- Ethereum is outperforming cryptocurrencies within the high 20 because the Fed decreased charges.

- The highest altcoin’s 16% rise comes after months of underperforming Bitcoin and Solana.

- Ethereum overcame the $2,595 resistance as merchants set sights on the $2,817 key degree.

Ethereum (ETH) is up almost 4% on Monday following its spectacular rally prior to now 5 days because the Federal Reserve (Fed) reduce charges by 50 foundation factors. ETH is at the moment trying to reclaim a key assist degree at $2,817.

Day by day Digest Market Movers: Ethereum’s 16% rise and open curiosity progress

Ethereum has put up a robust efficiency in opposition to Bitcoin and different high 20 cryptocurrencies by market capitalization because the Federal Reserve (Fed) decreased rates of interest by 50 foundation factors on Wednesday. Prior to now 5 days because the reduce, the highest altcoin has risen by over 16%, whereas Bitcoin and Solana have solely managed good points of seven% and 10%, respectively.

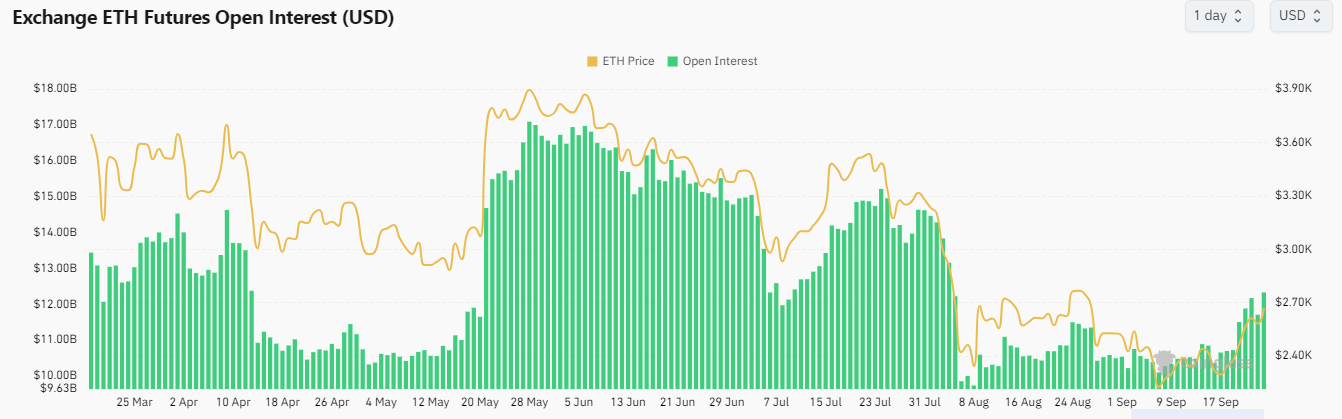

The rally can be supported by ETH’s rising open curiosity (OI) prior to now week. Open curiosity is the full variety of unsettled lengthy and brief contracts in a derivatives market.

ETH’s OI crossed $12.37 billion at press time and is approaching ranges final seen earlier than the market crash in early August, per Coinglass information. Rising open curiosity, alongside value will increase, suggests confidence amongst buyers.

ETH Open Curiosity

ETH’s rise comes after months of underperforming Bitcoin and Solana. The ETH/BTC ratio notably reached a low final seen in April 2021 earlier final week.

Bitfinex analysts famous in a report launched on Monday that ETH’s latest outperformance is as a result of “excessive melancholy in altcoin valuations and open curiosity that has been noticed since March 2024.” Nevertheless, the analysts additionally famous that the elevated open curiosity alerts the potential for heightened volatility within the altcoin market, which ETH leads.

In the meantime, Ethereum exchange-traded funds (ETF) posted $28.5 million in web outflows final week regardless of ending the week with inflows, per CoinShares information.

Ethereum targets $2,817 following transfer above higher rectangle boundary

Ethereum is buying and selling round $2,670 on Monday, up 3.7% on the day. Prior to now 24 hours, ETH has seen over $37 million in liquidations, with lengthy and brief liquidations accounting for $16.06 million and $21.39 million, respectively.

On the 4-hour chart, the highest altcoin overcame the $2,595 rectangle’s resistance over the weekend and is trying a transfer to retest the $2,817 key value degree.

ETH/USDT 4-hour chart

A profitable transfer above this degree may assist the bullish momentum, contemplating the $2,817 value degree has beforehand established itself as essential assist between April and August. Such a transfer would see ETH cross above the $3,000 psychological degree and goal the subsequent resistance at $3,057.

Nevertheless, a decline under the $2,595 degree may trigger ETH to maintain a correction towards the $2,395 assist degree.

The Relative Energy Index (RSI) and Stochastic Oscillator (Stoch) are trying to maneuver under their oversold area, indicating a possible value correction.

Within the brief time period, ETH may rise to $2,706 to liquidate positions value $56.35 million.

Share: Cryptos feed