BlockTower Capital, a enterprise capital agency, accomplished a considerable transaction of Ethereum (ETH), which was valued at $25 million. Ethereum value motion might see some waves amid the massive strikes.

The market panorama has been rattled by tremors of hypothesis amid the liquidation of 9,232 ETH. This was transacted throughout a number of established crypto buying and selling platforms.

This vital divestment by BlockTower Capital has occurred within the context of a broader market unease. As Ethereum value is at present experiencing rejection on the $2,700 resistance stage. This growth has vital implications for the long run trajectory of the main altcoin.

BlockTower Capital’s Ethereum Liquidation

As reported by LookonChain, BlockTower Capital executed an enormous sale of Ethereum on August 13. Additional, distributing the belongings throughout a number of buying and selling platforms.

The next are the specifics of the sale: FalconX: 3,537.81 ETH, B2C2.

Group: 2,954.28 ETH, Wintermute Buying and selling: 2,090.24 ETH, Cumberland: 639.28 ETH.

Supply: LookonChain

This strategic liquidation has resulted in a surge of market hypothesis. The sale is timed to coincide with a big decline within the crypto market. As each Bitcoin and Ethereum skilled losses on August 12.

BlockTower’s determination is indicative of a potential shift in market sentiment and broader institutional warning.

Institutional Development Reversal

The broader market is witnessing a big change in institutional funding habits within the context of BlockTower Capital’s Ethereum sell-off.

Institutional traders have discontinued substantial Tether (USDT) inflows, based on reviews from Lookonchain, a blockchain analytics platform.

The redirection of funds from the Tether Treasury to main exchanges comparable to Kraken and Binance signifies a big shift away from substantial market engagements by institutional entities, which is indicative of a reevaluation of funding methods and danger appetites.

Lookonchain’s insights underscore the pattern reversal in institutional funding. Depicting a cessation of considerable USDT inflows from institutional traders to main exchanges. This has exacerbated the influence of BlockTower Capital’s Ethereum sell-off on the broader market sentiment.

Whale Exercise and Market Sentiments

Complicating the present market sentiment, a outstanding Ethereum whale continues to have interaction in an aggressive promoting rampage, which additional complicates the market dynamics.

It is very important be aware that this whale, which was initially endowed with 1 million ETH throughout the Ether ICO at $0.31 per token, has engaged in vital Ether offloading in latest weeks. The whale’s most up-to-date endeavor concerned the disposal of a further 5,000 ETH, which is estimated to be value $13.2 million, on the OKX crypto change.

This regular pattern of enormous ETH gross sales, which added as much as 48,500 ETH within the final month, reveals how traders have gotten extra cautious in response to the sophisticated market situations.

Ethereum Worth Technical Outlook and Predictions

From a technical evaluation standpoint, Ethereum’s value is at an important level proper now due to the resistance on the $2,700 stage.

ETH Worth | Supply: @TedPillows X

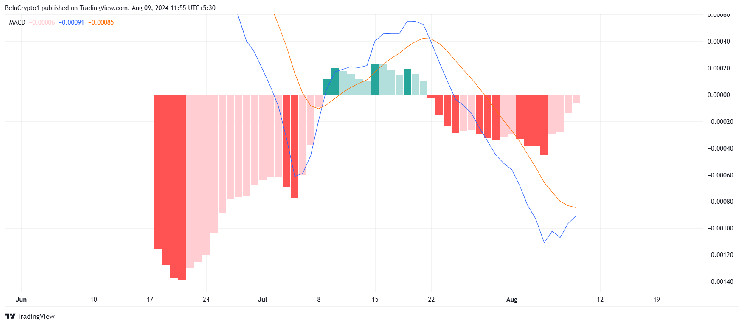

Potential bearish undercurrents are indicated by the 50-day Exponential Shifting Common (EMA) thresholding beneath the 200-day EMA, because the 78.6% Fibonacci retracement stage intersects with the upcoming demise cross.

The narrative of a cautious market outlook is additional supported by the Shifting Common Convergence Divergence (MACD) sliding into damaging territory within the midst of Ethereum’s value maneuvers.

A cautious surroundings has been established amongst Ethereum traders on account of the aggressive liquidation by a serious whale, the numerous ETH sell-off by BlockTower, and the technical hostile indicators. The cryptocurrency’s future efficiency is additional exacerbated by the final market decline and the shortage of great curiosity in Ethereum spot ETFs.