-

Ether buying and selling quantity has skyrocketed by 65%, indicating increased participation from merchants and traders.

-

There’s a robust chance that ETH might attain the $2,900 degree and even increased.

-

ETH has lately damaged out of the consolidation zone and is now heading towards the $2,900 degree.

Ethereum (ETH), the world’s second-biggest cryptocurrency by market cap seems to be tremendous bullish and will hit the $3,000 degree quickly. Regardless of nearly all of prime cryptocurrencies, together with Bitcoin (BTC), Solana (SOL), and plenty of others struggling to realize momentum, ETH has gained greater than 4% of its worth.

Ethereum Value Momentum

At press time, ETH is buying and selling close to the $2,680 degree and has skilled a worth surge of over 4.25% previously 24 hours. Throughout the identical interval, its buying and selling quantity has skyrocketed by 65%, indicating increased participation from merchants, doubtlessly because of the ongoing worth momentum.

Ethereum Technical Evaluation and Upcoming Ranges

Based on skilled technical evaluation, ETH seems bullish and is now heading towards the $3,000 resistance degree. After breaking the descending trendline, the sentiment has fully modified, and ETH has surged greater than 15%.

Supply: Buying and selling View

Nonetheless, previously two days, ETH was in a consolidation part between the $2,530 and $2,600 ranges. On September 23, 2024, it broke out of that zone and has been experiencing an upside rally.

Based mostly on the historic worth momentum, there’s a robust chance that the ETH worth might attain the $2,900 degree and even increased if the sentiment stays optimistic. As of now, it’s buying and selling beneath the 200 Exponential Shifting Common (EMA) on a day by day timeframe, indicating a downtrend.

ETH’s Bullish On-chain Metrics

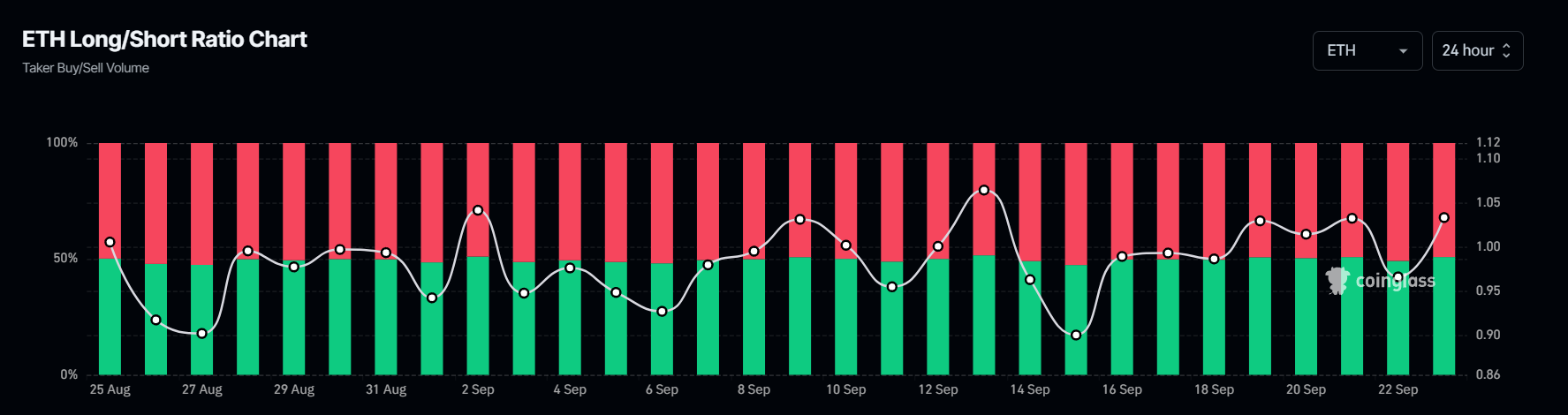

This bullish outlook is additional supported by on-chain metrics that point out market sentiment. Based on the on-chain analytic agency Coinglass, ETH’s Lengthy/brief ratio at present stands at 1.033, indicating bullish market sentiment.

Supply: Coinglass

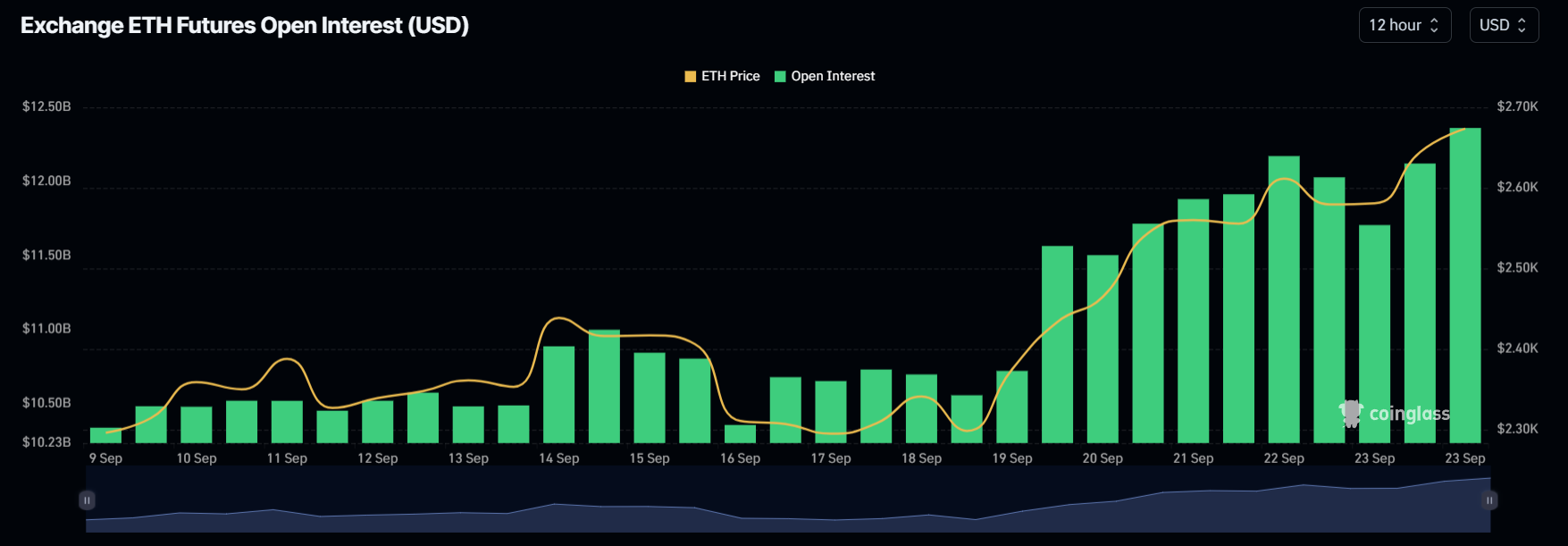

Moreover, its future open curiosity has elevated by 4.8% previously 24 hours and has been steadily rising since September 9, 2024.

Supply: Coinglass

This rising future open curiosity means that bulls are constructing extra lengthy positions. At the moment, 50.82% of prime merchants maintain lengthy positions, whereas 49.18% maintain brief positions.