Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised for a large value decline because it has fashioned a bearish value motion sample on its every day timeframe. Nonetheless, buyers and long-term holders appear to be making the most of this market outlook and are repeatedly accumulating tokens, as reported by the on-chain analytics agency Coinglass.

$321 Million Price of ETH Outflow

Knowledge from spot influx/outflow revealed that in Ethereum’s ongoing value decline, exchanges have witnessed an outflow of over $321 million price of Ether tokens, suggesting potential accumulation.

Such outflows in a bearish outlook trace at a great shopping for alternative and will result in shopping for stress and an extra upside rally.

Merchants Sturdy Bets on Brief Positions

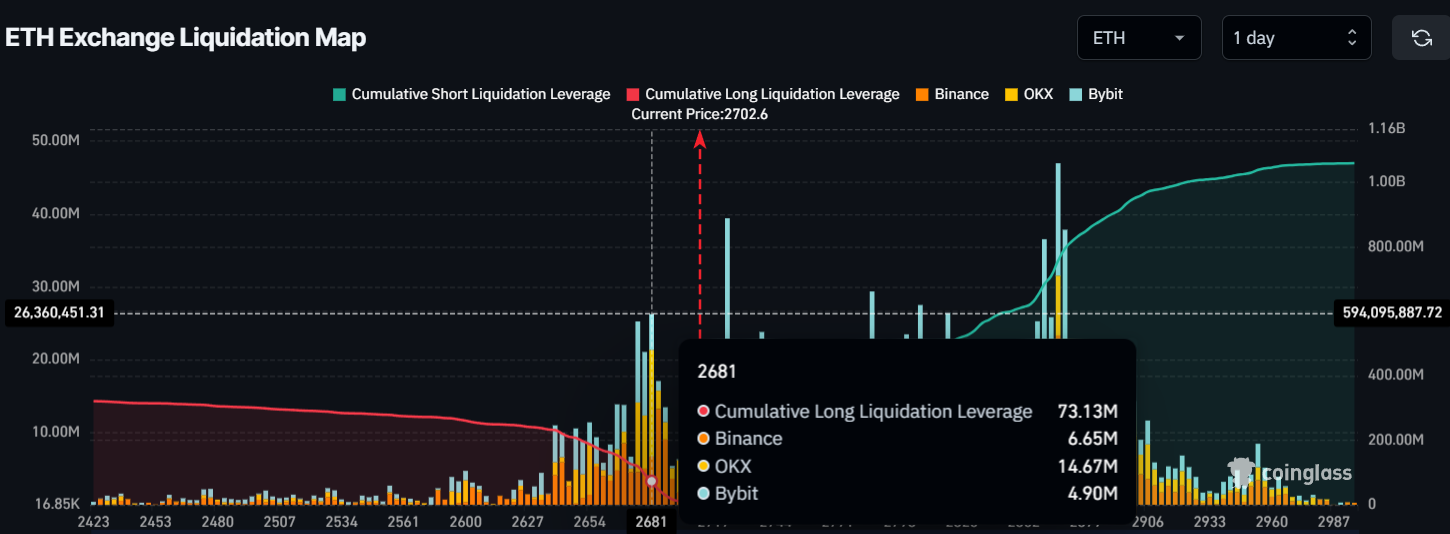

In the meantime, intraday merchants appear to be following the present market sentiment. Based on Coinglass information, merchants are strongly betting on the brief aspect.

As of now, the 2 main liquidation ranges are close to $2,680, the place merchants maintain $73.50 million price of lengthy positions, whereas $2,780 is one other main liquidation degree, the place merchants maintain $325 million price of brief positions.

This information reveals how bears are betting on the present sentiment, which is resulting in a steady value drop.

Present Worth Momentum

Ether is presently buying and selling close to the $2,690 degree and has witnessed a value drop of 1.30% previously 24 hours. Nonetheless, throughout the identical interval, as a result of bearish market sentiment and ongoing market uncertainty, its buying and selling quantity dropped by 25%, indicating decrease participation from merchants and buyers in comparison with the day before today.

Ethereum (ETH) Technical Evaluation and Upcoming Stage

With all these elements, consultants’ technical evaluation means that Ethereum has turned bearish, because it has failed to carry above the essential assist degree of $2,800 and appears to be repeatedly falling.

Based mostly on the current value motion and historic momentum, if ETH closes a every day candle beneath the $2,700 degree, there’s a robust risk it may fall by 20% to succeed in the $2,200 degree sooner or later.

Nonetheless, ETH’s Relative Energy Index (RSI) is close to the oversold space, suggesting a bearish pattern and the potential for additional value drops.