Alongside many different altcoins, ETH’s value continues to battle, and its future now hinges on some important help ranges. If these key ranges fail to carry, ETH might face a protracted bearish interval.

Latest value motion has proven that Ethereum (ETH) might be on the verge of bidding farewell to this cycle, which many have tagged because the enduring section of the bull market.

Ethereum Is About to Lose the Battle

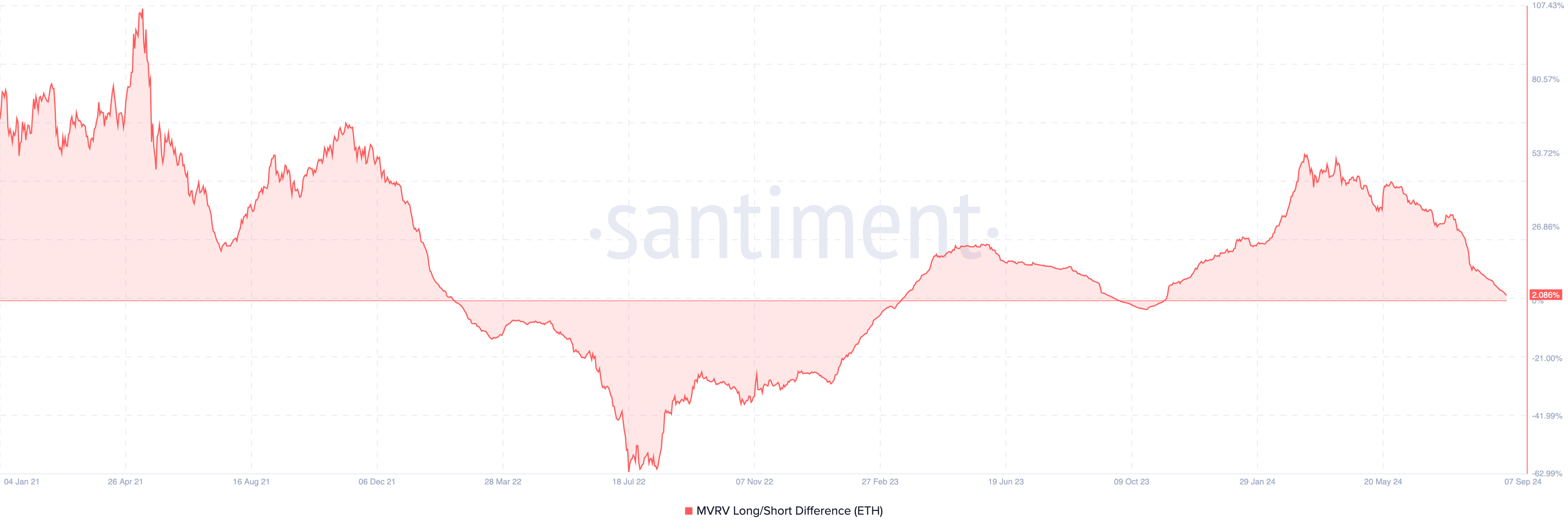

Six months in the past, Ethereum’s Market Worth to Realized Worth (MVRV) Lengthy/Quick Distinction hit a yearly excessive of 55%. This on-chain indicator is vital throughout bull markets, because it reveals whether or not short-term holders have extra unrealized income than long-term holders.

When the MVRV Lengthy/Quick Distinction rises, long-term holders achieve the benefit. A drop, particularly into the unfavourable vary, indicators the other. As of now, the studying stands at 2.08%, indicating that many long-term ETH holders have exited worthwhile positions.

If this development continues, the studying might flip unfavourable. The final time this occurred was in February 2022, adopted by a year-long bear market throughout cryptocurrencies, together with Ethereum.

Learn extra: 9 Finest Locations To Stake Ethereum in 2024

Ethereum MVRV Lengthy/Quick Distinction. Supply: Santiment

If the present development mirrors earlier patterns, expectations of Ethereum reaching 5 digits on this cycle could also be unrealistic.

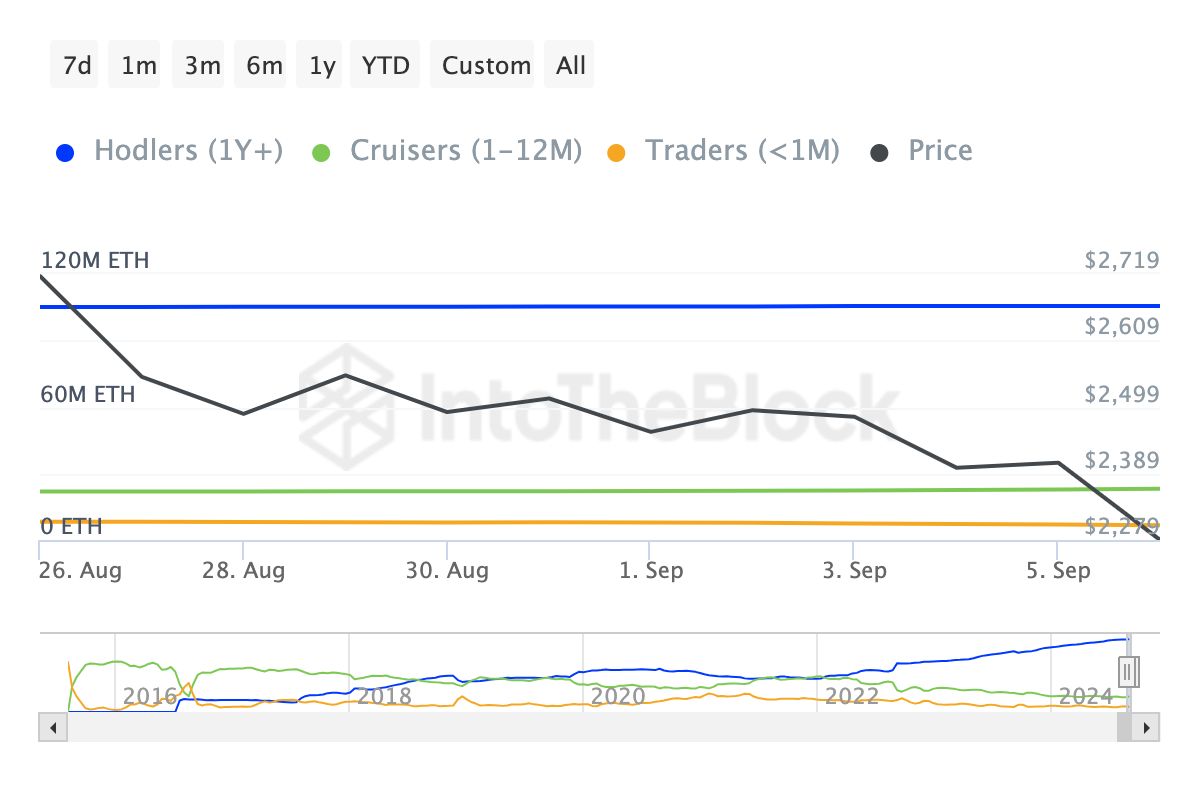

One other indicator reinforcing this sentiment is the Stability by Time Held metric, which measures how lengthy contributors maintain a cryptocurrency. Usually, a rise on this metric reveals that holders are usually not promoting, indicating confidence in a bull cycle.

Nevertheless, ETH’s steadiness held over the previous 30 days has elevated, suggesting that some holders are shedding confidence within the altcoin’s short- to long-term potential, probably signaling a shift in market sentiment.

Ethereum Addresses by Time Held. Supply: IntoTheBlock

ETH Worth Prediction: Bulls Can’t Maintain On

The Transferring Common Convergence Divergence (MACD) on the day by day timeframe reveals that Ethereum’s value continues to endure bearish momentum. The MACD makes use of the place of the 12 and 26-day Exponential Transferring Common (EMA) to find out momentum.

A optimistic MACD studying implies a bullish momentum. Detrimental readings, however, counsel doubtless stress to the draw back. From the picture beneath, ETH’s value wants to remain above $2,220 to forestall a notable value crash.

Nevertheless, given the present market circumstances, a drop beneath $2,000 appears doubtless. That stated, constant shopping for stress might assist stabilize Ethereum’s weak efficiency and stop additional declines.

Learn extra: Methods to Put money into Ethereum ETFs?

Ethereum Day by day Evaluation. Supply: TradingView

If this occurs, the value may leap towards $2,536 and doubtless $2.974, probably invalidating the bull market exit.