-

Ethereum Whale made an enormous guess by buying 2,117.7 ETH value $5.17 million as the value surged.

-

ETH might soar to the $2,800 degree if it closes its every day candle above the $2,485 degree.

-

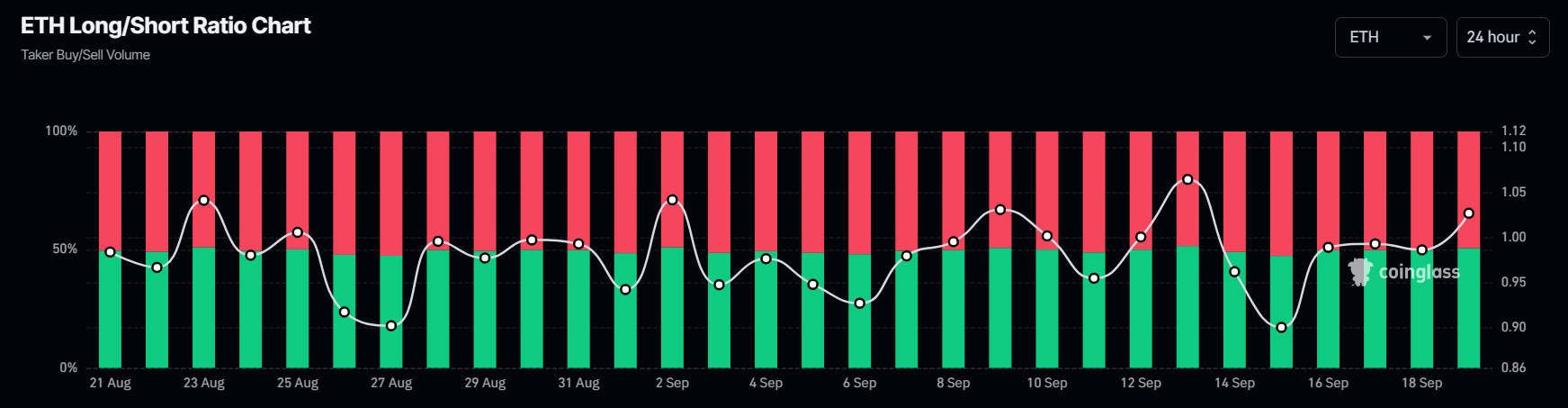

ETH’s lengthy/brief ratio at present stands at 1.027, indicating bullish market sentiment amongst merchants.

It seems that Ethereum (ETH) is able to take off, as buyers’ and merchants’ curiosity has skyrocketed up to now few days. On September 19, 2024, the on-chain analytic agency Lookonchain posted on X (Beforehand Twitter) that Ethereum Whale made an enormous guess by buying 2,117.7 ETH value $5.17 million as the value surged.

Ethereum Whale Massive Wager Amid Worth Rally

In response to the info, this whale is lengthy on ETH by way of round borrowing. The information additionally reveals that this whale had liquidated a considerable 6,078 ETH value $14.7 million when the general market crashed on August 5, 2024.

A whale purchased 2,117.7 $ETH($5.17M) after the $ETH value rose and went lengthy on $ETH by way of round borrowing once more!

He was additionally liquidated for six,078 $ETH($14.7M) when the value plummeted on Aug 5!

Up to now 6 months, he misplaced $13M by going lengthy on $ETH!

He went lengthy on $ETH… pic.twitter.com/URz01cfUv1

— Lookonchain (@lookonchain) September 19, 2024

Moreover, up to now six months, the whale went lengthy ETH 5 occasions and liquidated 4 occasions, leading to a lack of over $13 million. It seems that this time, because of the current breakout and rising curiosity from buyers and merchants, the whale might get well all of their losses.

Ether Worth Efficiency and Whale’s Latest Exercise

Moreover this whale’s large buy, on September 18, 2024, one other whale purchased 5,660 ETH value $13.1 million at a median value of $2,316 degree, as reported by CoinPedia. This knowledge reveals that whales have began accumulating ETH, indicating {that a} main rally could also be imminent.

At the moment, ETH is buying and selling close to $2,470 and has skilled a value surge of over 6% within the final 24 hours. Throughout the identical interval, its buying and selling quantity elevated by 16%, indicating increased participation from merchants and buyers amid ongoing value rallies.

Ethereum Technical Evaluation and Upcoming Ranges

In response to the professional technical evaluation, ETH seems bullish regardless of buying and selling beneath the 200 Exponential Transferring Common (EMA) on a every day time-frame. The 200 EMA is a technical indicator utilized by buyers and merchants to find out whether or not an asset is in an uptrend or downtrend.

Supply: Buying and selling View

The potential cause for the bullishness is the current breakout of the sturdy descending trendline that ETH has been dealing with since July 2024. Nevertheless, this breakout isn’t confirmed till ETH closes its every day candle above the $2,485 degree, if this occurs, there’s a sturdy chance that ETH might soar to the $2,800 degree within the coming days.

Bullish On-chain Metrics

Moreover this technical evaluation, Coinglass’s ETH lengthy/brief ratio at present stands at 1.027, indicating bullish market sentiment amongst merchants. The information additionally reveals that 51% of prime merchants at present maintain lengthy positions, whereas 49% maintain brief positions.

Supply: Coinglass

This bullish thesis will solely stay legitimate if ETH closes above the $2,800 degree, in any other case, it might fail.