Ethereum (ETH) continues to command strong buying and selling quantity regardless of a latest 3% drop during the last 24 hours and the present bearish strain.

The present market situation has not been particularly favorable to Ethereum, the second-largest cryptocurrency. As one of many main crypto belongings, ETH has been on the forefront of the continued selloffs. Consequently, the token has dropped 10.33% this month, struggling to retain the $3,000 threshold.

This month’s value collapse follows an 8.62% near June, which noticed Ethereum surrender the $3,700 and $3,500 psychological territories. Ethereum’s downturn is a product of its value correlation with Bitcoin (BTC), which has dropped 8.61% in July. IntoTheBlock knowledge reveals Ethereum has a 93% correlation with Bitcoin during the last month.

Ethereum Sees Elevated Quantity

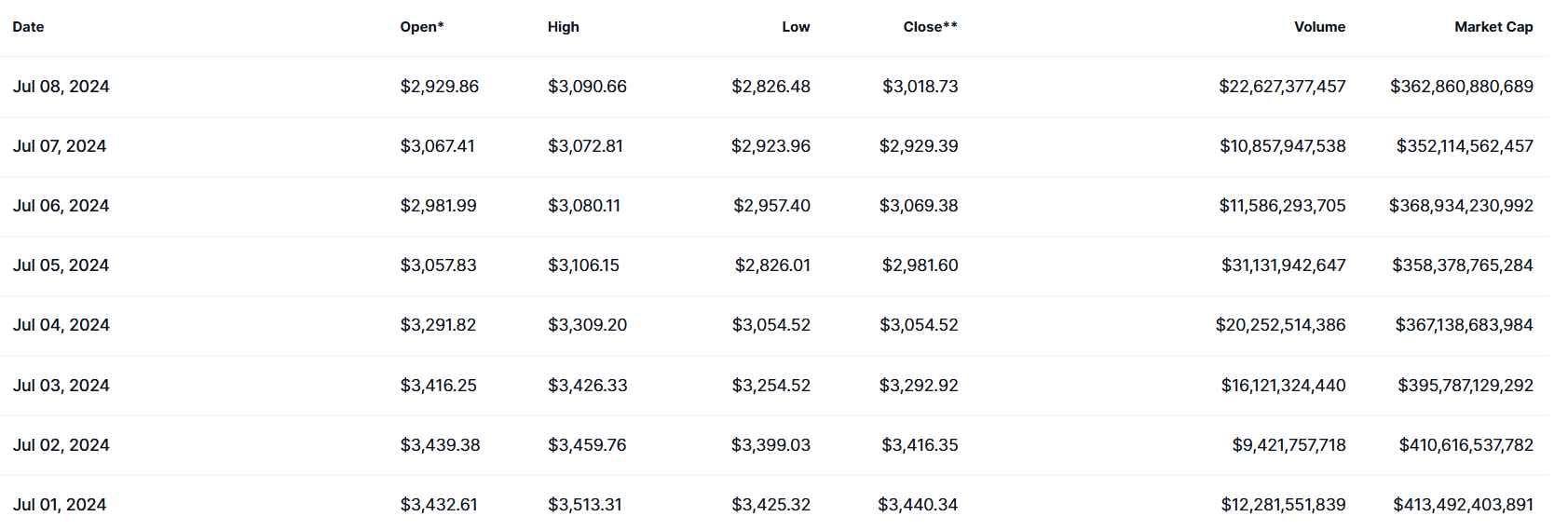

Curiously, regardless of the continued drop, market curiosity in Ethereum has not declined. Market knowledge sourced by CoinMarketCap signifies that Ethereum’s 24-hour buying and selling quantity has not dropped under $10 billion this month. The bottom determine ETH has witnessed is $10.85 billion, recorded on July 7 throughout a 4.43% value dump.

Ethereum Historic Efficiency | CoinMarketCap

The most recent knowledge reveals that Ethereum sees a $17.927 billion quantity during the last 24 hours regardless of a 3.09% drop. This makes it the third-largest asset by 24-hour quantity, solely behind Bitcoin and USDT. Two of Binance’s Ethereum buying and selling pairs command 14.54% of the worldwide quantity, boasting a mixed $2.605 billion.

Ethereum 24H Quantity | CoinMarketCap

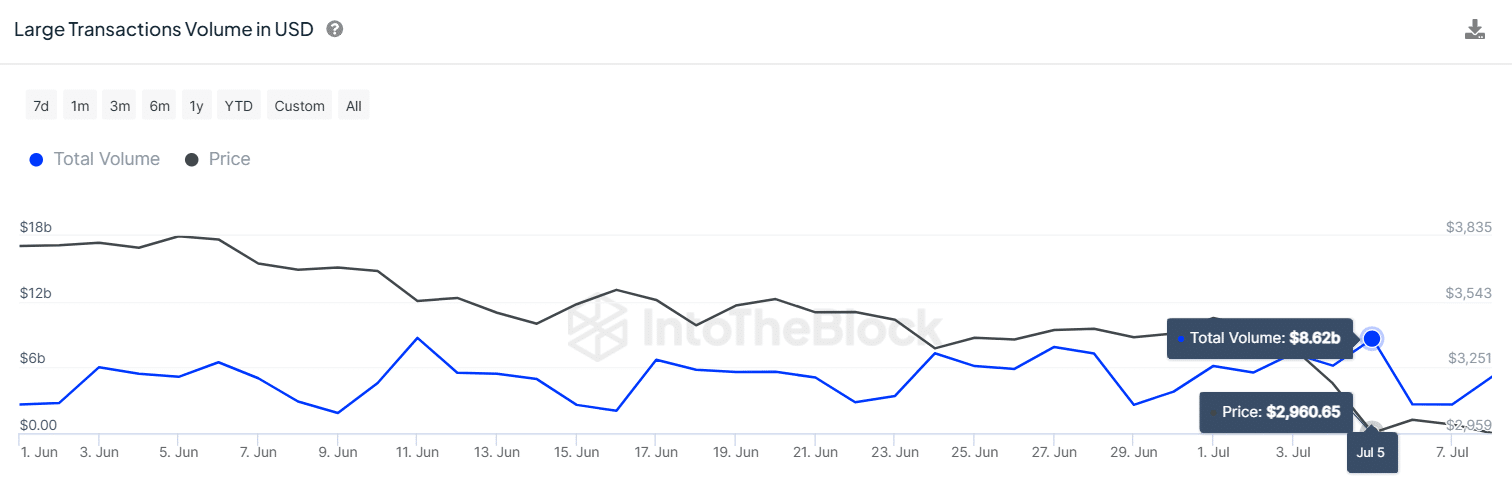

Additional, IntoTheBlock confirms that giant Ethereum transactions have been on the excessive facet, with a 7-day peak of $8.62 billion on July 5. The rise in commerce quantity displays sustained curiosity in Ethereum.

ETH Giant Transactions | IntoTheBlock

Nevertheless, knowledge on quantity alone can’t present insights into investor conduct by way of bullish or bearish sentiments.

A Development of Extra Whale Demand

Usually, elevated buying and selling quantity throughout a steep market collapse is an indication of rising promoting strain. Nevertheless, Ethereum’s value has recorded some stability in latest instances, hedging off subsequent declines. This confirms that the rise in commerce quantity just isn’t essentially a direct results of elevated selloffs.

Knowledge reveals that bulls have purchased over 6.065 million ETH ($18.62 million) in July. In distinction, bears have bought 5.815 million ETH value $17.9 million throughout the similar timeframe. This means that the Ethereum market has seen an extra demand of 250K ETH from giant whales this month.

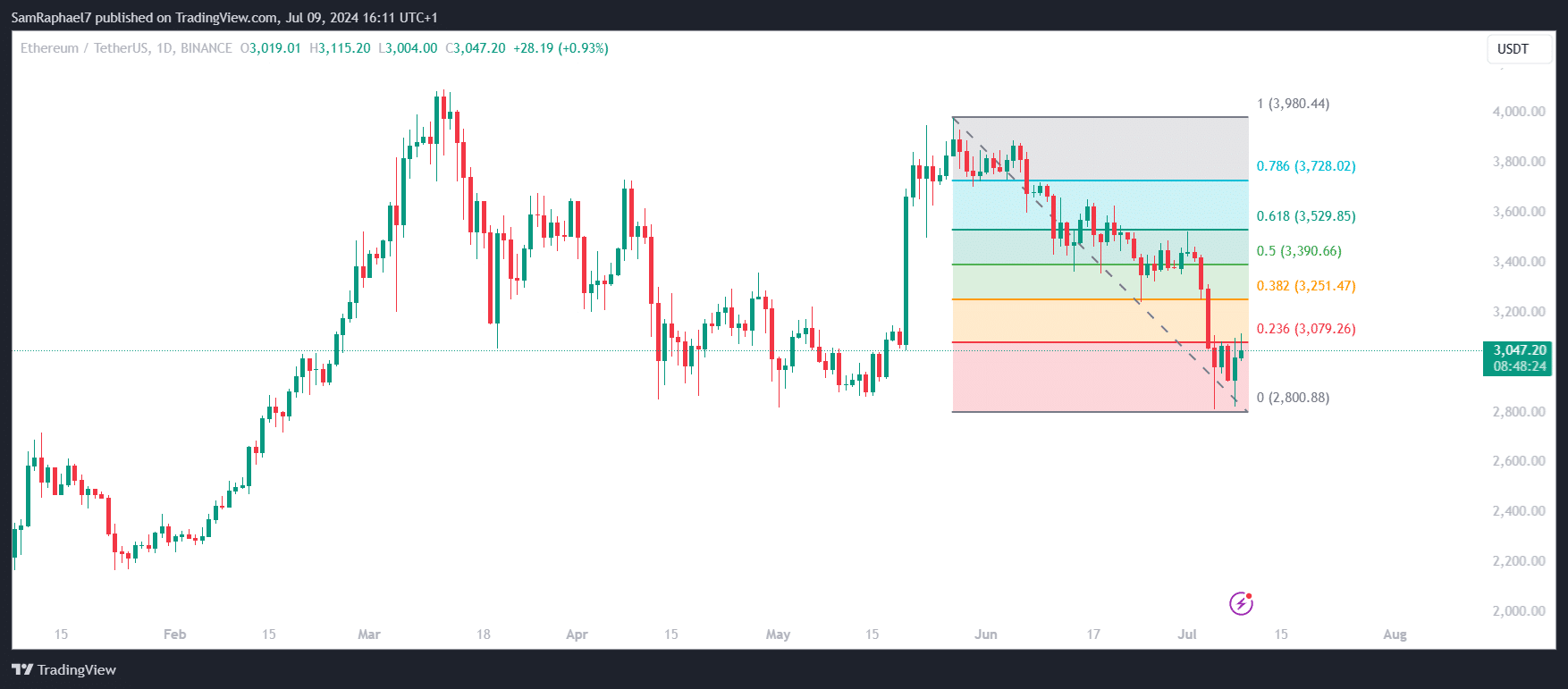

Ethereum may leverage this elevated demand for a restoration transfer when the broader market recovers. Nevertheless, to succeed in better heights, it should first conquer the resistance at $3,079, aligned with Fibonacci 23.6%. A breach of this degree would assist ETH reclaim the $3,200 degree, with the following roadblock at $3,251.

ETH Day by day Chart