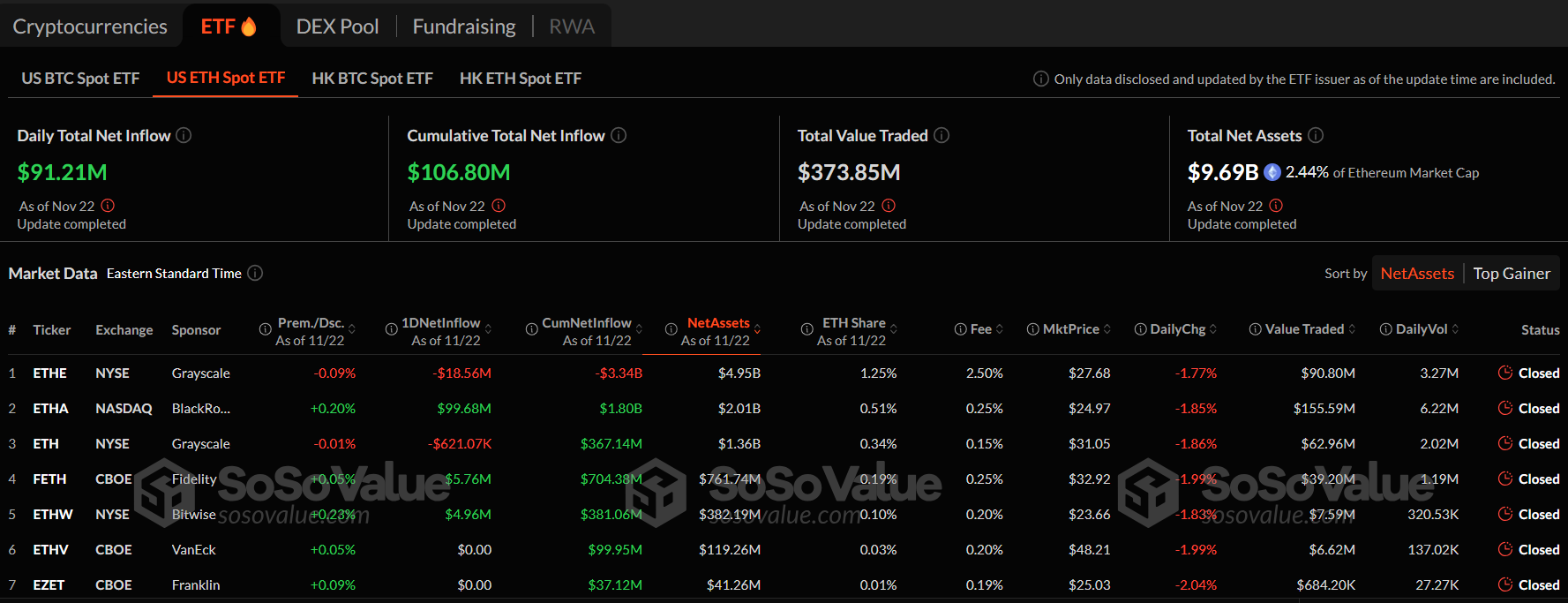

Ethereum Spot ETF inflows surged to $91.2 million, reversing six consecutive days of outflows. BlackRock’s Ethereum ETF (ETHA) considerably contributed to this development. The exchange-traded fund noticed a notable single-day influx of $99.67 million, reinforcing Ethereum’s place in institutional portfolios.

This influx pushed its complete historic internet influx to $1.80 billion. Following was Constancy’s FETH, which noticed a internet influx of $5.76 million, bringing its complete historic internet influx to $704 million.

Grayscale Ethereum Belief ETF ETHE had a internet outflow of $18.5621 million yesterday, and its historic internet outflow is at present $3.338 billion. Grayscale Ethereum Mini Belief ETF had a internet outflow of $620,000 yesterday, and its historic complete internet influx is $367 million.

Ethereum spot ETF inflows surge, signaling elevated institutional confidence

On November twenty second, Ethereum Spot ETF inflows rebounded considerably following six days of outflows. This return to optimistic inflows displays elevated investor curiosity in Ethereum as a digital asset.

The renewed inflows reveal Ethereum’s rising recognition as a mainstream funding product. Such institutional help, for instance, reveals the rising want for regulated funding selections associated to blockchain belongings. Sosovalue believes that this bodes properly for Ethereum-based ETFs sooner or later.

As of the time of publication, the full internet asset worth of Ethereum spot ETFs is $9.687 billion, with an ETF internet asset ratio (market worth relative to the general market worth of Ethereum) of two.44% and a historic cumulative internet influx of $107 million.

Supply: SoSoValue

BTC Spot ETF inflows proceed to dominate the market

Bitcoin Spot ETF inflows had been strong, totaling $490M on November 22, marking 5 consecutive days of internet inflows.

In accordance with knowledge from SoSoValue, spot Bitcoin ETFs within the US now have round $107.488 billion in complete belongings, far surpassing different crypto ETFs. Their belongings now account for round 6% of the flagship cryptocurrency’s market capitalization.

BlackRock’s IBIT ETF contributed an astonishing single-day $513 million to reveal Bitcoin’s growing standing because the go-to funding.

The worth of Bitcoin has moved up greater than 167% over the previous 12 months to now commerce at $98,598, a milestone achieved after the launch of those spot Bitcoin ETFs and after Republican candidate Donald Trump gained the US presidential elections.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap