Because the broader cryptocurrency market faces a downturn, Ethereum (ETH) has demonstrated notable resilience, sustaining its worth above $3,400. On the similar time, silver (XAG/USD) is holding agency at a key assist stage of $29.00, rebounding as US bond yields come beneath strain.

The evolving financial surroundings has led buyers to reevaluate their methods, evaluating the advantages of Ethereum as a number one digital asset with the essential function of silver in rising applied sciences and its responsiveness to industrial demand fluctuations.

Ethereum: The innovator’s selection vs. Silver: The regular performer

Ethereum’s potential for aggressive progress and excessive volatility makes it an interesting speculative funding. Its foundational function within the decentralized finance (DeFi) ecosystem and good contract performance presents vital upside potential.

Moreover, Ethereum’s steady technological developments, such because the transition to Ethereum 2.0 and rising institutional curiosity, add to its attractiveness as a high-reward funding. Commonplace Chartered, a world banking big, not too long ago introduced plans to open a buying and selling desk for spot Bitcoin (BTC) and Ethereum, enhancing Ethereum’s market presence.

Ethereum’s flexibility and innovation inside blockchain know-how present a hedge towards conventional monetary market instability and inflation, positioning it as a forward-looking funding selection.

Silver, alternatively, offers stability and progress potential tied to rising applied sciences and international sustainability tendencies. Not like Ethereum, silver is much less risky and advantages from its twin function as each an funding and an industrial commodity.

Its sensitivity to industrial demand cycles and use in high-tech options place it for regular appreciation. Silver’s conventional function as a hedge towards inflation and financial downturns makes it a dependable selection for extra conservative buyers.

ChatGPT’s evaluation: Ethereum vs. Silver funding prospects

In accordance with ChatGPT-4o, the choice largely depends upon particular person funding methods and danger tolerance.

Buyers Ethereum needs to be snug with larger dangers and the potential for prime rewards. This consists of tech fanatics captivated by blockchain improvements, long-term believers in the way forward for decentralized finance (DeFi) and NFTs, and institutional buyers looking for superior digital property.

Ethereum’s latest resilience, rising consumer engagement, and potential ETF approvals make it a compelling selection for these aiming for vital progress.

Alternatively, silver fits conservative buyers who prioritize stability and regular progress. Silver’s intensive use in electronics, photo voltaic panels, and medical gadgets ensures ongoing demand, making it a dependable industrial commodity.

Moreover, silver serves as a conventional hedge towards inflation and financial downturns, interesting to those that desire tangible, bodily property. Its function as each an funding and an industrial commodity makes silver a sound selection for these looking for a balanced and safe addition to their portfolios.

In the end, diversification with each Ethereum and silver generally is a method to handle danger and probably profit from the expansion of each main property. The selection between Ethereum and silver ought to align with particular person funding objectives, danger tolerance, and curiosity within the technological points of cryptocurrencies.

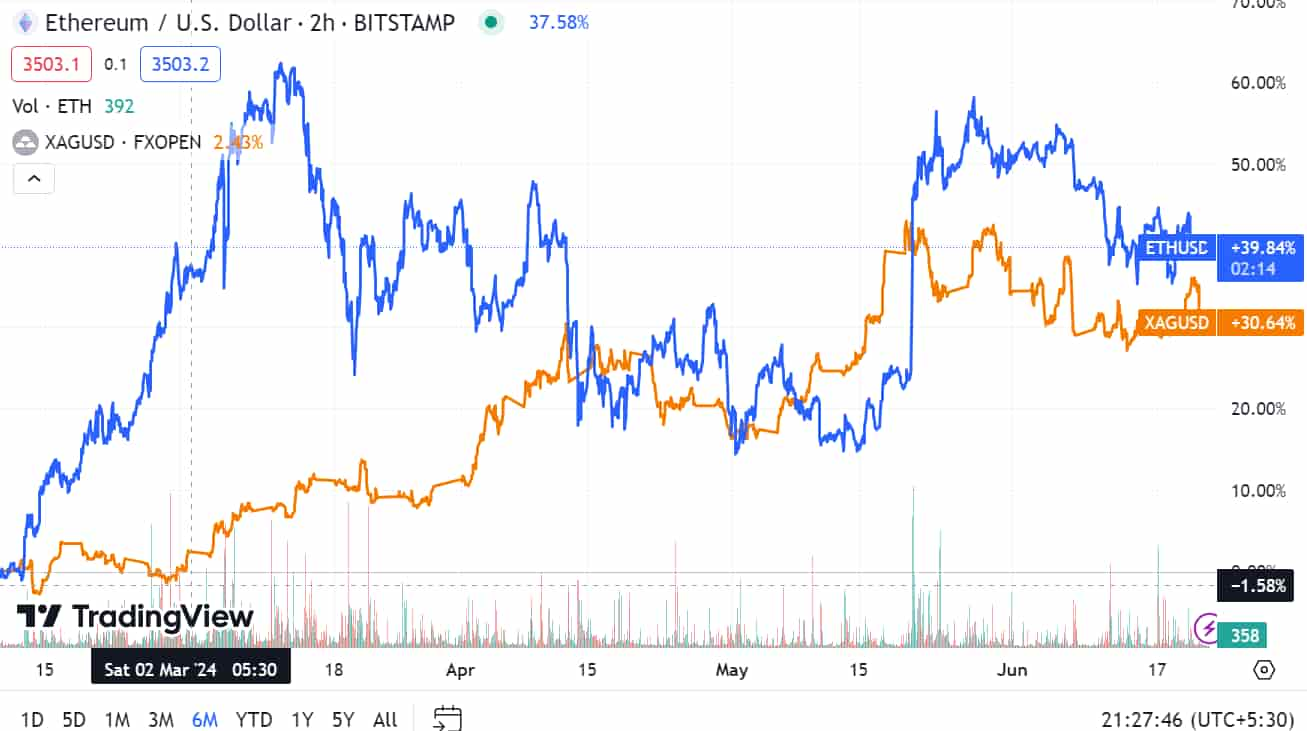

Ethereum and Silver latest worth efficiency

As of 2024, six months efficiency for Ethereum and silver presents a transparent distinction in funding returns. Ethereum has seen a major rise, with a rise of 39% in six months, showcasing its risky but high-growth nature with its present worth at $3,505.

As compared, silver has gained 30% in six months, with its present worth at about $29.5 per ounce.

In conclusion, each Ethereum and silver provide distinctive funding alternatives suited to completely different danger profiles and market views.

Ethereum’s revolutionary edge and high-growth potential make it a sexy possibility for these prepared to embrace volatility and technological developments. In distinction, silver’s stability and industrial functions present a safer, extra conservative funding route.

Diversifying with each property may provide a balanced method, permitting buyers to capitalize on the strengths of every whereas mitigating total danger.

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.