Ethereum (ETH) worth is exhibiting a interval of uncertainty as key indicators level to a scarcity of sturdy directional momentum. The DMI exhibits a weak pattern, with the ADX beneath 20 for a number of days, highlighting market indecision.

Moreover, the variety of ETH whale addresses has declined since hitting an 11-month excessive, signaling potential shifts in market sentiment. As ETH’s EMA strains stay undefined, the coin’s subsequent transfer will probably depend upon its potential to interrupt key resistance ranges or maintain vital help zones.

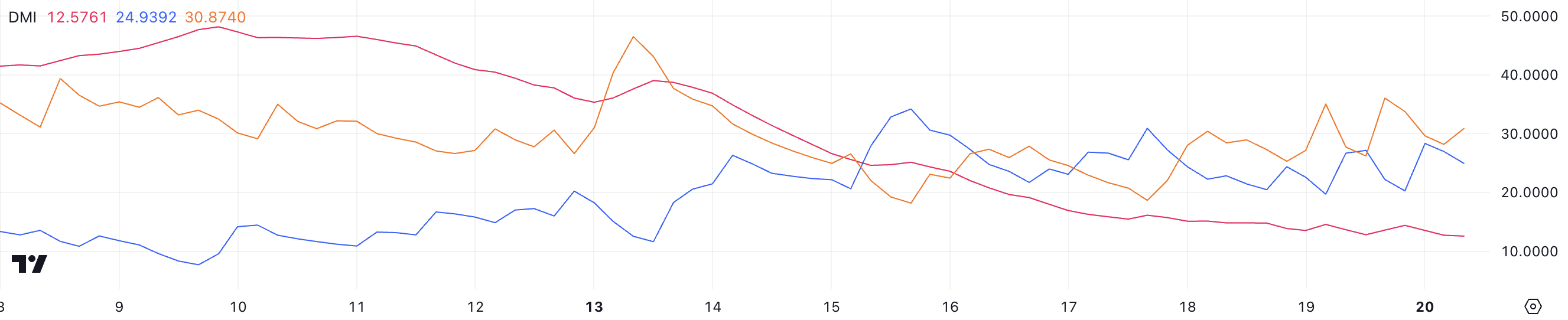

ETH DMI Signifies Weak Momentum

The Ethereum DMI (Directional Motion Index) chart reveals that the ADX is at present at 12.5 and has remained beneath 20 for the previous 4 days. The ADX (Common Directional Index) measures the power of a pattern, with readings beneath 20 indicating a weak or undefined pattern.

This lack of pattern power means that ETH is at present in a interval of indecision or consolidation, with no clear directional momentum dominating the market.

ETH DMI. Supply: TradingView

Along with the low ADX, the +DI (constructive directional indicator) is at 24.9, whereas the -DI (destructive directional indicator) is at 30.8. The upper -DI in comparison with +DI means that bearish momentum has a slight edge, although the weak ADX signifies that this bearish stress is just not strongly driving the value.

With the pattern showing undefined, Ethereum could proceed to maneuver sideways till stronger market momentum – both bullish or bearish — emerges to interrupt the present stalemate.

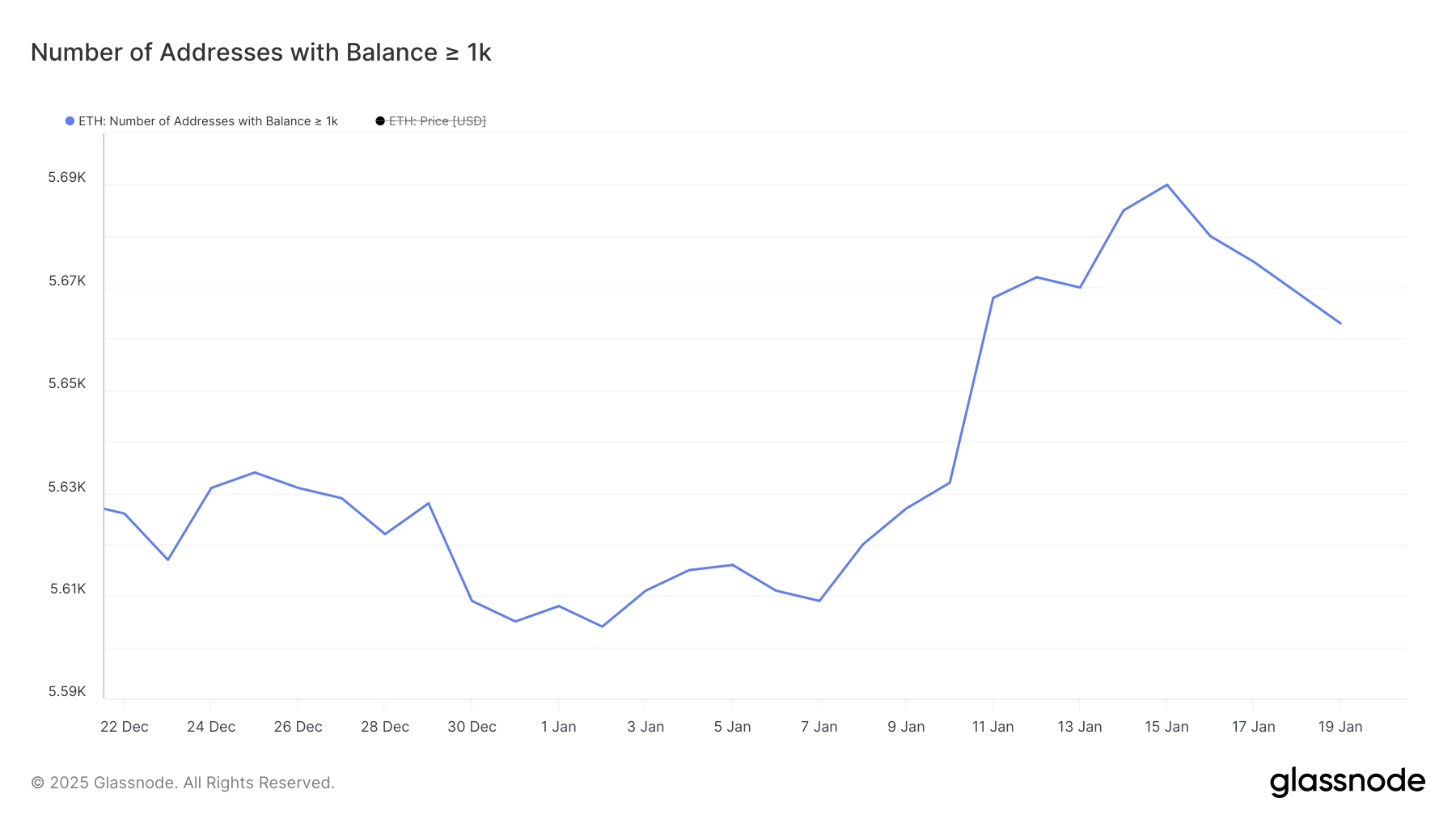

ETH Whale Addresses Decline After Current 11-Month Excessive

The variety of ETH whales — addresses holding at the very least 1,000 ETH — hit an 11-month excessive of 5,690 on January 15 however has since declined to five,663.

Monitoring these whales is essential as a result of their accumulation or distribution usually alerts shifts in market sentiment and potential worth traits. Giant holders can affect the market considerably, and their exercise gives priceless insights into broader funding patterns.

Addresses with Stability >= 1,000 ETH. Supply: Glassnode

This current decline in ETH whale addresses might be linked to the surge in curiosity and capital flowing into different property like BTC, TRUMP, SOL, and different altcoins. As these alternate options outperform or entice consideration, some ETH whales could also be reallocating their holdings, probably contributing to promoting stress on ETH worth.

If this pattern continues, ETH’s worth may face challenges, particularly if capital rotation reduces its market dominance in favor of different cash.

ETH Worth Prediction: EMA Strains Present No Clear Route But

ETH’s EMA strains point out that its present pattern stays undefined, reflecting a scarcity of clear path available in the market. Whereas ETH rose between January 13 and January 16, its efficiency over the past seven days has lagged behind main cash.

BTC surged by 17%, XRP by 36%, and SOL by 43%, with Ethereum worth rising 7.6% within the final seven days.

ETH Worth Evaluation. Supply: TradingView

If ETH can set up a robust uptrend, it might goal the important thing resistance degree at $3,473. A profitable breakout above this degree may pave the best way for an extra rise towards $3,745.

Nonetheless, if the present uncertainty persists and downward momentum builds, ETH worth may take a look at the help at $3,158. A breakdown beneath this degree may see ETH decline additional, probably reaching as little as $2,927.