The worth of Ethereum has just lately seen a major drop, inflicting a wave of losses for a lot of merchants. With over $95 million in lengthy positions liquidated, the market has skilled elevated volatility, resulting in a bearish momentum. However why did this occur? On this Ethereum value prediction article, we’ll discover the important thing elements behind the latest dip in Ethereum’s value, what it means for merchants and buyers, and the way the market’s volatility has influenced this downward pattern.

How has the Ethereum Worth Moved Lately?

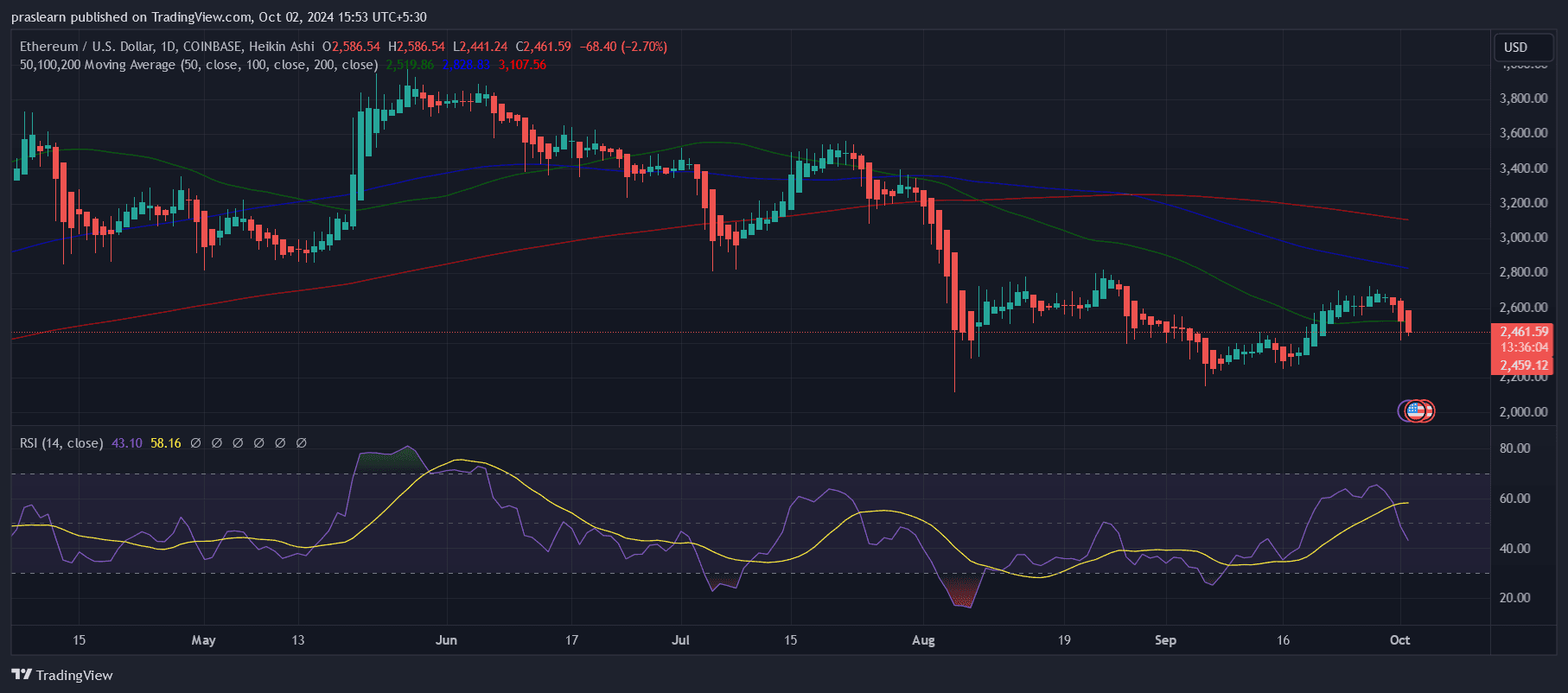

ETH/USD Each day chart- TradingView

Presently, Ethereum is priced at $2,454.59, with a 24-hour buying and selling quantity of $34.53 billion, a market cap of $295.45 billion, and holds a market dominance of 13.71%. Over the previous 24 hours, the worth of ETH has dropped by 6.92%.

Ethereum hit its peak on November 10, 2021, reaching an all-time excessive of $4,867.17. Alternatively, its lowest value was recorded on October 21, 2015, when it traded at simply $0.420897. The bottom level since its all-time excessive was $897.01 (cycle low), and the very best value since that time was $4,094.18 (cycle excessive). Presently, the market sentiment for Ethereum leans bearish, with the Worry & Greed Index indicating a degree of 42, signaling a state of “Worry.”

Ethereum’s circulating provide stands at 120.37 million ETH, with an annual provide progress fee of 0.11%, ensuing within the creation of 128,056 ETH during the last yr.

Why Ethereum Worth Drops?

The latest drop in Ethereum’s value will be attributed to the escalating tensions within the Center East, significantly between Israel and Iran, which have induced a ripple impact in world markets.

Because the battle intensified, with Israeli Prime Minister Benjamin Netanyahu vowing a response to Iranian missile assaults, buyers reacted by shifting their property from riskier investments like cryptocurrencies to extra conventional protected havens, reminiscent of gold and crude oil. This flight to security is a standard response in occasions of geopolitical instability, as buyers search to guard their capital from potential market downturns.

The consequence of this market shift is a decline in Ethereum’s value, resulting in the liquidation of many lengthy positions. When merchants anticipate a value rally and the market strikes towards their place, the worth of their property drops to a degree the place the change forcefully closes their positions, leading to a liquidation.

This mechanism protects exchanges from bearing the losses however usually leads to vital losses for merchants. In Ethereum’s case, the sudden market downturn compelled many to promote their positions at a lower cost, exacerbating the worth drop. Based on Coinglass information, ETH lengthy positions noticed liquidations totaling $96 million on Monday, marking the very best single-day liquidation in almost two months.

The predictive outlook for Ethereum means that the market may stay bearish so long as the Center East tensions persist and world market volatility stays excessive. Such geopolitical occasions usually create uncertainty, inflicting buyers to be cautious and favor property perceived as extra secure.

The cycle of liquidation additional pressures the worth downward, as extra merchants exit their lengthy positions to keep away from additional losses. If the scenario stabilizes or tensions ease, Ethereum may regain its upward trajectory; nevertheless, within the present local weather, warning and volatility are more likely to persist. Because the Worry & Greed Index signifies a “Worry” sentiment, merchants ought to maintain a detailed watch on world developments, as any escalation may additional affect Ethereum’s value and market route.

Will Ethereum Worth Rise within the Subsequent 7 Days?

Predicting Ethereum’s value motion within the subsequent 7 days requires analyzing each market sentiment and underlying exterior elements that would affect investor conduct. Presently, Ethereum faces downward stress as a result of macroeconomic uncertainty and geopolitical tensions, which have traditionally led to market volatility. Nevertheless, a number of key elements may probably set off a short-term value rebound or additional stabilize its worth.

From a market dynamics perspective, Ethereum’s value motion usually correlates with total cryptocurrency market sentiment and Bitcoin’s efficiency. If Bitcoin exhibits indicators of restoration or stability, it may positively have an effect on Ethereum’s value as buyers regain confidence.

Moreover, market indicators like buying and selling quantity, open curiosity in futures, and on-chain information—reminiscent of pockets exercise and Ethereum staking conduct—will play an important position. If these indicators present elevated exercise or bullish sentiment, this might sign an increase in demand, driving the worth upward.

One other issue to contemplate is any enchancment or decision of geopolitical tensions, which may positively impression world markets and investor sentiment towards riskier property like cryptocurrencies.

A de-escalation in Center East tensions or a normal calming of market fears would doubtless encourage merchants to reenter the market, probably resulting in a short-term rise in Ethereum’s value. Moreover, Ethereum’s personal developments, reminiscent of updates associated to scalability, community upgrades, or elevated adoption of decentralized finance (DeFi) platforms, may drive constructive sentiment and increase costs.

Nevertheless, given the excessive degree of uncertainty in world markets and the potential for additional liquidations, the potential of Ethereum rising within the subsequent 7 days is balanced towards vital dangers. If the bearish momentum continues and world market fears persist, Ethereum may wrestle to attain a considerable rise inside every week. The market may even see short-lived rallies or “useless cat bounces,” however until there’s a vital change in both the geopolitical scenario or a sudden bullish catalyst inside the crypto market, sustained upward motion could be restricted.

Whereas there’s a chance for Ethereum’s value to rise over the subsequent 7 days if market sentiment shifts positively or exterior tensions ease, merchants must be ready for continued volatility. The chance of a value rally is contingent on broader market dynamics, geopolitical elements, and particular developments inside the Ethereum ecosystem. Thus, a cautious, intently monitored strategy to buying and selling is advisable throughout this era.