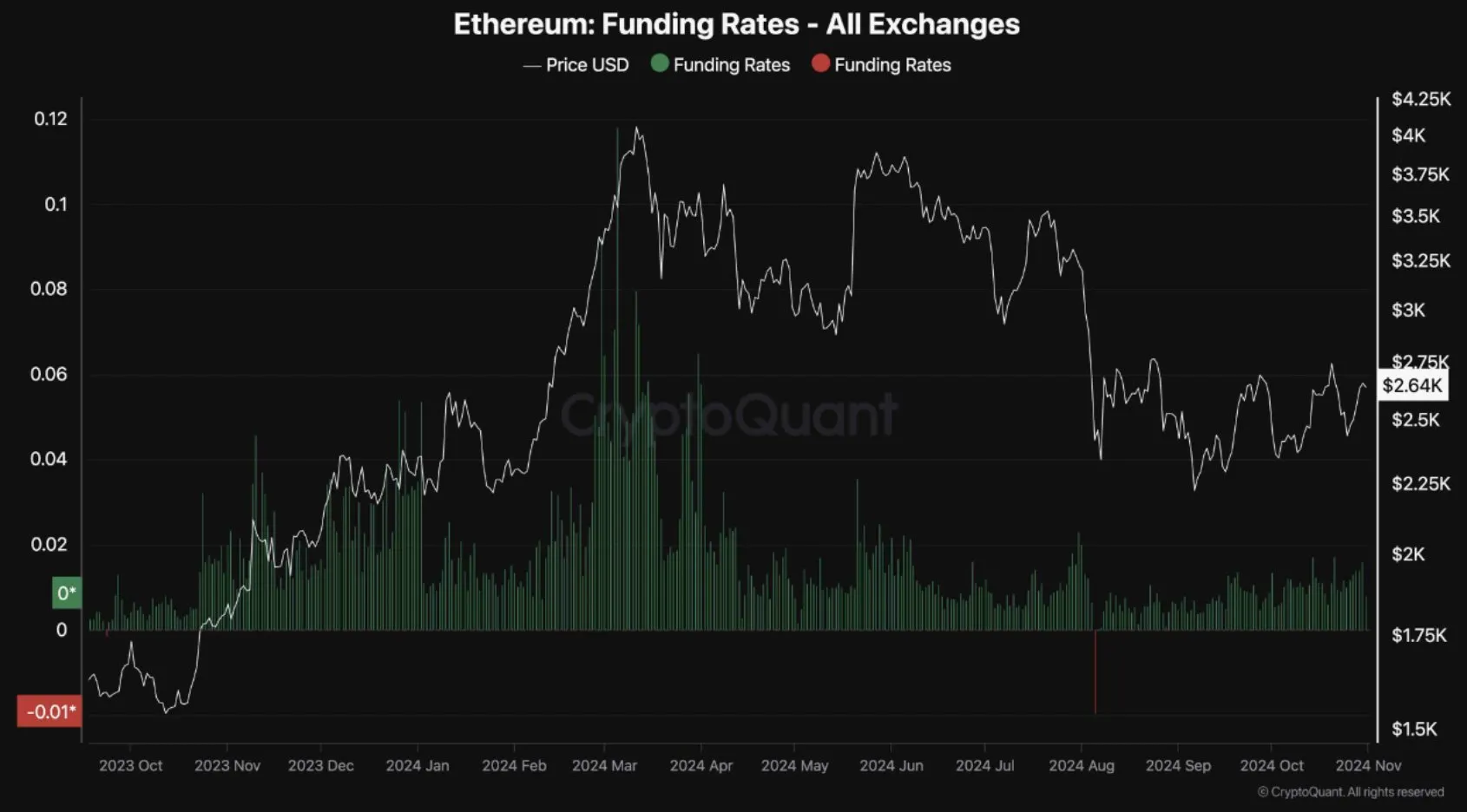

Bullish sentiment has intensified in Ethereum futures, with constructive funding charges pointing to optimism in ETH’s value potential.

The funding price metric in futures markets displays purchaser aggression, the place constructive values point out bullish sentiment and unfavorable values recommend bearishness.

Just lately, ETH funding charges turned constructive, displaying a shift towards optimism. Though the charges have but to succeed in ranges seen throughout earlier sturdy rallies, the development suggests growing confidence in Ethereum’s potential for a rally.

Supply: CryptoQuant

For Ethereum to beat important resistance ranges, funding charges have to climb greater. Rising charges would point out stronger shopping for curiosity from futures merchants, including upward stress to ETH’s value.

If this development continues, greater funding charges might sign confidence, elevating the chance of a sustained value breakout.

Such constructive sentiment might drive ETH’s value greater if it aligns with broader bullish developments within the cryptocurrency market.

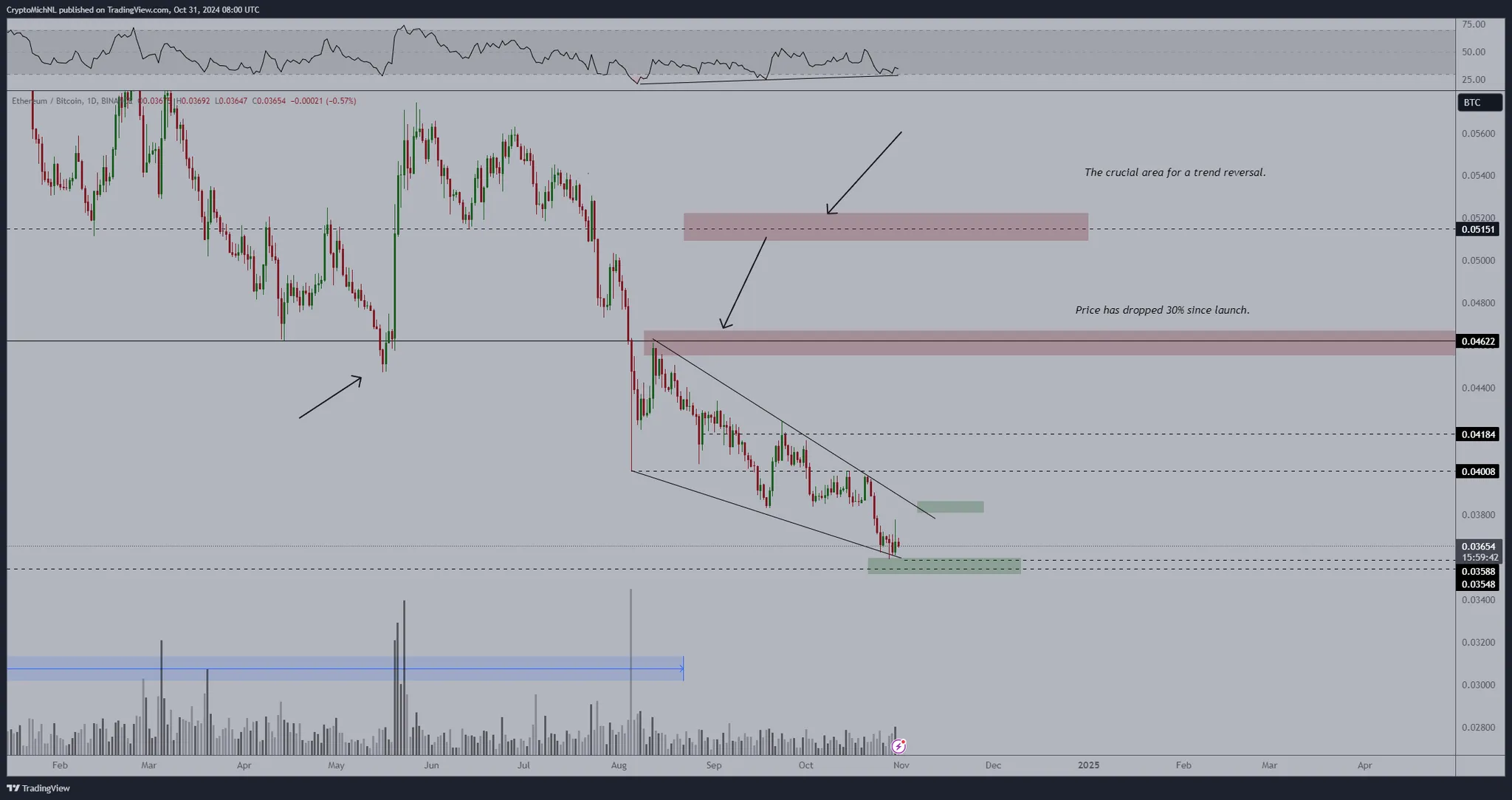

ETH’s Features Stay Weak Regardless of Bullish Divergence

Whereas bullish sentiment grows, Ethereum’s value stays weak to reversals. Historic knowledge exhibits ETH typically struggles to carry beneficial properties, indicating volatility.

If ETH continues to make decrease lows, this bullish divergence may lose credibility, weakening its momentum towards Bitcoin (BTC). Additional financial knowledge might affect ETH’s value motion, making warning crucial.

Decrease lows may point out market instability, suggesting buyers ought to search for indicators of reversal earlier than assuming any sustained uptrend.

Supply: Buying and selling View

At present ranges, ETH exhibits weak spot towards BTC, with every bounce rapidly reversing. The value motion displays a sample the place ETH struggles to keep up assist, resulting in lower cost factors.

If ETH reaches a brand new low across the 0.031 BTC stage, it might open new shopping for alternatives. Traders ought to look ahead to adjustments in momentum as ETH’s value may discover assist on this space.

Endurance might reveal a superb shopping for window, particularly as ETH might regain power nearer to early 2025.

Bond Yields and Financial Elements Form Ethereum’s Path

U.S. 2-year authorities bond yields lately confirmed a bearish divergence, trending downward after reaching a peak. Decrease yields typically level to slowing financial development and a possible shift in rate of interest insurance policies.

As yields drop, fixed-income investments turn out to be much less interesting, which can drive buyers towards higher-risk property like Ethereum. This atmosphere might create favorable circumstances for ETH, as buyers search higher returns in riskier markets.

If bond yields proceed their downward development, Ethereum might see greater demand. Falling yields might additionally trace at a dovish stance from the Federal Reserve, probably slowing down or pausing price hikes.

Supply: Buying and selling View

Such a shift would probably enhance liquidity, benefiting risk-on property like ETH. Nonetheless, this development comes with the chance of short-term volatility, as shifting financial circumstances may lead buyers to hunt safe-haven property.

ETH’s value would stay delicate to macroeconomic indicators and broader liquidity developments.

What’s Subsequent?

Ethereum’s path to sustained value development depends on just a few key elements. Constructive funding charges sign rising confidence, however ETH wants stronger momentum to interrupt previous resistance.

Nonetheless, ETH’s vulnerability towards BTC signifies warning, as any financial uncertainties might disrupt this constructive outlook.

For now, Ethereum’s value trajectory depends upon each investor sentiment and financial knowledge. The potential decline in bond yields might enhance ETH demand, however volatility dangers persist.

Traders ought to keep watch over funding charges and key financial developments, as these elements would information ETH’s value motion within the coming months.