- Ethereum ETFs will push ETH to a brand new all-time excessive above $5,000, says Bitwise.

- Citi predicts ETH ETFs will appeal to round $5 billion in internet inflows inside six months of launch.

- Peter Brandt suggests ETH might rally 60% if it makes a key transfer.

Ethereum (ETH) is up practically 2% on Tuesday following predictions from Bitwise chief funding officer (CIO) Matt Hougan that ETH ETFs might assist push ETH to a brand new all-time excessive above $5,000. Different predictions from Citi Financial institution and dealer Peter Brandt additionally align with Hougan’s place.

Each day digest market movers: Ethereum ETFs deciding issue for brand new all-time excessive

Bitwise CIO Matt Hougan predicted that inflows throughout Ethereum ETFs will enhance ETH’s worth to a brand new all-time excessive above $5,000.

“By year-end, I am assured the brand new highs will likely be in. And if flows are stronger than many market commentators count on, the value may very well be a lot increased nonetheless,” stated Hougan in a current memo to traders.

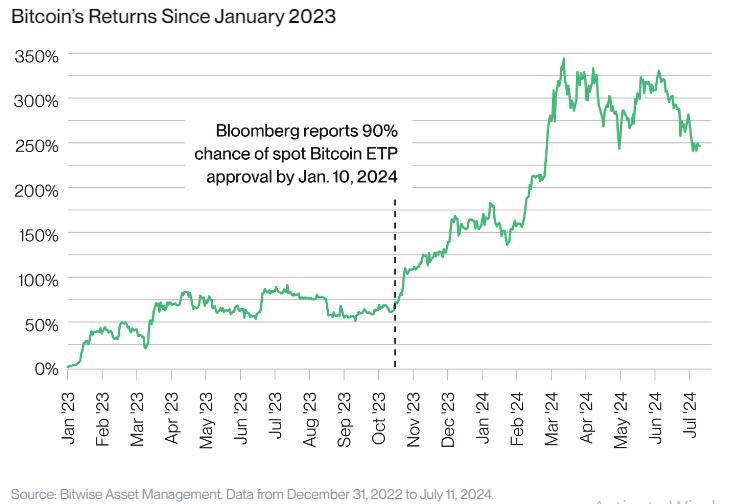

Hougan believes ETH ETFs may have an even bigger impression on ETH’s worth than Bitcoin (BTC) ETFs had on BTC because of the new demand that ETFs deliver to commodities with out altering their fundamentals. BTC has seen a 110% rise since October, when Bloomberg introduced the SEC would probably approve Bitcoin ETFs.

Bitcoin’s Returns since January 2023

He in contrast Bitcoin’s earlier 1.7% inflation fee to Ethereum’s, which has hovered from damaging to 0% up to now yr. ETH has maintained such a deflationary standing because the implementation of Ethereum Enchancment Proposal 1559 (EIP-1559), which reduces the quantity of ETH in circulation upon each transaction on the Mainnet.

“Vital new demand meets 0% new provide? I like that math. And if exercise on Ethereum ticks up, so does the quantity of ETH being consumed. That is one other lever of natural demand working in traders’ favor,” said Hougan.

Hougan additionally highlighted how the decrease financial price of Ethereum’s consensus mechanism reduces the promoting stress on ETH, in contrast to that of Bitcoin miners, who must promote a portion of their holdings to cowl up prices.

Lastly, he talked about how elevated staking and ETH utilization in DeFi protocols have already eliminated over 40% of ETH off the market.

Hougan believes these elements, mixed along with his earlier predictions of ETH ETFs raking in $15 billion within the first 18 months of launch, primes Ethereum for a brand new all-time excessive.

In the meantime, banking large Citi predicted in a analysis report final week that Ethereum ETFs might see as much as 30%-35% of the flows seen in Bitcoin ETFs. That might give an equal of about $4.7 billion to $5.4 billion of internet inflows, famous Citi analysts.

The Securities & Trade Fee (SEC) will probably greenlight ETH ETFs for buying and selling subsequent Tuesday. This follows updates from Bloomberg analyst Eric Balchunas and Reuters, which claimed sources advised them the regulator requested issuers to submit their last S-1 drafts this week in preparation for a Tuesday, July 23 launch.

ETH technical evaluation: May Ethereum rally 60% to $5,627?

Ethereum is buying and selling round $3,460 on Tuesday, up over 2% on the day. Up to now 24 hours, ETH witnessed over $45 million in liquidations, with shorts main the road at $25.36 million and longs at $19.92 million in liquidations.

ETH’s choices open curiosity has risen 13% up to now 24 hours to $6.66 billion. Open curiosity is the entire quantity of unsettled contracts in a derivatives market. A rise in choices OI mixed with worth progress signifies a possible for extra upside in a market. Because of this possibility merchants may very well be anticipating increased ETH worth and are reacting accordingly.

This aligns with a current prediction from in style dealer and analyst Peter Brandt.

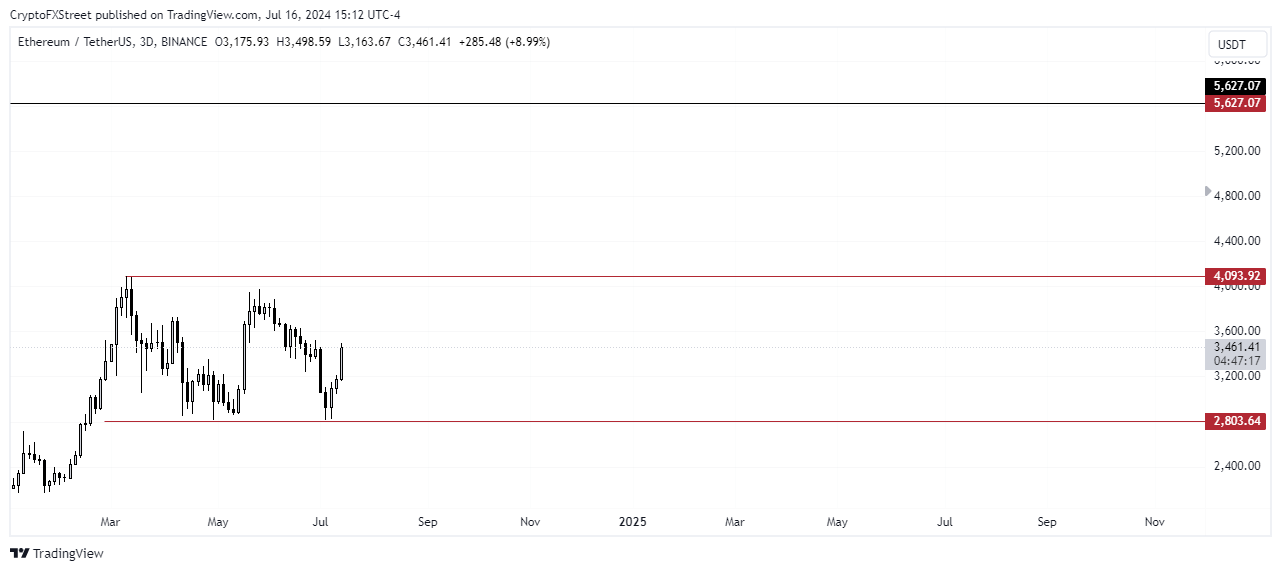

Brandt predicted that ETH might see a brand new all-time excessive quickly after discovering help at round $2,800, the decrease boundary of a four-month plus rectangle, “which was a retest of the Feb completion of a horn backside.” If ETH can full a transfer to the rectangle’s upside of $4,093, Brandt means that it might set a brand new all-time excessive at $5,627.

ETH/USDT Weekly chart

Within the brief time period, if ETH rises above $3,502, over $34.8 million value of brief positions will likely be liquidated from the market.

OCTA: Again and Higher Than Ever!

OCTA: Again and Higher Than Ever!