Ethereum merchants stay optimistic a couple of worth restoration regardless of the altcoin’s a number of false breakouts. Their continued confidence signifies that, no matter ETH’s current worth motion, the broader market anticipates the crypto will get well some losses.

On August 24, ETH’s worth reached $2,800 however confronted rejection at that stage. Will the value transfer in merchants’ favor?

Ethereum Bulls Stay Undeterred

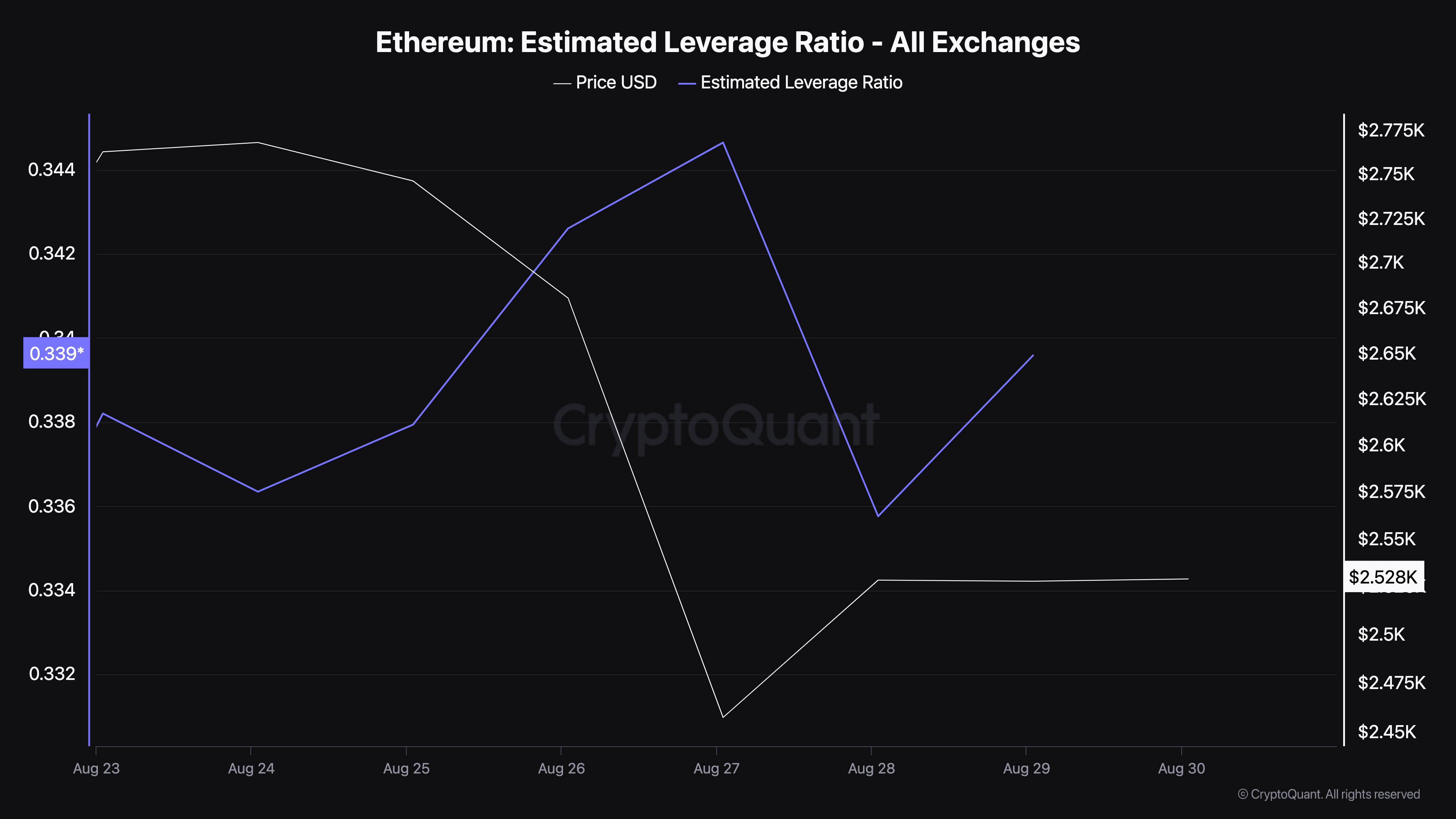

In keeping with CryptoQuant, Ethereum’s Estimated Leverage Ratio (ELR) has lately risen, indicating that buyers are more and more taking high-leverage bets within the derivatives market. This means rising confidence in a major worth motion.

Usually, a declining ELR factors to cautious sentiment, with merchants favoring low-risk bets. In distinction, a rising ELR alerts that merchants count on the value to maneuver decisively.

Ethereum Estimated Leverage Ratio. Supply: CryptoQuant

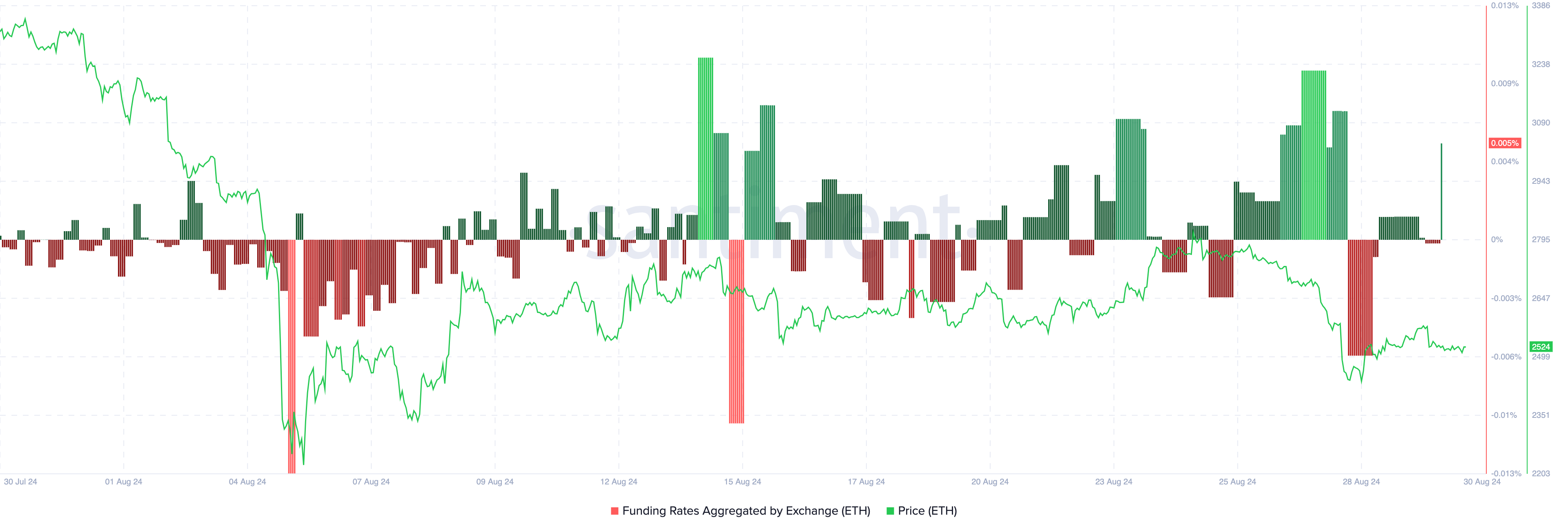

Supporting this outlook, on-chain information from Santiment reveals a sudden spike in Ethereum’s Funding Price, the price of holding an open place within the perpetual market.

When the Funding Price is optimistic, the perpetual futures worth trades at a premium to the spot worth, indicating bullish sentiment. Conversely, adverse funding suggests the cryptocurrency is buying and selling at a reduction, with most merchants choosing brief positions.

Learn extra: Solana vs. Ethereum: An Final Comparability

Ethereum Funding Price. Supply: Santiment

It’s essential to notice that the Funding Price can even affect worth actions. If funding is extremely adverse whereas the value is rising, it suggests aggressive shorting, which is usually a bullish indicator. Nonetheless, the current spike in funding, coupled with the value improve, means that Ethereum would possibly expertise one other bearish spherical earlier than probably rebounding.

ETH Value Prediction: Bears Are Not Out of the Method

On the day by day chart, Ethereum (ETH) should keep away from breaking under the $2,414 stage to keep up the potential of retesting the overhead resistance at $2,726. Efficiently holding this assist might pave the best way for a transfer larger, probably reaching $3,014.

The Shifting Common Convergence Divergence (MACD) indicator on the chart reveals a optimistic studying, suggesting bullish momentum. The MACD, which measures momentum by evaluating the 12 and 26 Exponential Shifting Averages (EMAs), signifies that so long as the momentum stays optimistic, ETH’s worth might proceed to rise.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

Ethereum Day by day Evaluation. Supply: TradingView

Nonetheless, ETH wants to interrupt above the descending trendline to focus on $2,800. Failure to take action could end in rejection, probably inflicting ETH to slip again towards $2,400.