Ethereum (ETH) value has been going through a difficult macro atmosphere for the previous six months, marked by a persistent downtrend. Since March, ETH has struggled to take care of a bullish momentum, repeatedly testing its long-term downtrend line as assist.

Nevertheless, current sentiment shifts counsel that restoration is likely to be on the horizon. The query stays whether or not this restoration shall be tougher than anticipated as Ethereum’s value motion continues to stay rangebound.

Ethereum Is Not Dealing with Bearishness

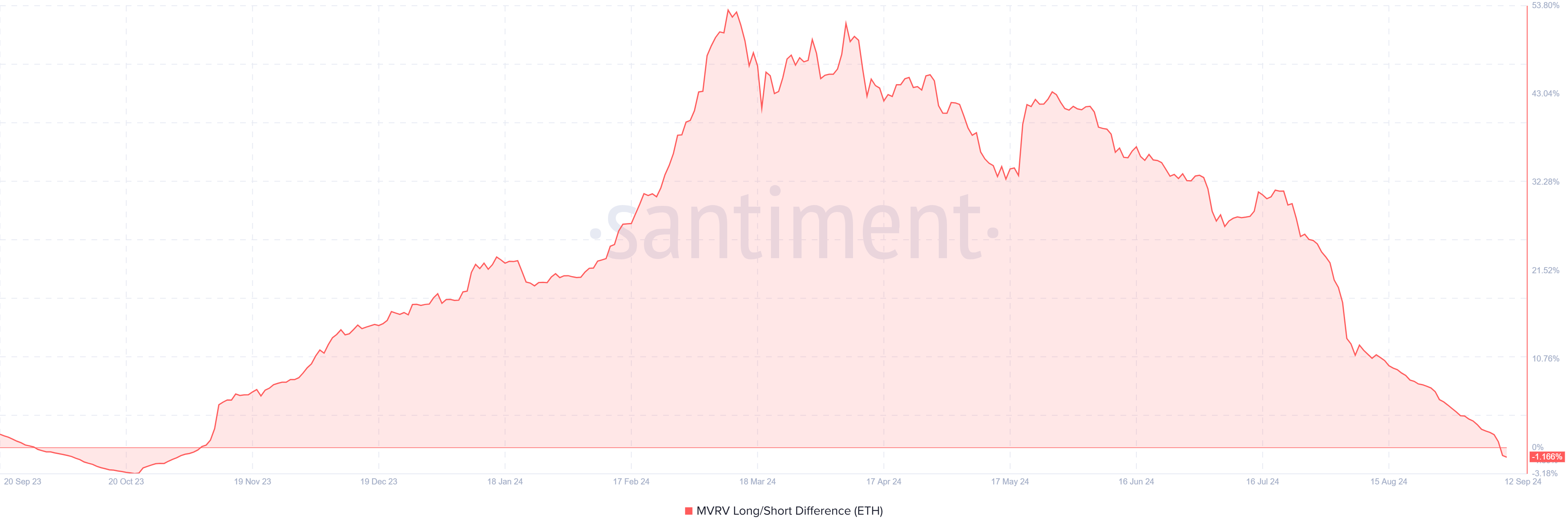

The MVRV Lengthy/Brief Distinction indicator reveals a vital perception into Ethereum’s present market situations. For the primary time since November 2023, this metric has fallen into the unfavorable zone, marking a ten-month low.

This indicators that each long-term and short-term holders are experiencing equal features and losses, which is usually an indicator of market indecisiveness. The decline within the MVRV distinction is an indication of short-term weak spot slightly than a robust indication that Ethereum has reached a market backside.

Brief-term holders normally maintain extra speculative positions, whereas long-term holders are thought of stronger palms. Ethereum’s short-term value motion would possibly face continued stress with each forms of holders at a relative equilibrium.

Learn extra: Find out how to Put money into Ethereum ETFs?

Ethereum Lengthy/Brief Distinction. Supply: Santiment

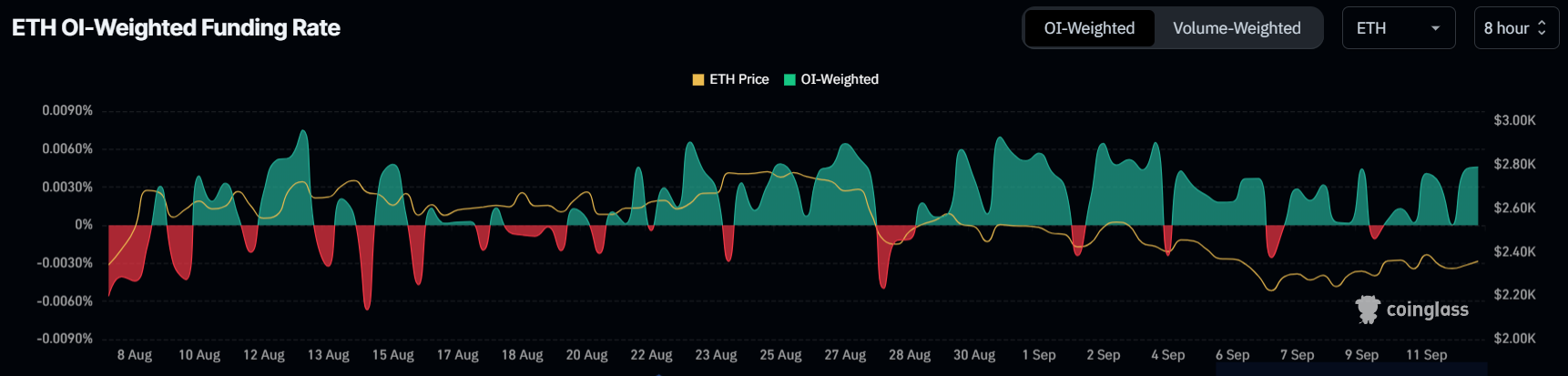

Nevertheless, regardless of the macro downtrend, some technical indicators, such because the funding charge, stay constructive. On a smaller scale, this means that merchants and traders keep a hopeful outlook for ETH’s value trajectory. The constructive funding charge displays that market individuals count on the worth to get better, despite the fact that Ethereum continues to be locked in a downward sample.

This optimism is an indication that, whereas Ethereum is presently struggling to interrupt free from the macro downtrend, underlying momentum may finally push the cryptocurrency upward. Merchants betting on restoration proceed so as to add lengthy positions, indicating that ETH’s restoration could also be gradual however nonetheless believable.

Ethereum Funding Fee. Supply: Coinglass

ETH Worth Prediction: Scare Forward

Within the close to time period, Ethereum’s value is prone to stay rangebound between $2,681 and $2,344. The cryptocurrency is presently recovering from the eight-month low of $2,220, testing $2,344 as assist.

This shall be essential for the following stage of value motion. If ETH can keep this stage, it would keep away from additional downsides and probably jump-start a bullish development.

For the time being, ETH appears poised to cease testing the downtrend line as assist, which may end in sideways value motion. This part of consolidation would supply Ethereum the respiration room wanted for a possible breakout, permitting the altcoin to get better its earlier highs above $2,681.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

On the flip facet, ought to Ethereum fail to carry the $2,344 assist, it dangers falling to $2,170, a vital stage that may re-test the downtrend line. This could invalidate any short-term bullish outlook and make sure an additional bearish continuation. Moreover, this state of affairs would place important stress on ETH and make restoration tougher than beforehand anticipated.