The worldwide crypto market has skilled stable bearish sentiment within the final 24 hours because the Ethereum (ETH) token takes a serious hit. As tracked on CoinMarketCap, the ETH token recorded an 8.20% loss, pushing its worth to $3,141. This adverse sentiment is basically attributed to Tuesday’s ETF launch, which prompted ripple results on all the crypto market.

ETH/USD 1-Day Chart (Supply: CoinMarketCap)

Consequently, the whole market capitalization dipped by over 4% to $2.3 trillion from a weekly peak of $2.60 trillion, recorded on Sunday. Following this adverse worth motion, key gamers like Bitcoin and Binance Coin additionally witnessed losses, with BTC plummeting over 3% to $63.9K and BNB declining by 4.18% to $560.

In the meantime, the whole buying and selling quantity within the crypto market paints a unique image, because it surged 15.84% to $87.03 billion throughout the identical interval. This indicators vital buying and selling actions regardless of the current worth drops.

Lengthy-Time period Bullish Outlook for Ethereum

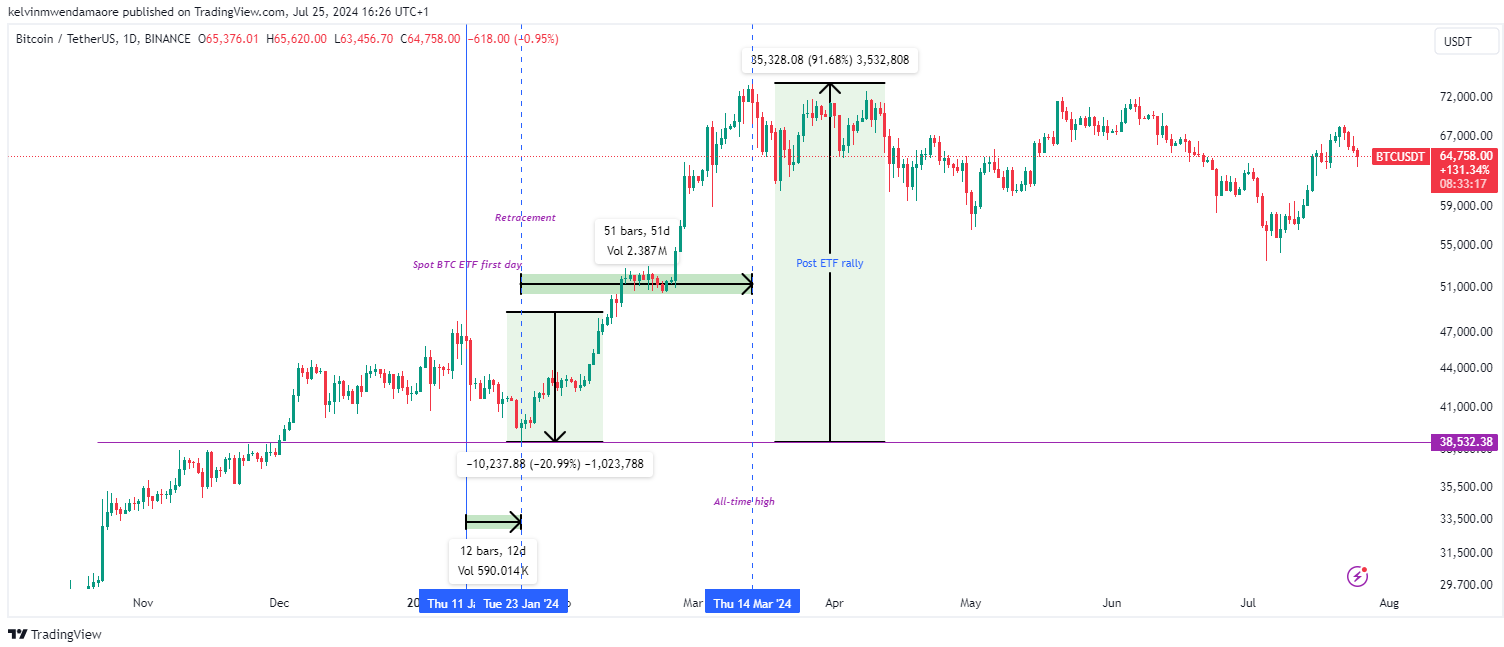

As cited in a CryptoNewsZ submit, this bearish sentiment within the ETH market echoes the “sell-the-news” context witnessed in Bitcoin ETF approval information in January. Per experiences, Bitcoin noticed a 20% retracement to this 12 months’s low of $38,532 inside 12 days. Upon reaching this degree, the token massively surged by over 91% to its all-time excessive of $73.7K within the subsequent 51 days.

BTC/USD 1-Day Chart (Supply: TradingView)

Consequently, market consultants predict a possible restoration and surge in Ethereum’s worth following its current dip. Ought to historical past repeat, ETH might see its worth drop to the $2.82K threshold, marking a 20% retracement. Subsequently, a large 90% rebound might push ETH’s worth to a brand new all-time excessive of round $5.38K by the top of Q3.

ETH/USD 1-Day Chart (Supply: TradingView)

Supporting this forecast, market analyst Michael Van de Poppe is extremely bullish on ETH in the long run. He believes the asset is essentially the most undervalued within the crypto market and predicts a big surge to an all-time excessive within the $7,000–$7,500 vary.

“Most likely it’s very more likely to suspect {that a} worth rally from $3,500 to $7,000–7,500 is on the playing cards and that Ethereum is, by far, essentially the most undervalued asset on the market.” Van de Poppe famous.

ETH Indicators Alerts Bearish Development

Specializing in the day by day charts, the RSI index is shifting in a downtrend under the sign line, indicating a strong bearish temper within the ETH market. Positioned at 40.80, the RSI index signifies ample area for the bearish temper to persist within the brief time period earlier than reaching oversold situations.

ETH/USD 1-Day Chart (Supply: TradingView)

On the identical accord, the Shifting Common Convergence Divergence indicator tells an identical story because the MACD line dips towards the zero line at 13.17. This sample is additional corroborated by the MACD’s histogram chart, with its bars flattening alongside the zero line, implying that bears take full management of the ETH market within the brief time period.