Ethereum (ETH) value lately surpassed $4,000 for the primary time since March 2024, marking a 25% achieve over the previous 30 days. Nonetheless, the 7D MVRV ratio, now at -1.35%, suggests short-term holders are experiencing unrealized losses, hinting at potential additional draw back earlier than a restoration.

Traditionally, ETH tends to rebound after the MVRV dips to -4% or decrease, aligning with rising whale accumulation, as addresses holding at the very least 1,000 ETH have steadily elevated in December. Whereas ETH faces key resistance at $3,987, breaking it might result in $4,100 and past, however bearish alerts from converging EMA strains might take a look at its help at $3,500 or decrease.

7D MVRV Reveals ETH May Go Down Earlier than a Surge

The ETH 7D MVRV has dropped to -1.35%, down from 3.32% on December 16, signaling that, on common, short-term holders are actually at an unrealized loss. Damaging MVRV values sometimes counsel that the market is in a state of heightened pessimism, usually reflecting oversold situations.

This may create an atmosphere the place draw back danger decreases, and the potential for restoration will increase as undervaluation attracts renewed shopping for curiosity.

ETH 7D MVRV. Supply: Santiment

The MVRV 7D Ratio measures the common revenue or lack of ETH tokens moved prior to now week relative to their present market value. Traditionally, ETH’s 7D MVRV tends to say no to round -4% or beneath -5% earlier than main value rebounds happen.

This sample means that whereas there should be some room for additional draw back, Ethereum might quickly attain ranges that traditionally set off accumulation, doubtlessly setting the stage for a value restoration.

Ethereum Whales Are Accumulating Once more

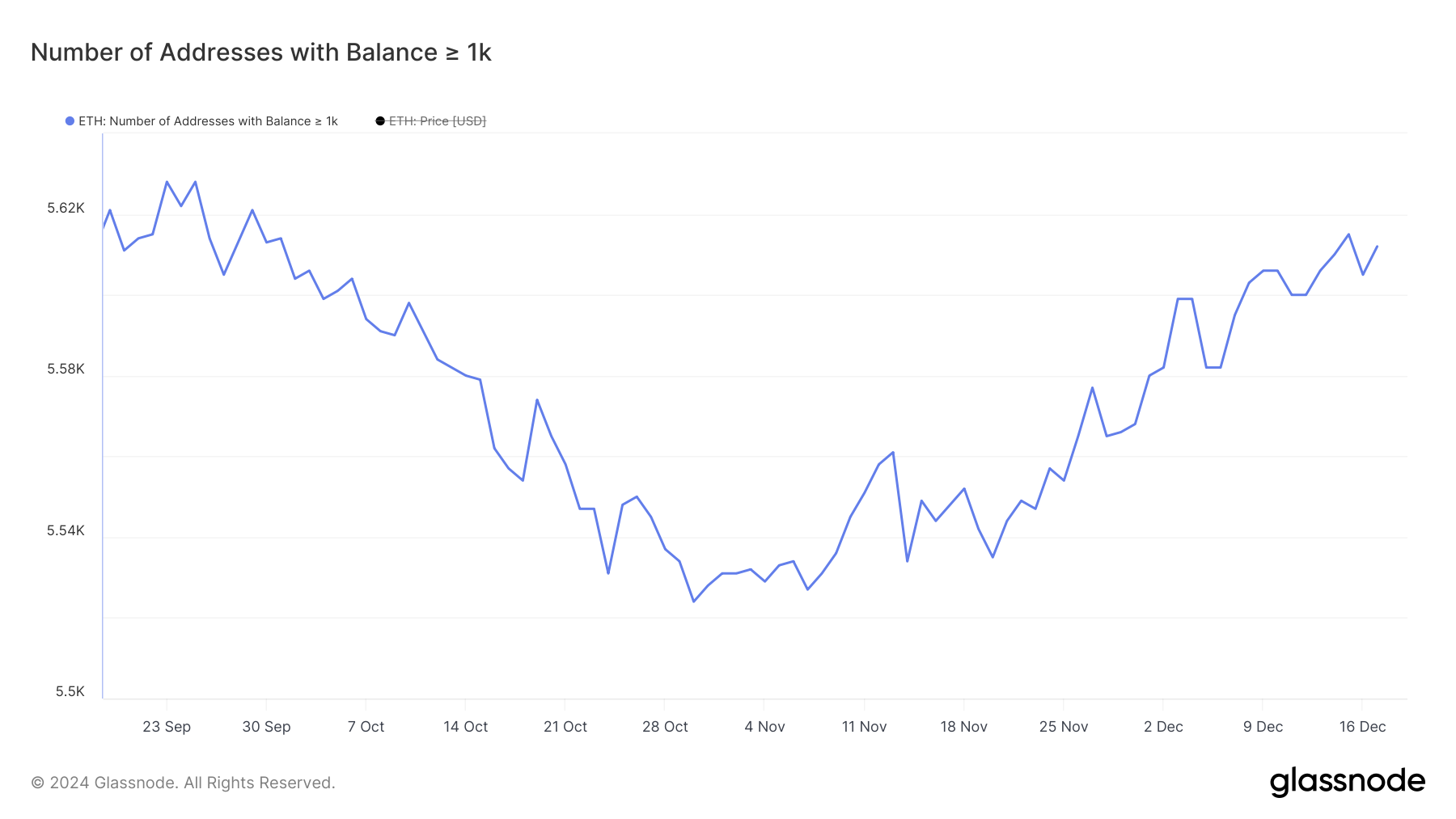

The variety of addresses holding at the very least 1,000 ETH has been steadily growing all through December. On December 1, there have been 5,580 such addresses, up from a three-month low of 5,524 on October 30.

This determine has now risen to five,612, reflecting constant accumulation by giant holders, or “whales,” over the previous month.

Addresses with Steadiness >= 1,000 ETH. Supply: Glassnode

Monitoring whale exercise is essential as a result of these giant holders can considerably affect market tendencies. A rise within the variety of whales suggests rising confidence amongst main traders, usually seen as a bullish sign.

This regular accumulation might point out that whales anticipate a optimistic value motion for ETH within the close to future, as their actions usually precede or contribute to upward value momentum.

ETH Worth Prediction: Can It Check $4,000 Once more In December?

Ethereum value is at present buying and selling between a resistance at $3,987 and a help at $3,763. If the resistance is damaged, ETH value might climb to check $4,100 and, with additional momentum, intention for brand spanking new highs close to $4,800 or $4,900.

These ranges characterize key targets for bullish continuation if consumers regain management.

ETH Worth Evaluation. Supply: TradingView

Nonetheless, the EMA strains are converging, signaling a possible weak spot within the pattern. Mixed with the 7D MVRV, which signifies potential additional corrections, ETH value might face draw back strain.

If the short-term EMA crosses beneath the long-term EMA, a bearish sign, ETH value might take a look at the $3,500 help. A failure to carry this degree might push costs decrease, doubtlessly reaching $3,256.