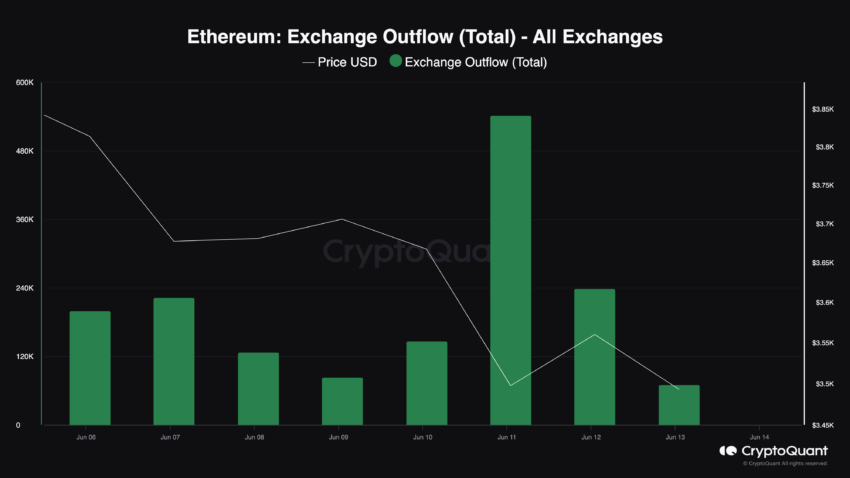

Readers will discover in the present day’s evaluation of Ethereum (ETH) attention-grabbing. On June 11, about 542,000 ETH moved out of exchanges— the biggest outflow of the yr.

Nonetheless, the pattern didn’t take lengthy to alter, prompting hypothesis that the potential improve to $4,000 could also be delayed.

Ethereum Opens the Flooring for Bears

In line with information from CryptoQuant, the variety of ETH withdrawn from exchanges has decreased. For example, the determine recorded on June 12 fell by nearly half from what it was the day earlier than.

As of this writing, BeInCrypto observes that 70,839 ETH has flown out of prime exchanges. In easy phrases, alternate outflow is the overall quantity of cash retired from exchanges into chilly wallets or self-custody.

By holding extra cryptocurrencies off-ramp, property might face lowering promoting stress. Nonetheless, for Ethereum, that will not be the case. A low alternate outflow might result in consolidation.

Learn extra: The best way to Purchase Ethereum (ETH) and Every part You Have to Know

Ethereum Trade Outflow. Supply: CryptoQuant

Additionally, if alternate influx will increase, costs might lower considerably. For context, alternate influx measures the variety of cash despatched into exchanges. When this determine will increase, it places promoting stress on the worth. Alternatively, a lower in alternate influx reduces the possibilities of a significant nosedive.

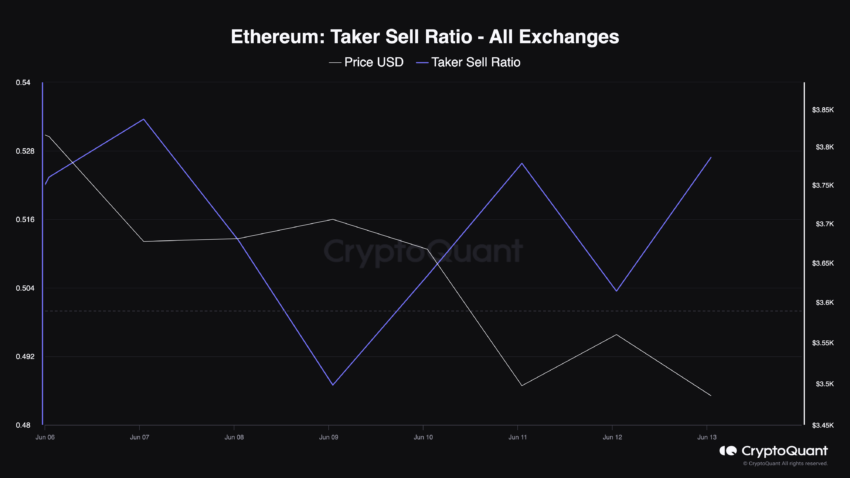

Ethereum’s value trades at $3,494, down from an earlier peak of $3,881 final week. Just like the metric above, the Taker Promote Ratio paints a bearish image. By definition, the Taker Promote Ratio is calculated because the variety of promote orders divided by the overall perpetual swaps available in the market. If the worth is over 0.50, it implies that sellers are dominant.

Nonetheless, a studying decrease than 0.50 exhibits that promoting sentiment is under the potential peak. For ETH, the Taker Promote Ratio was 0.52, indicating a excessive presence of bears available in the market.

Ethereum Taker Promote Ratio. Supply: CryptoQuant

Will ETH Worth Mirror Bitcoin’s Response?

Additional, a have a look at the ETH/USD Day by day chart exhibits a double-top formation with the ceiling at $3,885. In buying and selling, a double prime is a bearish reversal sample. It occurs when a cryptocurrency hits a excessive worth two consecutive instances whereas registering slight declines between the 2 highs.

In line with the chart under, the bearish construction broke the help degree at $3,665. If this pattern continues and bulls don’t seem, ETH might fall to $3,317, which was the subsequent main help.

Ethereum Day by day Evaluation. Supply: TradingView

As well as, the Superior Oscillator (AO) studying has dropped to 65.10. This comes with pink histogram bars. The AO is a technical instrument that compares latest market actions to historic tendencies to find out momentum.

On the day by day chart, the indicator’s lowering studying means that ETH is sliding towards a downward momentum. Ought to this pattern proceed or the studying turns into destructive, the worth of Ethereum might drop to $3,317.

Apparently, that is the place the 0.382 Fibonacci Retracement Indicator was positioned. The Fibonacci Retracement Indicator identifies potential reversal value ranges. Therefore, $3,317 is one spot to look at.

Learn extra: The best way to Spend money on Ethereum ETFs

Ethereum Day by day Evaluation. Supply: TradingView

Nonetheless, this prediction could also be invalidated if the not too long ago accredited Ethereum spot ETFs begin buying and selling dwell. Regardless of the inexperienced mild from the U.S. Securities and Trade Fee (SEC), among the candidates haven’t fulfilled all the necessities.

Nonetheless, as soon as a excessive buying and selling quantity begins getting into the ETFs, ETH might mirror Bitcoin’s (BTC) response to the same growth within the first quarter of 2024. If this occurs, ETH’s value might bounce, and the primary vital goal possibly $4,162.