Ethereum remained on edge through the weekend as its exchange-traded funds skilled giant outflows, trade balances rose, and staking yield fell.

Ethereum (ETH) was buying and selling at $3,268, down from final month’s excessive of $4,104. This value motion mirrors that of Bitcoin (BTC), which has retreated from an all-time excessive of $108,000 to beneath $95,000.

Ether has pulled again as information reveals that demand for its ETFs on Wall Avenue has fallen up to now few days. In accordance with SoSoValue, all Ethereum funds misplaced $68 million in belongings on Friday after dropping $159.3 million on Thursday. They misplaced $86 million in belongings on Wednesday.

These funds now have over $11.61 billion in belongings, representing 2.96% of Ethereum’s market cap. In distinction, Bitcoin ETFs have $107 billion in belongings, or 5.2% of its market cap.

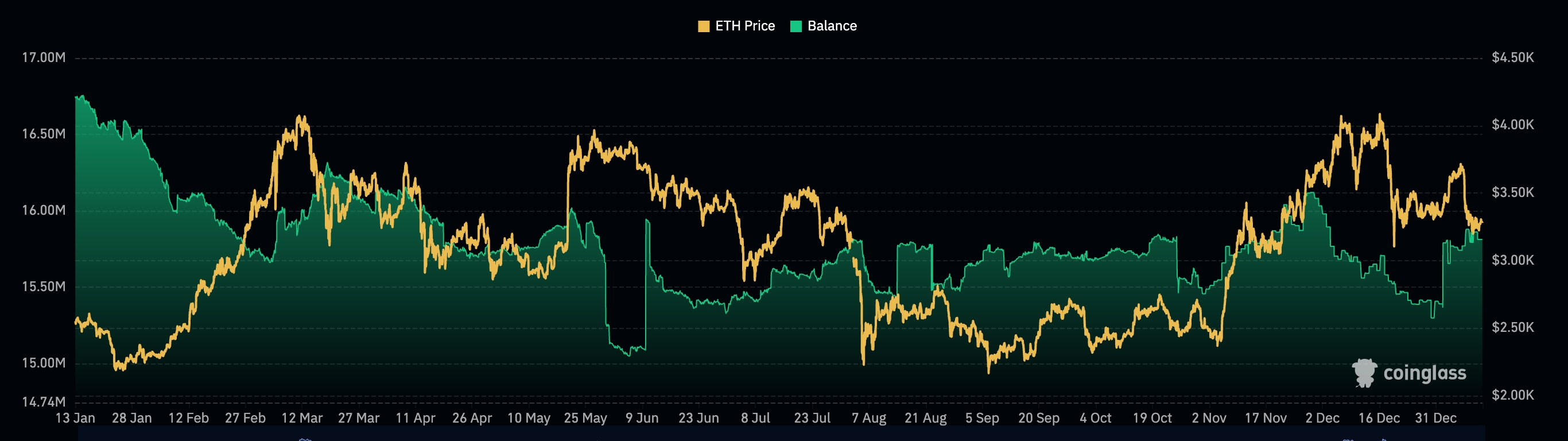

In the meantime, in response to CoinGlass, Ethereum balances on centralized exchanges have risen this yr. There are actually 15.8 million ETH cash on exchanges, up from 15.30 million on Dec. 30.

Larger trade balances is an indication that buyers are transferring their tokens from their wallets to CEX platforms. Transferring cryptocurrencies to exchanges is normally step one for promoting them.

Ethereum balances on CEX exchanges | Supply: CoinGlass

Extra information reveals that Ethereum’s futures open curiosity has dropped from its December excessive of $31.1 billion, an indication of falling demand. Within the final 5 days, its every day open curiosity has remained at $28.4 billion, down from the December excessive of $31.1 billion.

You may also like: Donald Trump: First Sitting U.S. President to HODL meme cash

On the constructive facet, Ethereum and different cryptocurrencies typically rebound when the open curiosity falls. For instance, ETH value began its latest rally in November when the curiosity dropped to $14 billion.

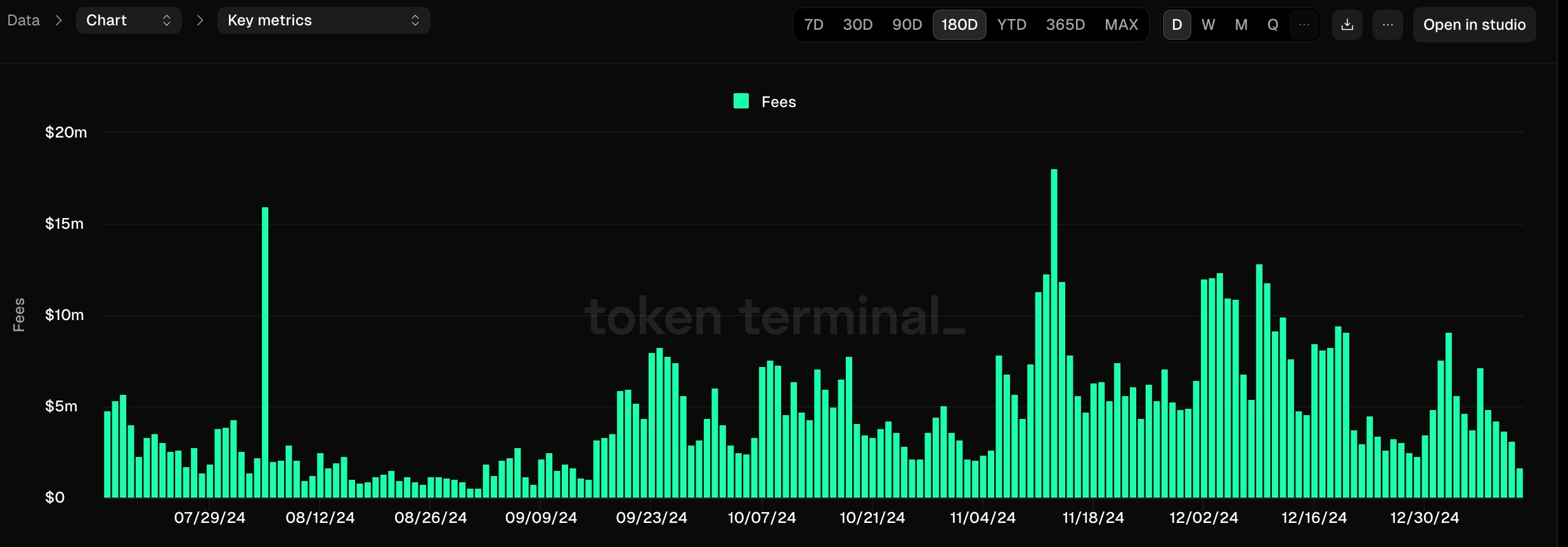

In the meantime, Ethereum stakers are producing a smaller yield. In accordance with StakingRewards, ETH has a staking reward price of three.10%, a lot decrease than Solana’s (SOL) 7% and Tron’s (TRX) 4.52%. Ethereum’s staking rewards typically drops when extra tokens are delegated to staking swimming pools and when charges fall. As proven beneath, Ethereum’s charges have been on a downward trajectory in the previous few weeks.

Ethereum charges | Supply: TokenTerminal

Ethereum value chart evaluation

ETH value chart | Supply: crypto.information

The every day chart reveals that the ETH value peaked at $4,104 in December, forming a double-top sample with a neckline at $3,520.

It has dropped beneath the 50-day transferring common at $3,415, and located substantial assist on the 100-day transferring common. Ethereum additionally discovered assist on the ascending trendline that connects the bottom ranges since Nov. 15.

There are indicators that the coin has shaped a head-and-shoulders sample, a well-liked bearish signal. Due to this fact, a drop beneath the 100-day transferring common and the ascending trendline will level to a bearish breakdown, doubtlessly to $2,820, the best stage since August final yr.

Learn extra: Bitcoin value in danger as bearish divergence varieties, hash price falls