Ethereum (ETH) which is addressed as ultra-sound cash resulting from its deflationary provide technique, now seems to be going through new challenges which have prompted some analysts to query whether or not this narrative nonetheless holds.

A outstanding crypto analyst, Thor Hartvigsen, lately highlighted this challenge in an in depth publish on X, the place he mentioned the present state of Ethereum’s payment technology and provide dynamics.

Is ETH Now not Extremely-Sound cash?

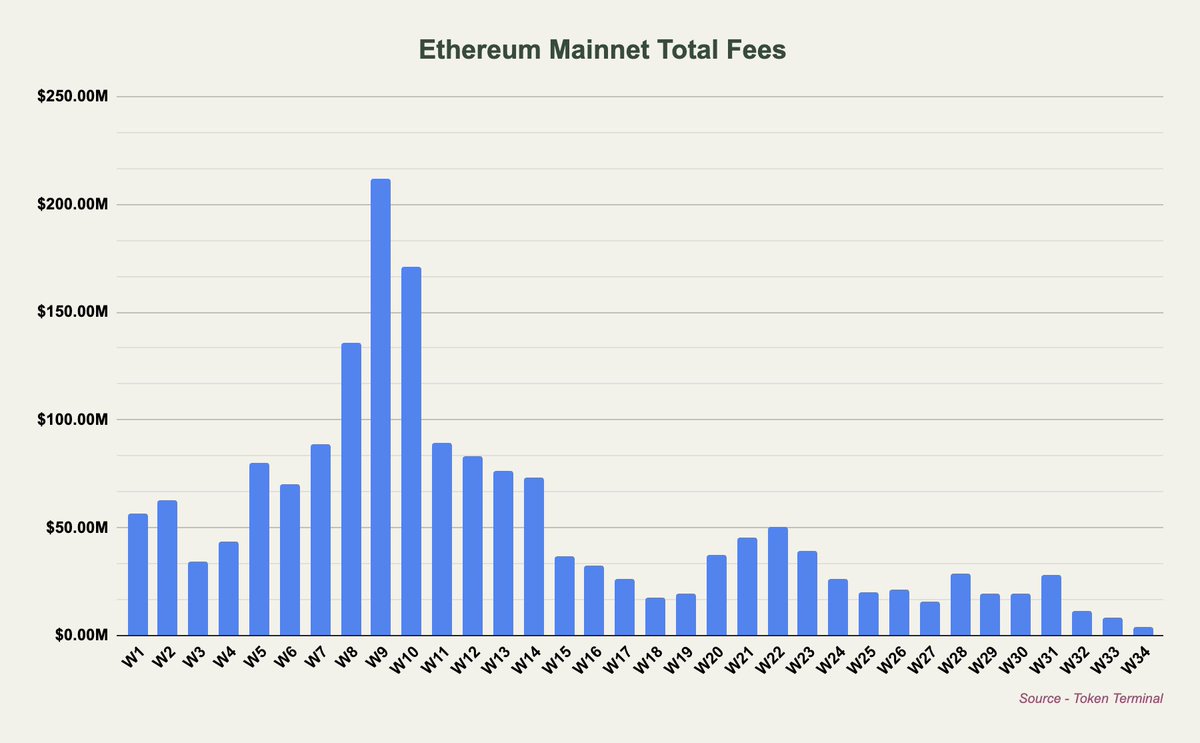

Hartvigsen identified that August 2024 is “on monitor to be the worst month by way of charges generated on the Ethereum mainnet since early 2020.” This decline is basically attributed to the introduction of blobs in March, which allowed Layer 2 (L2) options to bypass paying important charges to Ethereum and ETH holders.

Because of this, a lot of the exercise has shifted from the mainnet to those layer two (L2) options, with a lot of the worth being captured on the execution layer by the L2s themselves.

Consequently, Ethereum has grow to be web inflationary, with an annual inflation price of roughly 0.7%, which means that the issuance of recent ETH at present outweighs the quantity being burned by transaction charges.

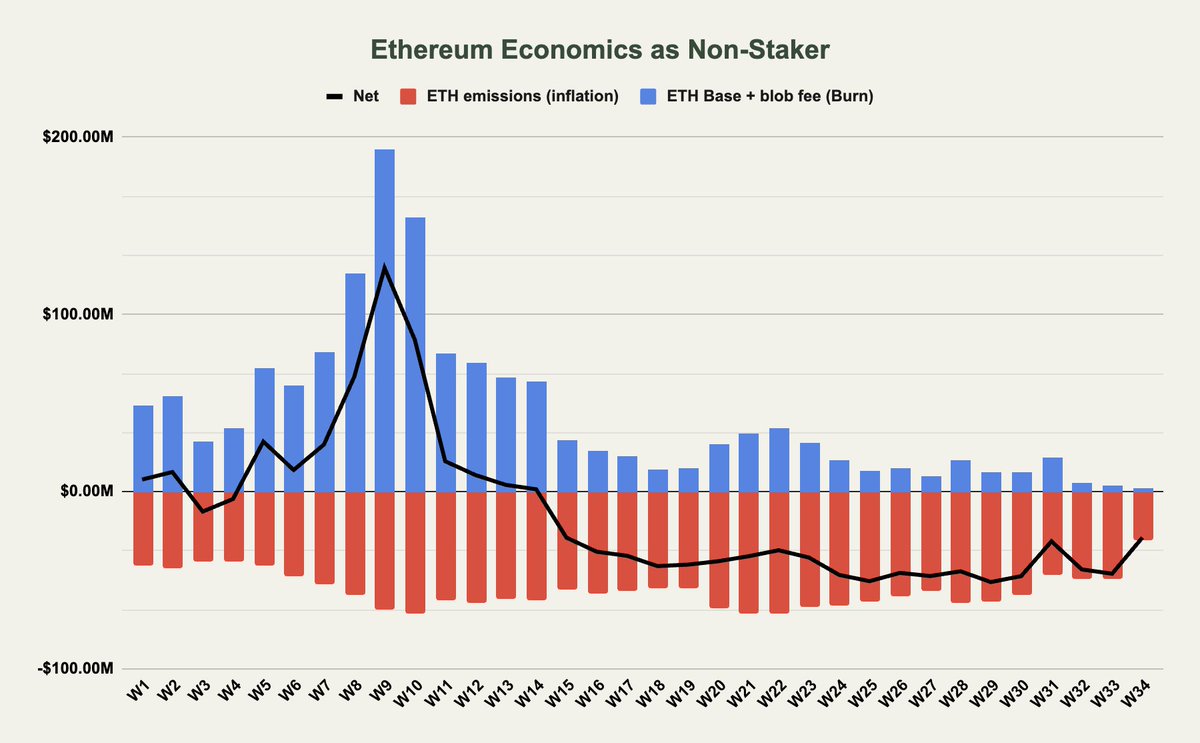

Hartvigsen disclosed the impression of this on Non-Stakers and Stakers: In keeping with the analyst, non-stakers primarily profit from Ethereum’s burn mechanism, the place base charges and blob charges are burned, lowering the general provide of ETH.

Nonetheless, with blob charges typically at $0 and the bottom payment technology reducing, non-stakers are seeing much less profit from these burns. On the similar time, precedence charges and Miner Extractable Worth (MEV), which aren’t burned however reasonably distributed to validators and stakers, don’t profit non-stakers instantly.

Moreover, the ETH emissions that circulate to validators/stakers have an inflationary impact on the provision, which negatively impacts non-stakers. Because of this, the web circulate for non-stakers has turned inflationary, particularly after the introduction of blobs.

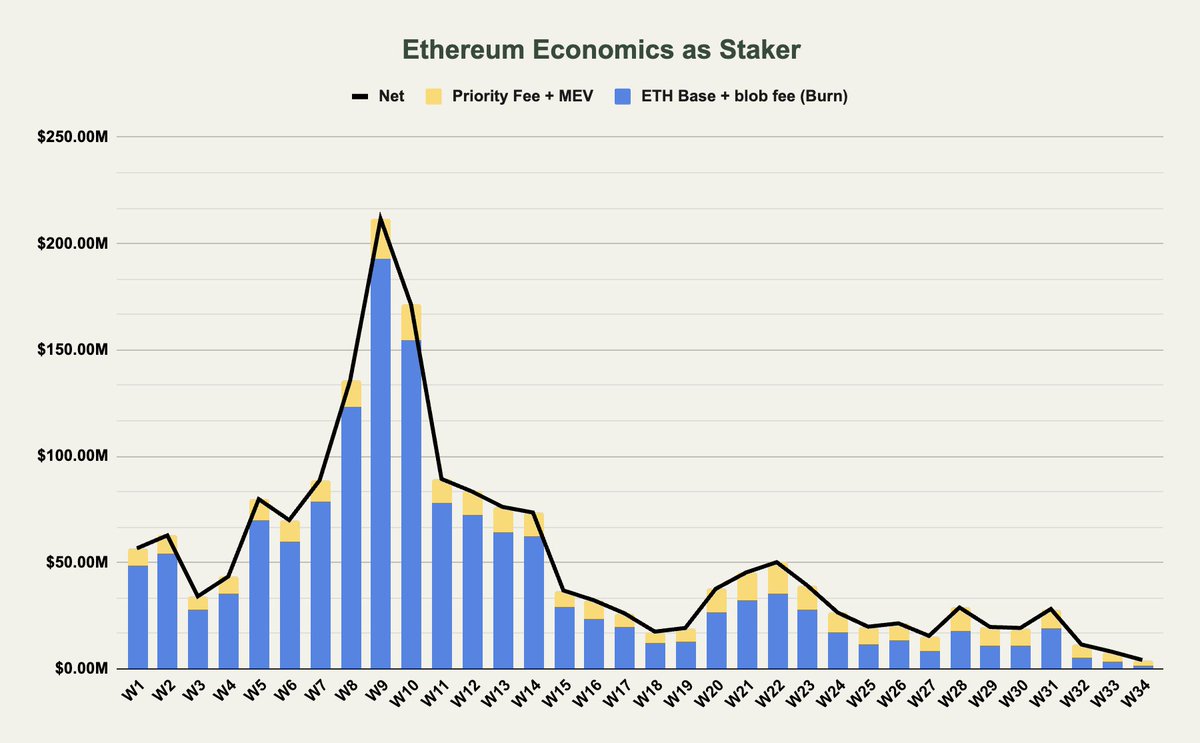

For stakers, the scenario is considerably completely different. Hartvigsen revealed that stakers seize all of the charges, both by the burn or through staking yield, which means that the web impression of ETH emissions is neutralized for them.

Nonetheless, regardless of this benefit, stakers have additionally seen a big drop within the charges flowing to them, down by greater than 90% since earlier this yr.

This decline raises questions concerning the sustainability of the ultra-sound cash narrative for Ethereum. To reply that, Hartvigsen sated

Ethereum now not carries the extremely sound cash narrative which might be for the higher.

What’s Subsequent For Ethereum?

Up to now, it’s fairly evident with the present tendencies that Ethereum’s ultra-sound cash narrative could now not be as compelling because it as soon as was.

With charges reducing and inflation barely outpacing the burn, Ethereum is now extra akin to different Layer 1 (L1) blockchains like Solana and Avalanche, which additionally face comparable inflationary pressures, says Hartvigsen.

Hartvigsen notes that whereas Ethereum’s present web inflation price of 0.7% per yr continues to be considerably decrease than different L1s, the reducing profitability of infrastructure layers like Ethereum could necessitate a brand new strategy to sustaining the community’s worth proposition.

One potential answer the analyst mentioned is rising the charges that L2s pay to Ethereum, although this might pose aggressive challenges. Concluding the publish, Hartvigsen famous:

Zooming out, infra-layers are normally unprofitable (research Celestia producing ~$100 in every day income), particularly if viewing inflation as a price. Ethereum is now not an outlier with a web deflationary provide and, like different infra-layers, require one other approach to be valued.

Featured picture created with DALL-E, Chart from TradingView