Ethereum is struggling to interrupt by means of key resistance ranges, even after the current crypto market surge led by Bitcoin. Whereas ETH’s worth stays below strain, there’s encouraging information for buyers. Current information from IntoTheBlock highlights Ethereum’s continued dominance in decentralized alternate (DEX) quantity, reinforcing its place as a significant participant within the DeFi house.

This perception is significant for these involved about Ethereum’s worth underperforming in comparison with Bitcoin and different altcoins. The information means that regardless of the present worth struggles, Ethereum’s community stays strong and extremely utilized, particularly in DeFi.

This broader market perspective may also help buyers keep knowledgeable and make higher long-term choices, focusing not solely on worth but additionally on Ethereum’s underlying energy and rising utility. Because the market continues to evolve, Ethereum’s position in DeFi might stay a crucial issue driving future worth motion.

Ethereum DEX Dominance May Be Challenged

One of many core merchandise born out of DeFi is the decentralized alternate (DEX), permitting customers to commerce property permissionlessly with out the necessity for intermediaries. DEXs additionally allow customers to grow to be market makers by supplying liquidity to asset pairs, incomes charges from trades between these pairs.

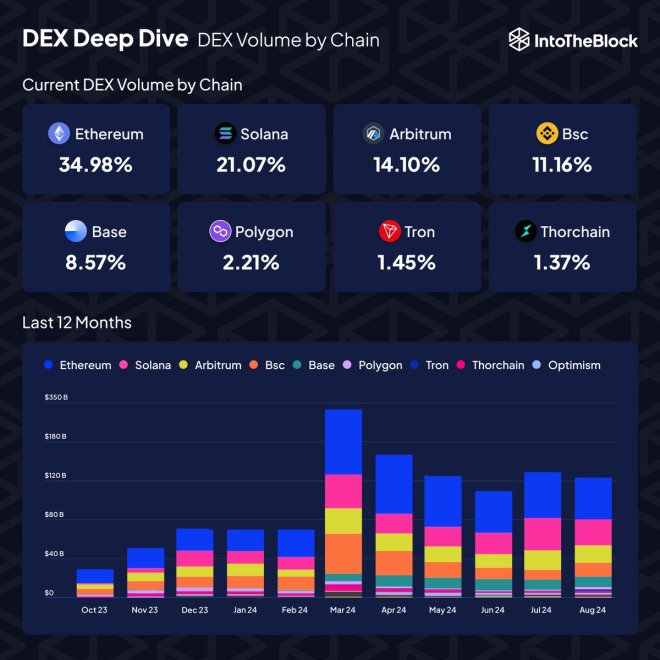

In keeping with a current IntoTheBlock report on X, Ethereum stays the dominant power in DEX quantity, controlling nearly 35% of the overall market share. Nevertheless, different blockchain networks are more and more difficult Ethereum’s dominance. Solana, specifically, is rising as a powerful competitor, steadily solidifying its place throughout the DEX house. Solana’s growing quantity highlights its rising relevance regardless of Ethereum’s longstanding affect.

Different blockchains, corresponding to Arbitrum and Binance Good Chain (BSC), additionally maintain a considerable share of the DEX market, with Arbitrum accounting for 14% of complete DEX quantity and BSC capturing 11%.

These networks proceed to achieve momentum as they provide sooner transaction speeds and decrease prices, making them engaging alternate options for decentralized buying and selling. Whereas Base, a brand new participant, skilled speedy early development, it has since leveled off, indicating the fierce competitors throughout the DeFi panorama.

The competitors to guide within the DEX market is intensifying, with varied blockchain ecosystems striving to develop their market share. Ethereum’s huge liquidity and established person base give it a powerful benefit, however Solana, Arbitrum, and BSC are quickly gaining floor.

ETH Technical Evaluation

Ethereum (ETH) is presently buying and selling at $2,427 following a 5% surge on Friday. Regardless of this current uptick, ETH has been underperforming throughout this cycle, with the most recent worth motion displaying comparable struggles. The value has confronted problem breaking previous the $2,460 resistance and has but to check the 4-hour 200 exponential transferring common (EMA) at $2,534.

This persistent resistance is fueling concern and uncertainty amongst buyers, suggesting a possible retrace to decrease ranges. Help ranges to observe embrace $2,300 and, if additional declines happen, a deeper dip round $2,150.

Conversely, if ETH manages to reclaim and maintain above the 4-hour 200 EMA, the outlook might shift positively. Efficiently surpassing this crucial stage may place ETH for a possible rally towards $2,600 and even increased, offering a extra bullish situation. The market’s path hinges on whether or not ETH can keep momentum above the EMA or if it’ll face continued resistance and a potential consolidation at decrease ranges.

Featured picture from Dall-E, chart from TradingView