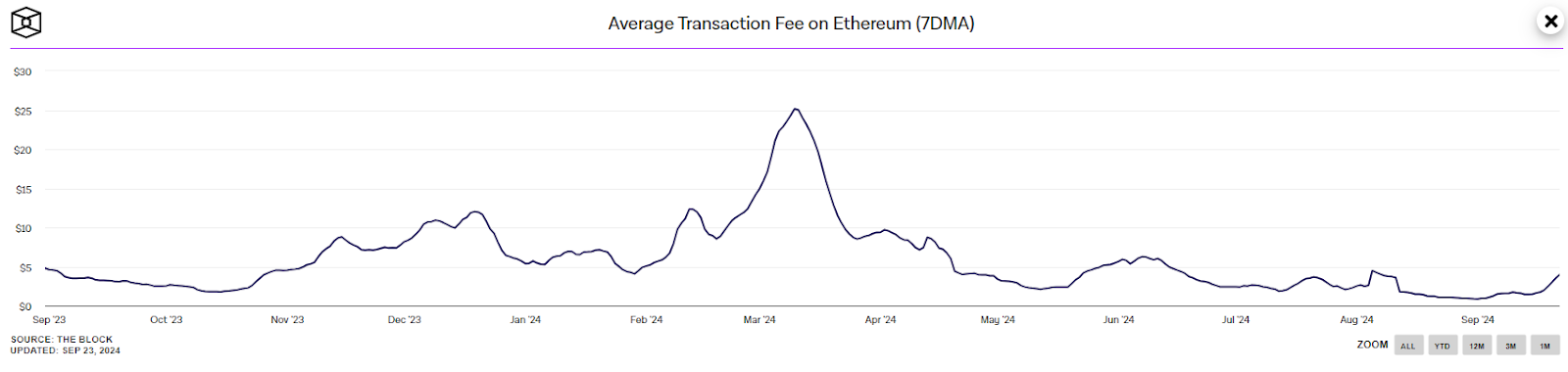

Throughout the identical interval that the Basis remains to be promoting, the transaction charges and burning charges inside the Ethereum community have additionally risen.

By September 23, the seven-day transferring common transaction price had reached $3.52, up from simply $0.85 at first of the month. This represents a considerable rise in community charges, the final time such prices have been as little as this was in July 2020 earlier than Ethereum shift to the proof of stake mannequin.

Supply: IntoTheBlock

Moreover, the burn price of ETH has risen considerably, going up by greater than 1600% from 80.27 ETH on September 1 to 1,360 ETH on September 21.

The primary contributors to this burn are excessive fuel use dApps equivalent to Uniswap, buying and selling bots like Maestro and Banana Gun, and transactions involving in style stablecoins equivalent to Tether (USDT) and USD Coin (USDC).

Market Outlook Amid Elevated ETH Outflows

ETH liquidations by Ethereum Basis and different giant buyers have taken place at a time when establishments have been bearish. In accordance with the most recent report from CoinShares, Ethereum witnessed weekly outflows of $28.5 million and complete outflows for the month stand at $145.7 million.

Then again, Bitcoin obtained giant inflows in the identical interval as establishments shifted their focus away from Ethereum.

Although there was steady outflow and market considerations, the worth of Ethereum has been secure at round $2,635 on the time of writing.

Nevertheless, the liquidation by the Basis and enormous holders remains to be a possible threat as a result of the rise of ETH on exchanges could result in extra promoting stress. Specialists have cautioned that if this persists, it could pose dangers to the sustainability of and even a rise within the value of Ethereum.