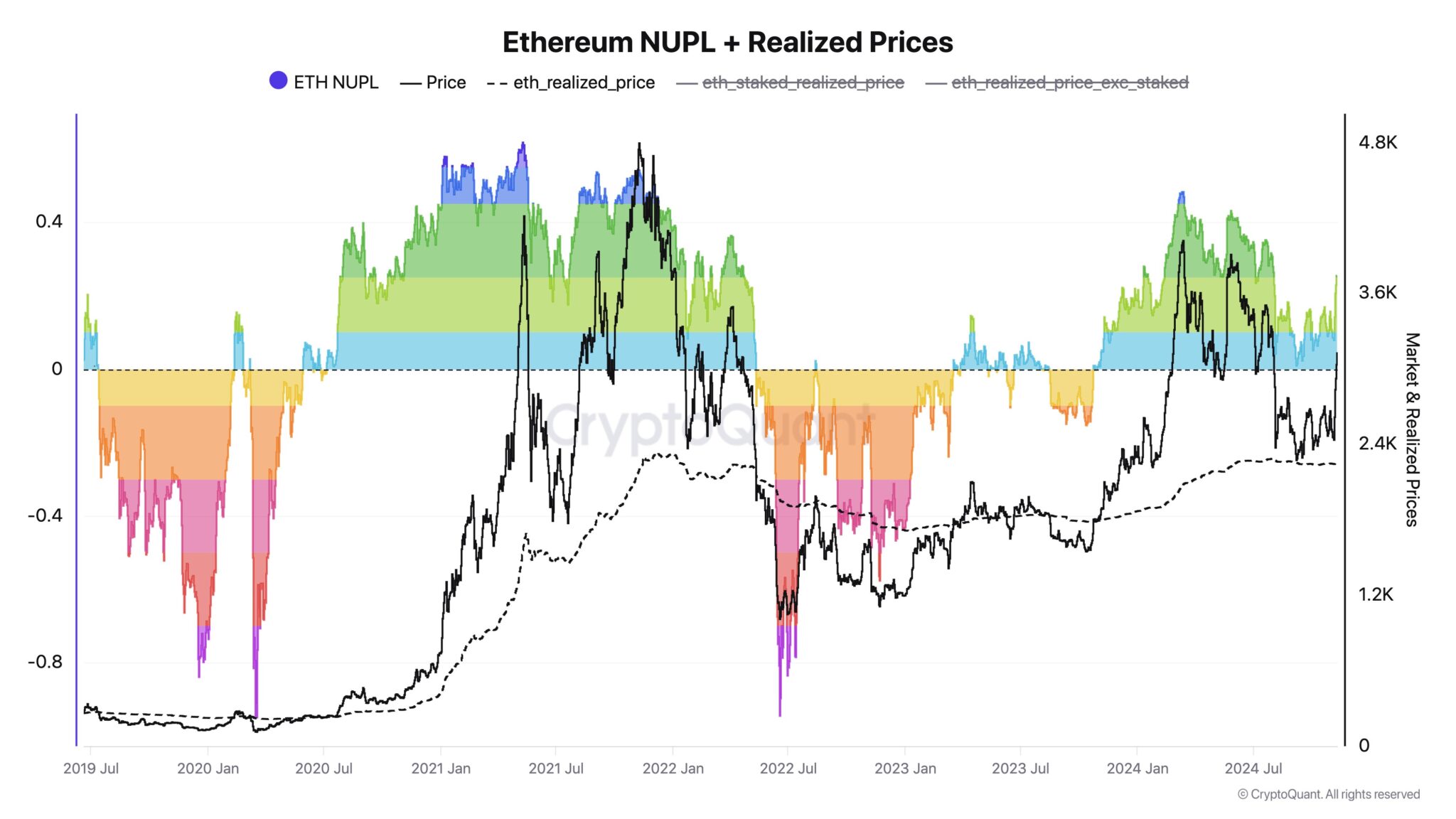

Ethereum seems to be to be again and its price noting when to take earnings which could be predicted utilizing the Internet Unrealized Revenue/Loss (NUPL). That alongside numerous realized value metrics can be utilized for insightful clues.

As value of ETH moved, the NUPL worth shifted throughout a colour spectrum from deep crimson to blue. This indicated phases of loss to potential greed management zones.

As at press time, ETH NUPL was above the impartial line, demonstrating substantial revenue however not but to a peak.

– Commercial –

Beforehand, the shift from darker inexperienced to blue indicated moments the place market sentiment is perhaps overly bullish, suggesting it was an excellent time for traders to think about taking earnings or at the least hedge in opposition to a possible correction.

ETH NUPL + Realized Value chart | Supply: CryptoQuant

The realized value indicated the market value was above the common value at which cash had been final moved. Traditionally, markets peaked above the realized costs, particularly through the darkish inexperienced to blue NUPL phases. It signified excessive revenue realization zones that means it’s not but time to take earnings on ETH. There was nonetheless room for development.

To maximise positive factors and keep away from overexposure throughout excessive bullish situations, traders want to scale back positions or take earnings. Normally revenue taking when NUPL neared or entered the blue zone, aligning with peaks available in the market value above the realized costs works nicely. The indicator can be utilized to anticipate market tops to lock in positive factors earlier than any main retracements.

– Commercial –

Ethereum Value Momentum in a Week

ETH ascended to shut the hole to $3,200 inside every week with momentum. After breaking by a consolidation vary that it examined a number of occasions, Ethereum surged previous the $3,150 resistance stage. This transfer was marked by elevated buying and selling quantity, indicating sturdy shopping for stress.

The current massive inexperienced candles, confirmed that Ethereum overcame vital resistance and took liquidity above the earlier highs round $2,768. The present value close to the $3,200 mark is predicted to come across resistance given its historic significance as a psychological and technical barrier.

ETH/USD 3-day chart | Supply: Buying and selling View

Given the sturdy shut above key resistance ranges, if Ethereum maintains its momentum and holds above these ranges, it might proceed to ascend, probably to new highs within the close to future. The worth motion prompt that Ethereum’s ecosystem is positioned to outperform within the coming interval supporting NUPL’s prediction.

The Golden Cross on The Weekly MACD

Ethereum flashed two long-term bullish indicators as value broke development line whereas MACD had the Golden Cross as Dealer Tardigrade famous. ETH broke by a descending trendline that had been capping the value for a number of months. This breakout confirmed a shift in market sentiment from bearish to bullish.

https://twitter.com/TATrader_Alan/standing/1855538398813102438

The indicators prompt that Ethereum was positioned for an prolonged upward motion. Historic efficiency beneath related situations recommend that Ethereum might proceed to rally, probably reaching new highs.

Future market actions will rely closely on broader market situations and investor sentiment, however the indicators current on the time pointed in direction of extra positive factors for ETH completely aligning with the NUPL.