For the primary time since September 27, Ethereum has surged previous the $2,700 mark and is exhibiting robust indicators of sustaining its upward momentum. About ten days in the past, ETH dropped under $2,400, sparking hypothesis that the cryptocurrency would possibly battle to interrupt out once more.

Nonetheless, over the previous seven days, ETH has surpassed key resistance ranges. On this on-chain evaluation, BeInCrypto reveals how this upward momentum might drive the worth even greater.

Ethereum Sees Decreased Promoting Stress

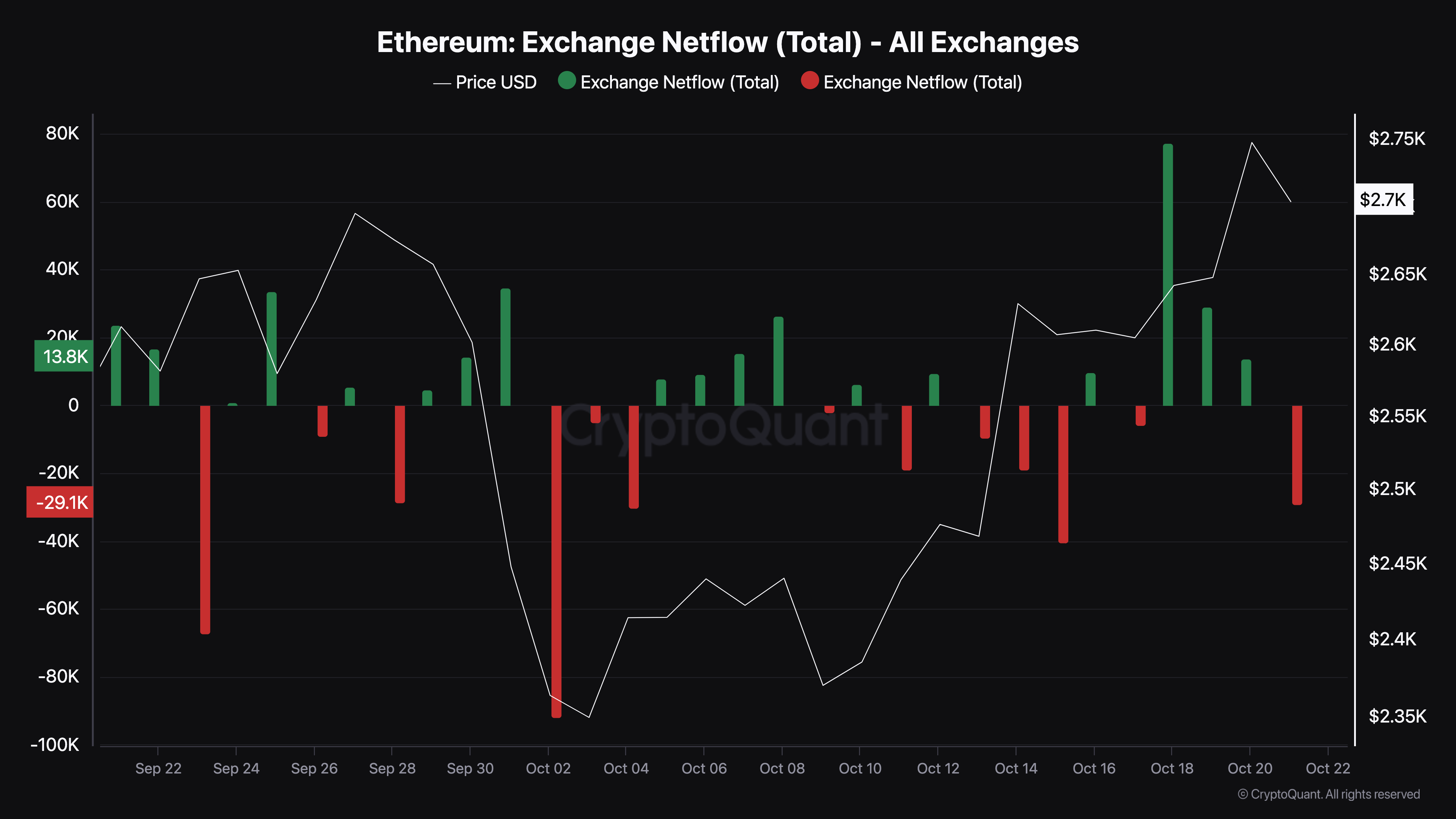

One indicator fueling this prediction is the Ethereum Trade Netflow, which exhibits the quantity of cash flowing out and in of exchanges. In keeping with CryptoQuant, market contributors have taken 29,378 ETH off exchanges as of this writing.

From a spot buying and selling perspective, excessive values sometimes sign elevated promoting strain. Nonetheless, with roughly $80 million being eliminated, it means that ETH could not face important promoting strain within the close to time period.

On the derivatives facet, the decline factors to low volatility, indicating that merchants with open positions are much less prone to face liquidations. When mixed, this present situation could possibly be bullish for Ethereum’s value.

Ethereum Trade Netflow. Supply: CryptoQuant

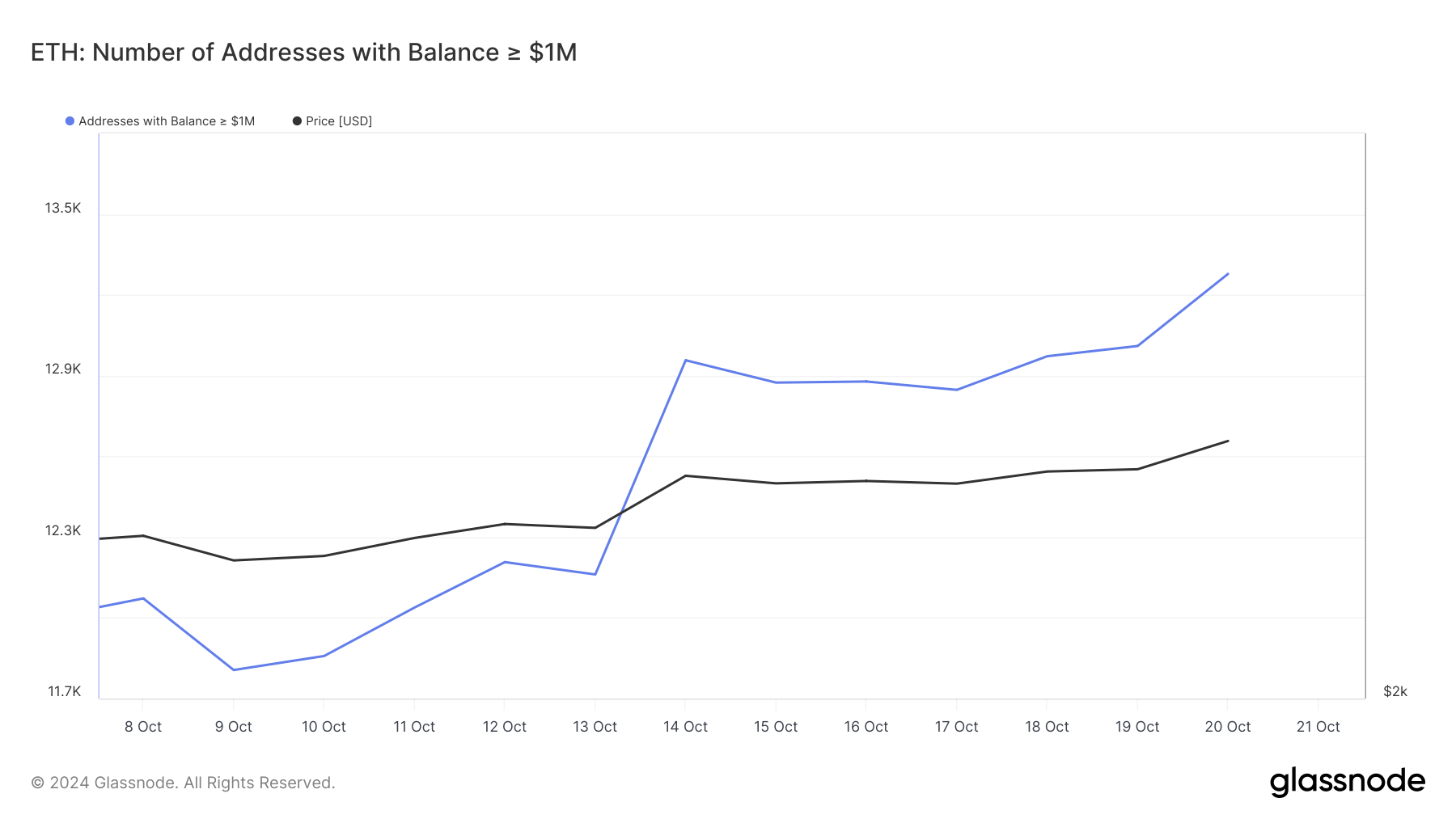

One other metric supporting the bullish outlook is the variety of addresses holding ETH valued at $1 million or extra. When this metric rises, it signifies that HODLers are accumulating extra cash, reflecting bullish conduct. Conversely, a decline means that long-term holders are cashing out, sometimes signaling bearish sentiment

Based mostly on Glassnode’s knowledge, the variety of addresses holding ETH price $1 million and above has elevated, suggesting that Ethereum’s value might keep away from going via one other drawdown.

Ethereum Variety of Addresses with Excessive Stability. Supply: Glassnode

Crypto analyst and founding father of MN Consultancy Michaël van de Poppe shares an identical view. Nonetheless, in his publish, van de Poppe famous that ETH must rise above $2,770 to have any likelihood of surpassing $3,000.

“Ethereum would possibly lastly reverse. Breaking via the essential resistance at $2,770 can be nice. If that occurs, the following goal is $3,200, ” the analyst emphasised.

ETH Worth Prediction: Bulls Should Defend $2,689 Help

A have a look at the every day chart exhibits that Ethereum’s value has damaged out of a symmetrical triangle. For context, a symmetrical triangle is a chart sample outlined by two converging trendlines that join a collection of sequential peaks and troughs.

Often, when an asset’s value breaks under the triangle, the asset’s value tends to fall additional. For ETH, it’s the different method round, suggesting that the worth might proceed climbing. However for that to occur, bulls need to defend the $2.689 assist

Past that, shopping for strain wants to extend so the worth can climb above the resistance at $2,989. If that’s the case, ETH’s value might rally to $3,316.

Ethereum Each day Worth Evaluation. Supply: TradingView

Nonetheless, this thesis could possibly be rendered null and void if ETH falls under the aforementioned assist line. In that state of affairs, the worth might tumble to $2,471.