Ethereum fell to as little as $2,100 this week earlier than bouncing, including a powerful 25% from August 2024 lows. Whereas there’s confidence that costs will proceed increasing, breaching $2,800 and even the psychological spherical quantity at $3,000, different market-related occasions would possibly decelerate bulls.

Ethereum Community Unlocking Over 143,000 ETH

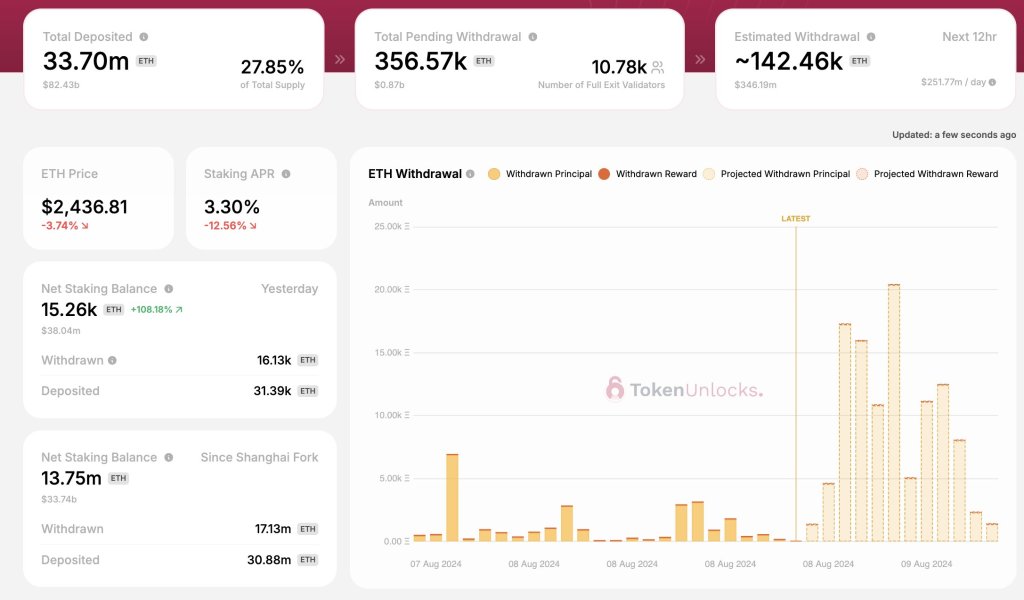

In accordance with Token Unlocks information, tons of of 1000’s of ETH are within the queue and are set for withdrawal in the present day. On-chain information reveals that validators are getting ready to withdraw 143,000 ETH value almost $350 million. One other batch of 212,000 ETH shall be out there for buying and selling within the coming days, which might heap extra stress on costs.

As of August 9, Ethereum has a circulating provide of over 120 million, in accordance with CoinMarketCap information. Since Dencun, the community has been inflationary, that means extra cash are usually not burnt like earlier than.

Validators should stake not less than 32 ETH and guarantee their nodes keep a excessive uptime of almost 100%. On the identical time, in accordance with the community’s consensus guidelines, validators shouldn’t interact in outlawed actions reminiscent of banding to approve invalid transactions.

Failure can result in slashing, the place a portion of their stake is taken as a penalty. Nevertheless, as a result of they need to decide to maintaining the community decentralized, they obtain a portion of the annual staking yield. On the identical time, they get an opportunity to approve a block of transactions, receiving rewards in consequence.

The ETH anticipated to hit the market would be the yield from their staking actions. This unlock is completely different from block rewards distributed roughly each 13 seconds.

Even because the market expects a provide spike, Token Unlocks analysts notice that these withdrawals gained’t essentially imply they are going to be liquidated. Nevertheless, if they’re bought, the restoration will doubtless be sluggish.

Will Bulls Take Over And Drive Costs Above $3,000?

There’s a trigger for concern. Traditionally, Token Unlocks analysts observe that costs have a tendency to chill off each time the Ethereum community unlocks such a lot of tokens over a brief interval. Within the final three months, unlocks between 150,000 and 220,000 ETH coincided with worth drops.

Trying on the every day chart, Ethereum is recovering. Although the downtrend stays following the sudden dip to as little as $2,100 early this week, the bounce has been respectable.

The fast liquidation line is round $2,600. If consumers push on, confirming beneficial properties of August 8, ETH costs would possibly rally, soaking on the anticipated deluge, and retest $3,000.

Function picture from Canva, chart from TradingView