Ethereum lately demonstrated a big buying and selling sample on the charts, reflecting each investor warning and bullish potential.

After taking liquidity beneath a key degree, Ethereum’s worth motion surged, breaking by means of the resistance space close to $2,650, and quickly approaching an important zone round $3,200.

The chart reveals a possible resistance zone set between $3,146.95 and $3,210.05, which merchants are carefully monitoring.

– Commercial –

If Ethereum manages to maintain its momentum and decisively break above $3,200, the trail might be clear for an advance in the direction of the $3,700 mark.

This worth level represents a big resistance space, doubtlessly indicating the higher boundary of the present bullish momentum.

Ethereum worth motion

Conversely, if Ethereum fails to carry above these ranges, it could retrace in the direction of the $3,000 mark. This space served as a basis for the latest rally and will turn out to be an important help zone in case of a pullback.

– Commercial –

The latest buying and selling quantity and worth spikes recommend a rising curiosity and hypothesis amongst merchants.

The market’s subsequent transfer will possible hinge on Ethereum’s skill to take care of help above $3,200 or face resistance that would stall the present rally.

As traders watch these developments, the approaching interval may show pivotal for Ethereum’s worth trajectory.

Ethereum Ecosystem Day by day Customers and Transactions

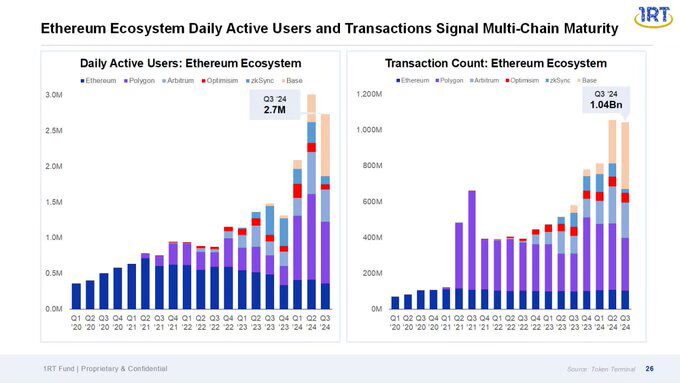

Current knowledge from the Ethereum ecosystem signifies a sturdy improve in each each day energetic customers and transaction counts, signaling the community’s continued progress and vitality.

The charts present a transparent pattern of rising engagement throughout a number of chains throughout the ecosystem, together with Ethereum mainnet, Polygon, Arbitrum, Optimism, xSync, and Base.

As of the third quarter of 2024, Ethereum boasted roughly 2.7 million each day energetic customers, with xSync trailing carefully at 2.7 million.

This marks a big uptick from earlier quarters, demonstrating sustained consumer curiosity and expanded utilization.

Transaction counts mirror this progress, with Ethereum transactions reaching a staggering 1.048 billion in the identical interval.

Ethereum ecosystem each day customers and transactions | Supply: Token Terminal

This vital quantity signifies not simply energetic buying and selling but in addition a rise in decentralized purposes utilization, from DeFi to gaming and past.

Regardless of some voices within the crypto neighborhood suggesting a decline in Ethereum’s relevance, the info tells a special story.

Ethereum’s community results proceed to build up, underscoring its foundational position within the digital asset ecosystem.

This ongoing enlargement and consumer engagement current a bullish outlook for Ethereum, contradicting claims of its obsolescence and reaffirming its standing as a cornerstone of blockchain innovation.

Crowd vs Good Cash sentiment

Additionally the sentiment gauged for ETH confirmed a standard perspective between the overall crowd and the ‘sensible cash’ or extra knowledgeable traders.

In keeping with the newest sentiment knowledge, the gang held a bullish stance on Ethereum with a rating of simply 0.06, indicating minimal enthusiasm or pessimism amongst common traders.

Then again, sensible cash sentiment was extremely constructive, marked at 2.28 on a scale that peaks at 5, suggesting vital confidence from seasoned traders. This bullish outlook from sensible cash could sign upcoming worth actions.

$ETH Sentiment

CROWD = Bullish 🟩

MP | #SmartMoney = Bullish 🟩 #Ethereum

Take a look at sentiment and different crypto stats at https://t.co/HQDyBNuzek#crypto #cryptotrading #CryptoX pic.twitter.com/az8oLQMGyt— Market Prophit (@MarketProphit) November 17, 2024

Given the optimistic sentiment amongst skilled traders, there’s a rising anticipation that ETH couldn’t solely revisit the $3,000 worth degree but in addition push in the direction of the next goal of $3,700.

The robust confidence from sensible cash may scale back the chance of Ethereum dropping to decrease help ranges and as a substitute, could gasoline a extra rapid ascent in the direction of these increased valuations.

The divergence in sentiment suggests a possible for ETH worth to make vital good points within the close to time period, backed by sensible cash’s sturdy conviction.